A new record-high estimate of Texas’ budget surplus for the next two years has a pro-taxpayer group renewing calls for lawmakers to cut Texans’ property taxes and freeze state spending during the legislative session now underway in Austin.

On Monday, Texas Comptroller Glenn Hegar announced a Biennial Revenue Estimate of $188 billion available for general-purpose spending during the 2024-25 budget period, a 26-percent increase over 2022-23 revenue.

The new estimate includes a record $32.69 billion budget surplus.

“This absolutely is a ‘historic, once-in-a-lifetime opportunity,’” says Tim Hardin, president of Texans for Fiscal Responsibility, echoing earlier descriptions of the surplus by Hegar and Texas Lt. Gov. Dan Patrick.

Hardin says the surplus is an opportunity for lawmakers to give Texans the biggest property tax cut in state history and maintain that tax cut in perpetuity, as well as stop the growth of state spending.

“To fix a bloated government, we must cut the size and scope of government,” he said.

TFR believes the best way to do that is by capping the budget where it currently sits and encouraging lawmakers to cut wasteful agencies and programs.

In 2021, Texas passed a law that limited state spending increases to inflation plus population growth.

But with inflation out of control, Hardin says that number topped 12 percent.

“That is way too much to grow government,” he said.

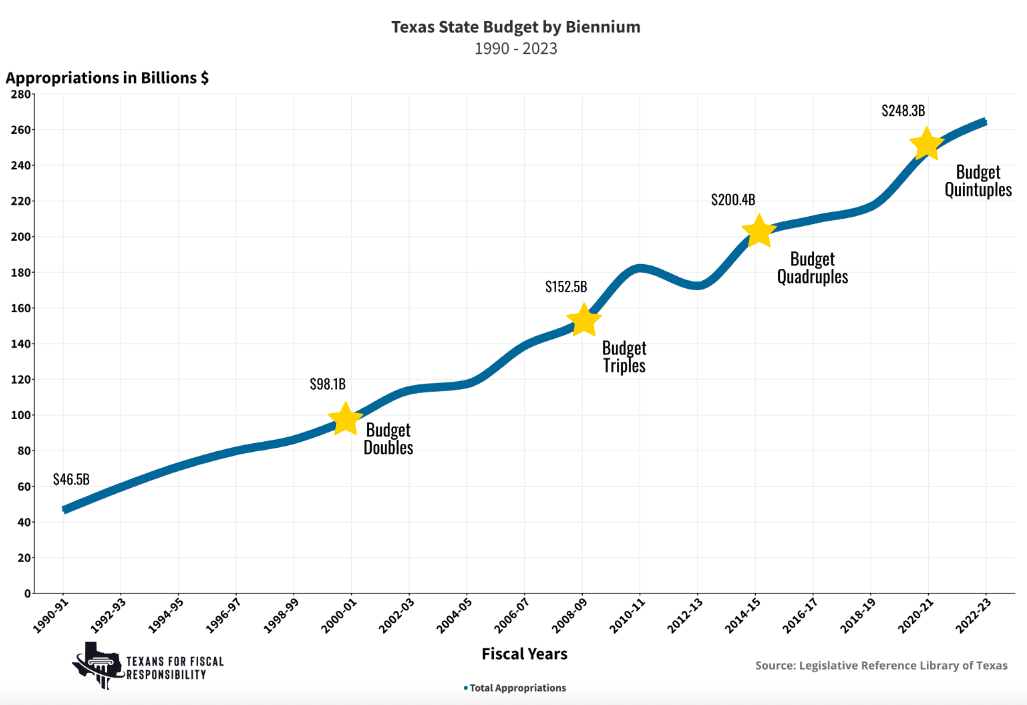

According to TFR, Texas’ state budget has increased almost 170 percent since 2000 and is on track to triple in size in just a few years, while Texas’ population has only increased by 40 percent during that same period.

TFR’s top policy goals for the 2023 legislative session—adopting a no-growth budget, eliminating property taxes, and banning taxpayer-funded lobbying—are explained in the organization’s Texas Prosperity Plan.

Hardin concedes a no-growth budget is unlikely to pass this session, but says Texas needs a “new conservative standard” for state budgets, either a no-growth or a solid low-growth spending cap around 3 percent.

He said TFR would also like the state to place spending caps on local governments, which are drowning in debt.

“Ultimately, TFR is going to support anything that lowers taxes for people,” he said.

Unfortunately, he says government officials see the budget surplus as an opportunity for lawmakers to grow the government.

“Many of the statewide elected officials have conceded that this is in fact taxpayers’ money,” Hardin said. “But not one of them has suggested that we give it all back in the form of tax relief, but rather if we are lucky enough, we might get half back.”

As with every important policy issue, Hardin says grassroots voters must be willing to engage with lawmakers in order to see progress.

With the 140-day Texas legislative session now underway, Hardin says lawmakers have a decision to make:

Will they continue to spend and maintain a bloated and overgrown government budget, or will they cut it and give taxpayers back the money it stole from them in the first place while also maintaining property tax cuts? Whatever decision they make, rest assured that Texans for Fiscal Responsibility (TFR) and the voters of Texas will be watching and holding them accountable for what they decide to do with OUR tax surplus.

In addition to advocating for policies that protect Texas taxpayers, TFR publishes the Fiscal Responsibility Index, a tool to help taxpayers measure legislators’ commitment to fiscal restraint and limited government by showing how lawmakers vote on key issues.

“At the end of the session, we’ll tabulate your score based on one thing and one thing alone: your voting record,” Hardin said in a letter to lawmakers. “We’ll then communicate it—good or bad—to your constituents.”

Texans can find contact information for their state lawmakers here.

Soli Rice contributed to this report.