Last week, Lt. Gov. Dan Patrick and Speaker Joe Straus both released their interim charges, giving Texans a sneak-peak at what the legislature will be focused on until the next regular session in January 2019.

Between legislative sessions, the Texas Lt. Governor and Speaker of the House appoint interim committees to study important issues and serve to guide future action by the Texas Legislature.

The interim committees hold hearings and take public testimony and will impact the next legislative session. The charges determine the course committees should take, and topics to be covered.

Interim charges often target issues that are ongoing, or that failed to be addressed in previous legislative sessions for varying reasons. The work laid out for committees in the House and Senate reflect what each head of chamber believes ought to be state priorities.

Comparing the lists of charges is instructive insofar as they can gauge the degree to which each body will take up not only pressing issues, but also apply conservative solutions.

While both sets of charges aim to address the aftermath of Hurricane Harvey, the issue of property taxes is particularly revealing. Aside from being a Texas GOP priority, a public poll conducted by The University of Texas and Texas Tribune showed most respondents identifying the lowering of property taxes as their top issue. Another recent UT/TT poll year showed 77% in support of “limiting the extent to which local governments can raise property taxes.”

While both sets of charges aim to address the aftermath of Hurricane Harvey, the issue of property taxes is particularly revealing. Aside from being a Texas GOP priority, a public poll conducted by The University of Texas and Texas Tribune showed most respondents identifying the lowering of property taxes as their top issue. Another recent UT/TT poll year showed 77% in support of “limiting the extent to which local governments can raise property taxes.”

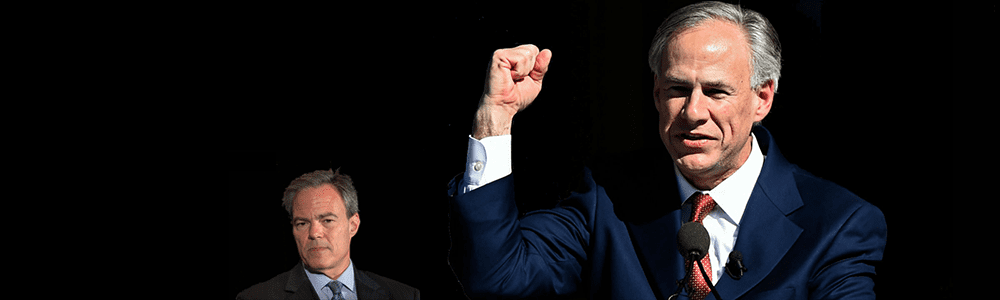

Property tax reform has been a focus for the Governor and Lt. Governor as well. In his special session call, Gov. Greg Abbott specifically asked for, and would have signed a strong bill that created robust taxpayer protections, were it not for obstruction by the house.

This priority, for taxpayers across the state, including democrats, is reflected in both interim charges, however, the approaches differ substantially. In his charges for the House Committee on Ways & Means, Straus included one item, asking members to “review and identify improvements” related to the property tax system.

Meanwhile, in addition to tasking the Senate Committee on Finance to evaluate property tax as it applies to business personal property, Patrick has created the Senate Select Committee on Property Tax Reform. The committee exists for the sole purpose of addressing one of Texans’ top issues.

In addition to studying ways to enhance voter engagement, the select committee will evaluate effective tax rates and rollback rates, seeking meaningful improvements. (The rollback rate is a calculated maximum rate allowed by law without voter approval.)

Patrick is not stopping there, however.

In addition to efforts to lower the rollback rate and empower taxpayers, the select committee will also be tasked with evaluating the feasibility of replacing the property tax with sales tax or other consumption tax revenue, a broader goal by grassroots conservatives and reflected in the platform.

Keeping with a property based theme, the senate charges also include reviewing the process of bringing taxpayers into a city’s extra-territorial jurisdiction for needed limitations, one small step from annexation, which was the subject of one of the governor’s special session issues seeking to eliminate abuses by cities.

Another topic included in the special session’s agenda was education choice, long treated as a non-starter in a house chamber largely protective of educrats and a wasteful system rife with inefficiencies and misplaced priorities.

Echoing the governor’s concerns, Patrick’s charges for the Senate Education Committee ask for a review of “whether children with special educational needs … should have additional options to meet their unique educational needs.” In contrast, public education-related charges in the house continue to double down on the current system that lacks options for special needs students and their families.

The issuance of interim charges is important for charting the future policy direction of the state. They also serve to inform the electorate what the Lt. Governor and Speaker of the House consider the most pressing issues facing the state and how to approach them. While similar in their efforts to address Hurricane Harvey’s impact to the state, in many ways they illustrate differences between chambers of the legislature.

Conservative republicans statewide can hopefully expect to see a different tact in future House charges, given the recent announcement by Straus that he would not seek reelection. Whether those priorities align more closely with grassroots priorities, Lt. Governor, and Governor will be an unfolding story over the next 14 months.