Property taxes in Texas are some of the highest in the country, according to a recent report from the Huffines Liberty Foundation.

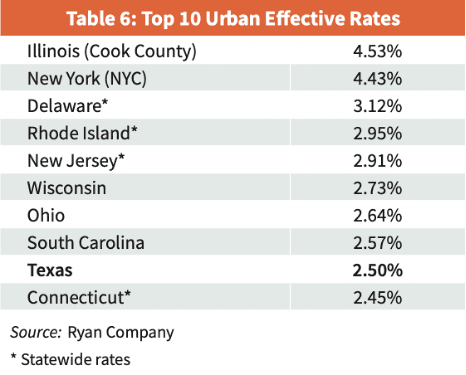

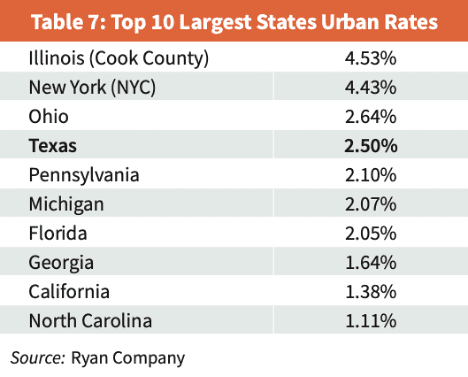

The Huffines Liberty Foundation, led by former state senator and gubernatorial candidate Don Huffines, determined that Texas ranks fourth in having the highest effective tax rate among the 10 largest states, behind only Illinois, New York, and Ohio. Among all 50 states, Texas ranks ninth.

These rankings correspond with other comparisons referenced in the report, namely Mortgage Calculator (third), Rocket Mortgage (sixth), the Tax Foundation (seventh), The Motley Fool (seventh), and WalletHub (seventh).

The following tables from the report list the 10 ten states with the highest urban effective tax rates (Table 6) and the urban effective tax rates of the 10 largest states (Table 7).

How was this ranking determined?

While the taxes a property owner pays are determined by published tax rates and assessed property values, the effective tax rate—the percentage of a property’s actual value paid in taxes—is a more meaningful measure of the tax burden associated with ownership. Exemptions for primary residence or agricultural use can lower a property’s assessed value, in which case the published rate is higher than the effective rate.

The study derives its determination of effective tax rates by evaluating the taxes imposed on commercial properties in urban areas of Texas—specifically, its five largest counties—and other states. The rationale provided for this method is two-fold.

First, in Texas, as in most other states, more people live in cities than in rural areas, so the taxes imposed in urban jurisdictions affect a large majority of the population.

Second, commercial property owners typically don’t receive as many exemptions as owners of residential property, and since commercial property is more concentrated in urban areas, the published tax rates in major population centers are more reflective of a state’s overall effective tax rate.

Why are property taxes so high?

According to the report, the state’s high property tax burden can be attributed to excessive spending by local government entities, which regularly attempt to deceive taxpayers by obfuscating the difference between tax rates and tax payments. Recent examples are provided from the city of Pflugerville in Central Texas and Fort Bend ISD, southwest of Houston.

The elected administrators of both entities have sought to portray themselves as being fiscally responsible because they proposed reducing or retaining the current tax rate, neglecting to acknowledge that individual taxpayers would be required to pay more than they did the previous year because property values increased.

The report also assigns blame to state legislators for failing to curb local spending or provide meaningful property tax relief despite numerous attempts to do so in the past 30 years. Instead, lawmakers have recklessly enlarged the state’s budget.

What are the implications?

Still, due largely to not having a state income tax, Texans enjoy a high degree of economic liberty and a regulatory environment conducive to business. The report cites a recent study by the Fraser Institute that ranks Texas fourth among the states in economic liberty. It also uses metrics provided by CNBC, the American Legislative Exchange Council, and HomeIA to show that Texas is a top competitor for business development, has a strong record of economic performance, and is relatively affordable.

However, the report questions whether this environment can be sustained given the current high levels of state and local spending. This concern appears justified when comparing Texas’ economic liberty ranking to that of other states with the largest property tax burdens; Ohio is 39th on the list, New York is 50th, and Illinois ranks 33rd.

Indeed, recent reports indicate that restrictive zoning laws, crime, and homelessness—challenges that have plagued these other states for years—are becoming more common in Texas’ largest cities.

In contrast, three of the largest states with lower property taxes than Texas all rank within the top 10 of the Fraser Institute’s economic liberty index; North Carolina is 10th, Georgia is sixth, and Florida is third. The report notes that each of these states competes with Texas for economic development, implying their lower property taxes give them an advantage.

What’s going on in Florida?

In a close examination of Florida, the report shows that less spending by local governments and state legislators translates to lower property taxes and a lower sales tax.

According to the U.S. Census Bureau’s 2020 Annual Survey of State and Local Government Finances, local government spending in Florida is $5,582 per capita, compared to $6,021 per capita in Texas. At the state level, Florida spends $4,999 per resident, while Texas spends $6,004.

Unsurprisingly, Florida’s average effective tax rate (2.05 percent) is significantly lower than Texas’ (2.50 percent), and so is its average sales tax (7.01 percent compared to 8.2 percent). In fact, the report estimates that Texans could save around $25 billion in taxes this year if legislators reduced the state’s spending per resident to match Florida’s.

What’s the solution?

If property taxes were lowered in response to a reduction in state and local spending, taxpayers would experience several benefits. Homeowners, renters, and business owners would realize significant savings, leading to gains in purchasing capacity, property values, and economic production.

In turn, the increase in economic activity stemming from a more efficient use of capital would actually produce more tax revenue, the report argues, citing Reagan adviser Art Laffer. This revenue would provide state and local government with funds that could be used to lower property taxes even further.

Conclusion

The report contends that the current situation is not sustainable. Texas’ high property taxes threaten its economic productivity and its citizens’ freedoms.

For many prospective residents, the absence of a state income tax is certainly appealing, but the high property tax burden is a serious drawback, putting Texas at a competitive disadvantage with states like Florida that impose much lower taxes.

To address this concern, local governments and state lawmakers should reduce spending and be transparent with taxpayers. The ensuing tax cuts will immensely benefit all Texans and ensure the state remains a beacon of economic opportunity.

This report is the first in a three-part series intended to provide the rationale and strategy for abolishing school property taxes in Texas.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!