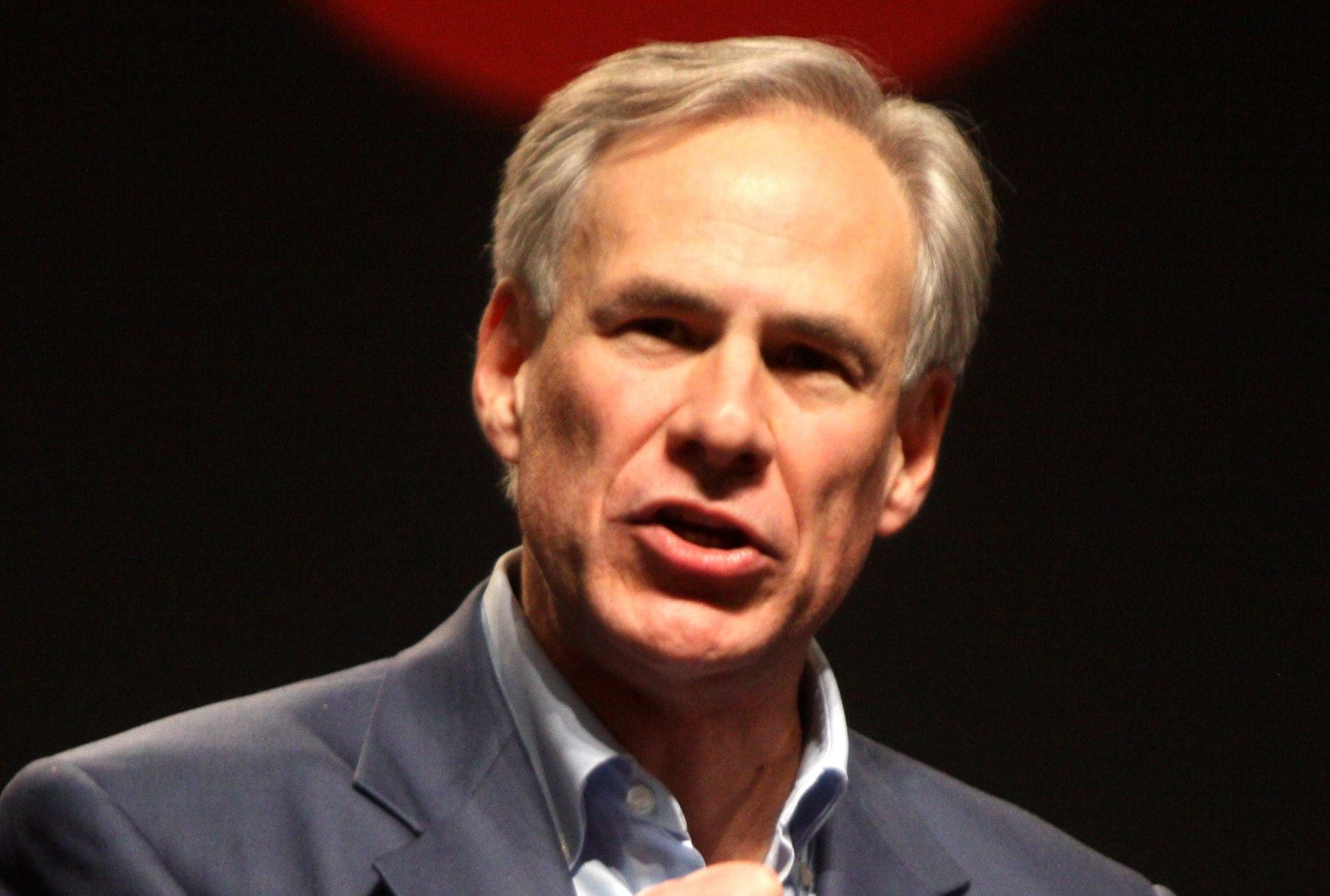

Yes, you read the headline correctly. Texas Gov. Greg Abbott is supporting a new tax increase claiming it will be used to lower property tax rates. The problem is, there’s no mechanism to ensure it results in real property tax relief for taxpayers.

Even though legislators came to Austin with a historic $9 billion surplus of state revenue courtesy of you and other taxpayers. Even though, according to House Appropriations Chairman John Zerwas (R–Simonton), the Texas Legislature has “more money than we’ve ever had,” Abbott and other lawmakers don’t think that’s enough.

They think you’ll be foolish enough to approve of a tax increase that would put 10 billion more taxpayer dollars in government coffers, all without any spending reforms.

On Wednesday, Abbott, Lt. Gov. Dan Patrick, and House Speaker Dennis Bonnen announced their support for increasing the state sales tax under the fig leaf of buying down local property tax rates.

“If the 1 cent sales tax passes, it will result in billions of dollars in revenue to help drive down property taxes in the short and long term,” the so-called “Big Three” said in a joint statement.

The statement appears to be an endorsement of House Joint Resolution 3 by State Rep. Dan Huberty (R–Kingwood) that would essentially increase the state sales tax from 6.25 cents to 7.25 cents, the rate assessed by the State of California, with the goal of dedicating the revenue gained to buying down school M&O tax rates.

That sounds good in theory, as conservatives almost universally agree consumption taxes are superior to property taxes. But what’s being proposed could actually result in a net tax increase.

The problem stems mainly from the fact that school taxes have been struck from House Bill 2—the magnum opus property tax reform plan unveiled by the same “Big Three” at the beginning of the session. If passed as filed, that bill would have limited the ability of school districts to take more from taxpayers without first securing their permission.

But under the cover of darkness (literally), House Ways & Means Chairman, and bill author, Dustin Burrows (R–Lubbock) stripped school districts from the reform package. This means there is no longer even a proposal to place a lid on school property tax increases in the Texas House.

That change means that even if the State of Texas provides 100 percent of the additional dollars to school districts, the property tax “buy-downs” paid for by the state won’t be permanent or lasting. That’s right, Joe Taxpayer’s property taxes would continue to rise and they’ll have to pay 1 percent more on almost every transaction as well!

Unless lawmakers pass serious and substantive tax reform that prevents further increases, the proposed swap (even at a 1:1 ratio) will result in higher tax burdens for everyone.

Lawmakers should reject Abbott’s proposed tax hike without first applying the necessary taxpayer protections, but the unfortunate truth is that many of them—anxious to be seen as doing something—appear to be lining up behind him and readying to jump the plank alongside.

Gov. Greg Abbott: (512)-463-1782

Texas Capitol Switchboard: (512)-463-4630