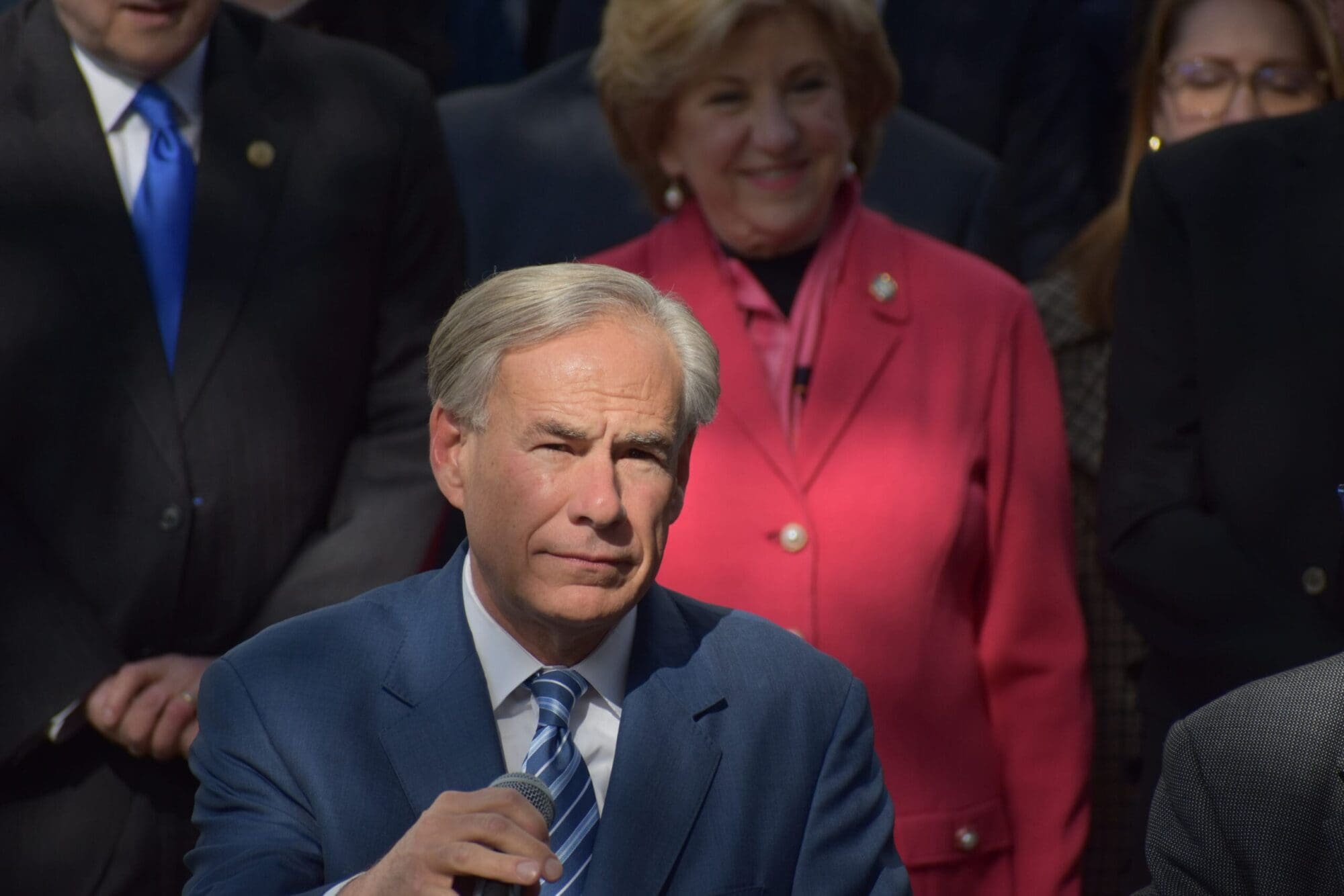

In his State of the State Address, Gov. Greg Abbott announced that he wants $10 billion in property tax relief this session. His proposal outmaneuvers the Texas House and Senate, which are offering $6 billion in relief.

During the State of the State Address on Sunday, Abbott called for at least $10 billion of the state’s $23.76 billion surplus to go toward tax rate compression for school district maintenance and operation taxes, declaring it an emergency item.

Tax compression is the intentional act of lowering the tax rate by “buying it down.” The process is primarily implemented in Texas by utilizing state revenue generated from sales tax funds.

Abbott also called for increasing the exemption for taxes imposed on business personal property—which includes items, accessories, office supplies, vehicles, and inventory used to generate income.

Currently, a business owner can exempt business personal property taxes on property with a taxable value of less than $2,500. Before 2022, the exemption was $500. Abbott, however, wants to raise it to $100,000.

He also stressed the need to end local governments’ use of loopholes to raise property taxes, calling for raising the threshold for voter-approved tax increases from a simple majority to a two-thirds supermajority.

While Abbott is calling for $10 billion in tax relief, the preliminary House and Senate budget proposals only allocate around $6 billion of the state’s surplus for relief, albeit in different ways.

The Senate proposal focuses on the homestead exemption, which is the amount of money a homeowner can deduct from the value of his or her house before it is taxed. The current baseline exemption is $100,000, and the Senate proposal would raise it to $140,000.

While the Senate proposal also includes some tax compression, the preliminary House budget utilizes it exclusively. It would specifically approve $3 billion for initial compression and an additional $3.5 billion contingent upon new legislation.

Texans for Fiscal Responsibility President Andrew McVeigh told Texas Scorecard that while Abbott’s $10 billion proposal is “a step in the right direction,” his organization calls on the legislature to “return most, if not all, of the state’s $24 billion surplus to its rightful owners: the taxpayers.”

“We also urge the governor and the legislature to put Texas on a pathway to eliminating property taxes by spending less at every level of government and dedicating surplus dollars to compressing rates so that all Texas property owners can stop renting their property from the government,” stated McVeigh.

In addition, McVeigh commended Abbott for highlighting “the ability of local entities to constantly raise taxes” and working to establish a two-thirds vote threshold for future increases.