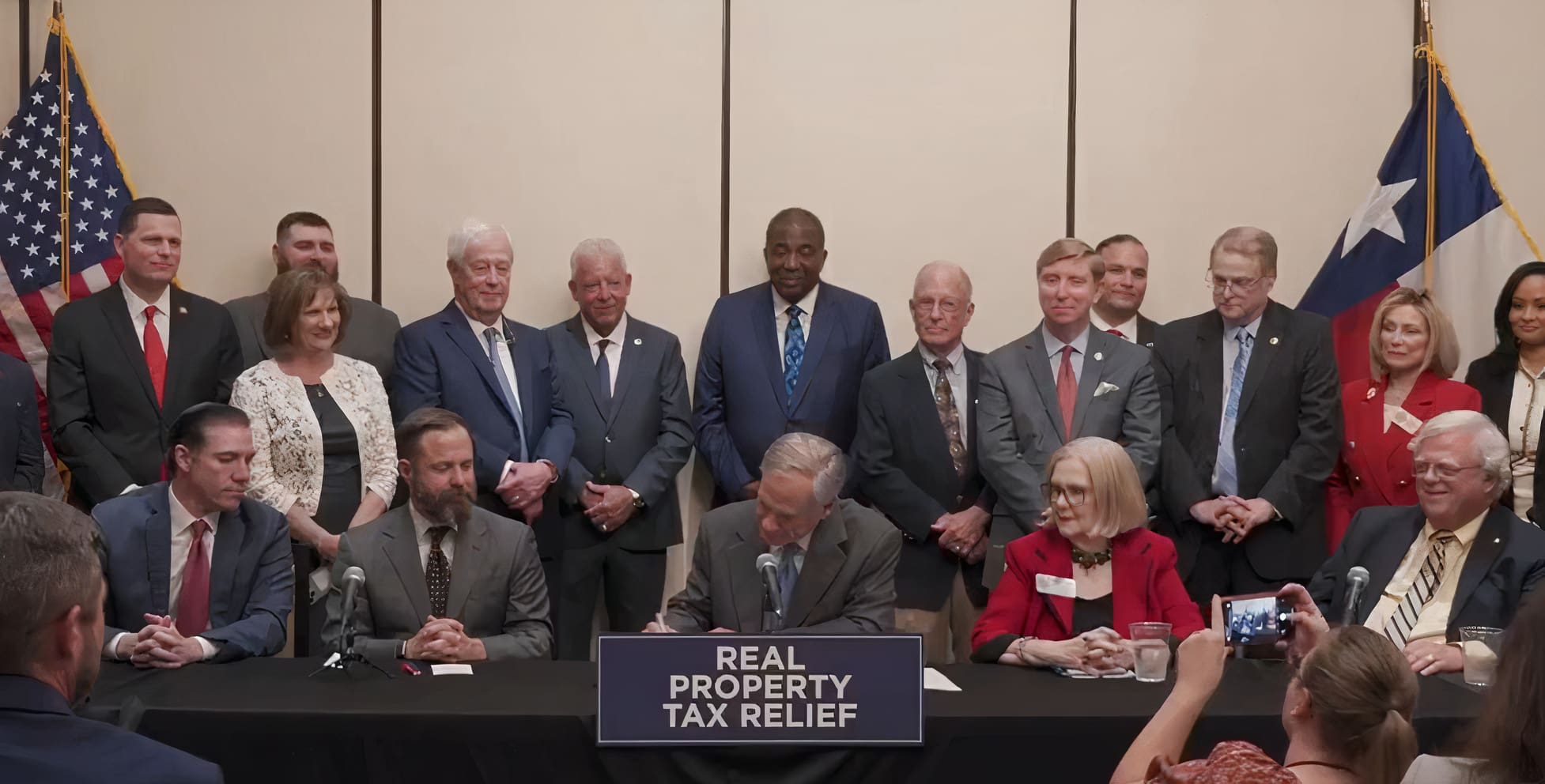

Gov. Greg Abbott has signed three measures providing new property tax relief to homeowners and businesses.

During a press conference in Denton on Monday, Abbott signed Senate Bill 4, Senate Bill 23, and House Bill 9 into law, which he says will bring the total amount of additional tax relief passed this session up to $10 billion. That number, however, includes some existing property tax relief passed in previous sessions.

All three measures in the tax relief package were worked on by State Sen. Paul Bettencourt (R–Houston) and State Rep. Morgan Meyer (R–Dallas), who were in attendance at the signing.

The first measure signed, SB 4, raises the homestead exemption to $140,000.

The homestead exemption refers to the amount a homeowner can deduct from the value of his or her home before property taxes are assessed. Before SB 4, the exemption stood at $100,000 for most adults.

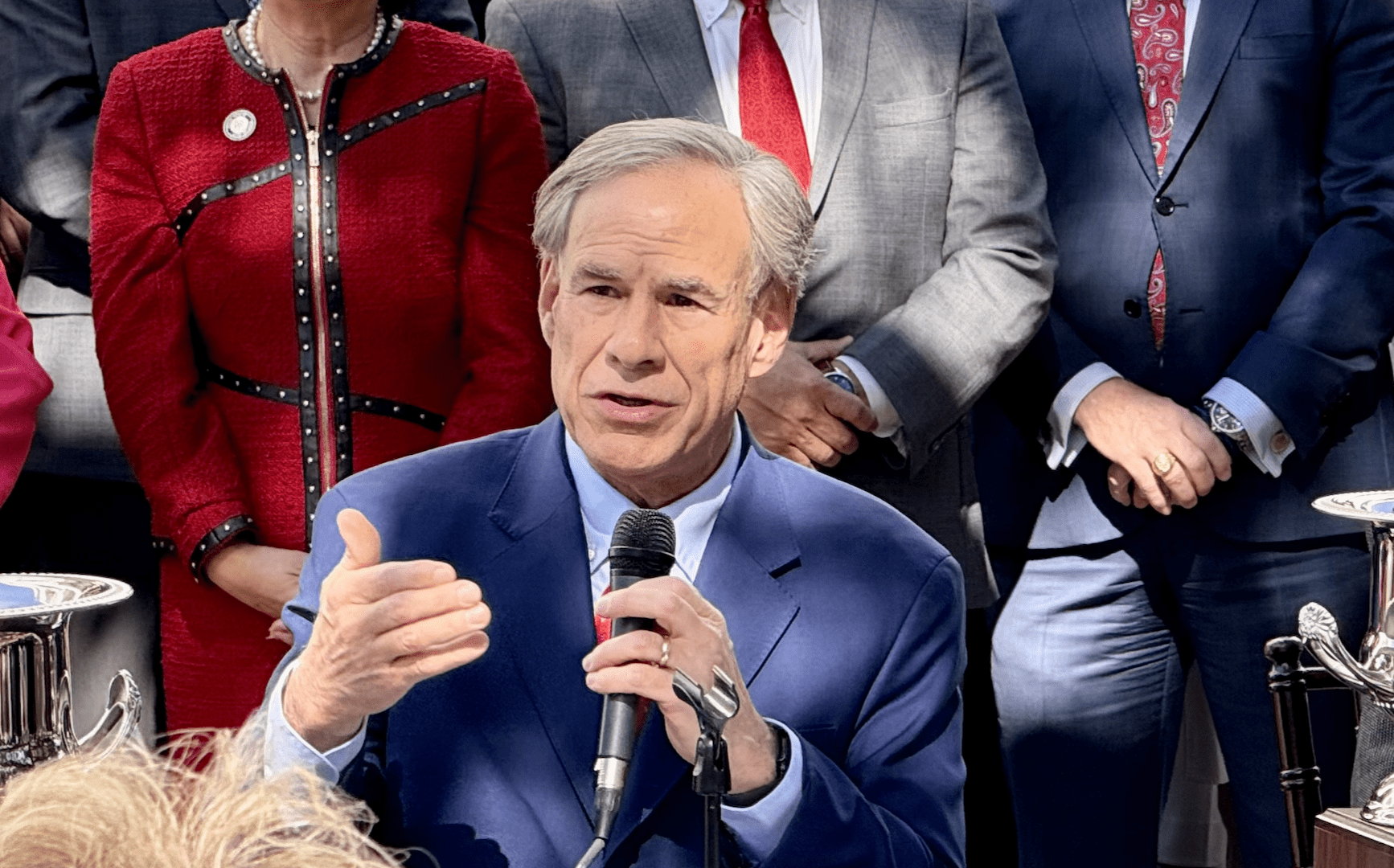

“If you go to where the homestead exemption was when I first became governor at $15,000 to now $140,000, that’s almost a 1,000 percent increase,” said Abbott at the briefing.

In addition to raising the homestead exemption, SB 4 also creates a framework for school districts to further pay down their tax rates, reducing the average school district tax rate from $0.9766 to $0.9086.

The money allocated for that tax compression—around $3 billion—is already accounted for in the 2026-2027 biennium budget, which Abbott could sign later this week.

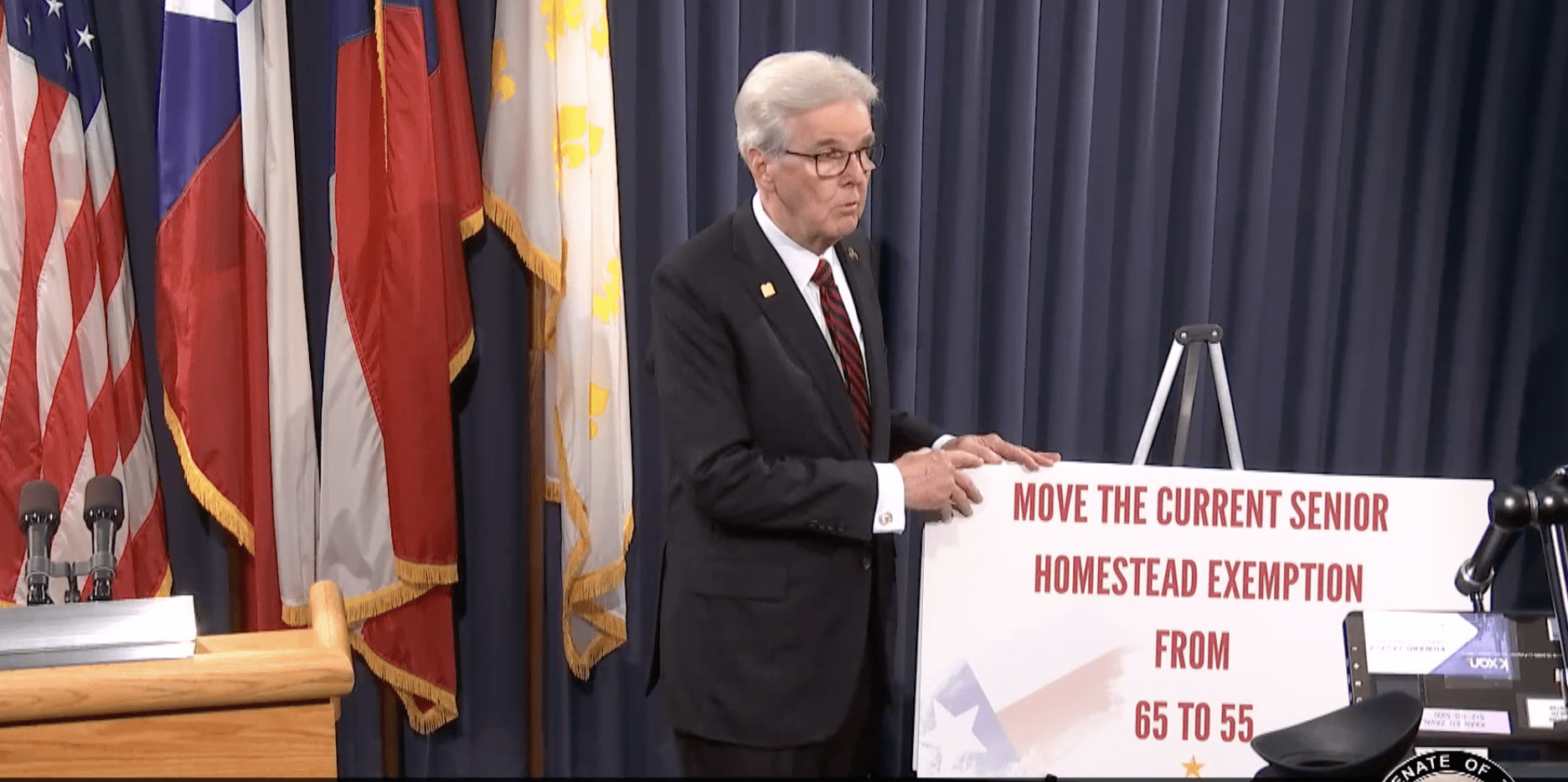

SB 23 raises the homestead exemption for elderly or disabled homeowners to $200,000, reducing their average homestead property tax bills by around $950.

“More than half of Texas seniors are not going to pay a school property tax at all after I sign this law,” said Abbott.

Burrows, speaking later in the press conference, said he believed Texas could become a “retirement destination” because of the new law.

HB 9, meanwhile, includes a significant increase to the exemption on taxes assessed on business personal property—such as equipment, items, or inventory used to produce income—from $2,500 to $125,000.

Senate Joint Resolutions 2 and 85 are proposed constitutional amendments that would enable the homestead exemption increases in SB 4 and SB 23, respectively, to take effect. House Joint Resolution 1 does the same for HB 9.

For the amendments to pass, they must be approved by a majority of voters during the general election on November 4.

Andrew McVeigh, president and CEO of Texans for Fiscal Responsibility, characterized the session as “a missed opportunity” to provide more tax relief.

Texas had a $23.76 billion surplus to work with in the 2026-2027 biennium.

“Instead of using our historic surplus to provide real relief and shrink government, Austin chose to balloon the budget and entrench big spending,” stated McVeigh. “We hope future sessions will correct course and recommit to the principles that have made Texas strong.”

In total, Texas will now spend around $50 billion to sustain property tax relief passed over the last decade, according to the governor.

Abbott also assured that the state was “not done yet” in seeking tax relief and called for spending limits on local jurisdictions to curb hikes in local property taxes.