UPDATED September 22 to show property tax relief added to the third special session agenda.

A plan to buy down Texans’ school property taxes using surplus money in the state budget advanced in the Texas Senate for the second time this year, and may emerge stronger than before.

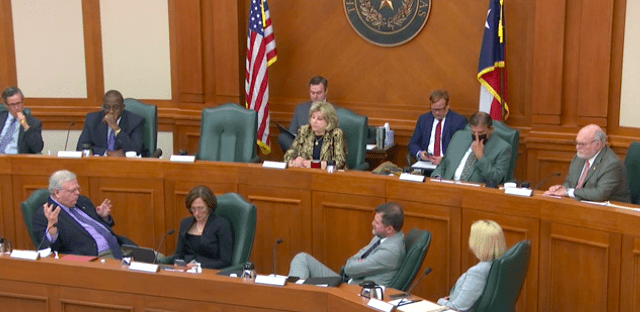

On Tuesday, members of the Senate Finance Committee voted 14-0 to approve property tax relief measure Senate Bill 1 (not to be confused with the election reform bill passed during the second special session—bill numbering restarts every session).

“The basic tenet of this bill is this: If we have excess money, give it back to the taxpayers because they’re the ones who need it,” said SB 1 author State Sen. Paul Bettencourt (R–Houston).

The bill is nearly identical to a bill Bettencourt filed during the second special session that passed the Senate 29-2 but didn’t make it through the House.

SB 1 is a temporary measure to reduce school tax rates by replacing local dollars with state dollars for the 2022-23 school year.

Bettencourt’s bill would “compress” local school maintenance and operation (M&O) tax rates using at least $2 billion in state general revenue funds.

Each billion dollars of compression lowers school M&O tax rates by 3.3 cents.

That means all property owners in Texas would see their school tax rate reduced by at least 6.6 cents. Bettencourt said the owner of a home with the median value of $330,000 would save about $188, which he called “welcome” property tax relief.

Total tax relief could be significantly higher, depending on the state comptroller’s estimate of surplus revenue in 2022. As much as $2 billion more could be allocated to buying down next year’s school taxes.

“It’s important we continue to do everything we can to help property taxpayers,” Bettencourt said. “This is the type of step we need to take when we have this kind of excess revenue.”

Finance Committee Chair Jane Nelson clarified the tax relief plan would not use federal COVID relief money, which she said comes with strict spending guidelines.

State Sen. Kelly Hancock (R–North Richland Hills), a former school board member, said he didn’t want to see a repeat of what happened the last time the Legislature lowered school property tax rates.

Back then, local school districts took advantage of the M&O buy-down to significantly increase their bond debt (money borrowed to spend on buildings, equipment, and long-term maintenance), along with the interest and sinking (I&S) taxes to pay for the debt—leaving little to no relief for taxpayers:

What was intended for good, to help property owners with their tax rates back in 2006 … simply converted from M&O to I&S, and we’ve never seen a compression of that indebtedness that increased significantly during those next two years.

Now school boards simply keep buying new bonds as old ones are paid off, so districts never have to lower their total tax rates and taxpayers never see a decrease in their bills.

“They’ll tell voters they won’t see a tax increase, but they also won’t see a tax decrease,” he said.

Hancock asked Bettencourt to tighten the language “so this bill actually leads to a tax decrease—which is what our intent is—rather than leading to an increase in debt of local school districts across the state and no compression at all.”

State Sen. Robert Nichols (R–Jacksonville) agreed with Hancock that the bill needs added protections to keep school districts from using the temporary tax compression measure to “bond up” more debt.

“Don’t just assume they might; they will,” he said, adding school officials are confident voters will approve more debt because districts don’t have to raise their tax rates. “I know my district. They’re going to go out and talk up the benefits of a new football stadium.”

Bettencourt said he already asked the Legislative Council to draft an amendment to prevent districts from spending the savings intended for taxpayers, but added the Legislature has to respect voter-approved debt.

When voters approve a bond proposition, they are also approving whatever property taxes are needed to repay the debt, with interest. Current state law limits school districts’ I&S rate to $0.50 per $100 valuation.

“Sometimes voters are deceived about what they are told,” Nichols said.

State Sen. Charles Perry (R–Lubbock) proposed amending SB 1 to lower the current 50-cent I&S tax rate limit.

“Limit their ability to play games between M&O and I&S. Cap their ability to spend statutorily,” he said. “The policy aspect of that is it may keep them from putting travertine tile in the football stadiums’ restrooms. It may force them to make better use of taxpayers’ dollars.”

Nichols and other senators also said they want to see a more permanent solution for school taxpayers.

Bettencourt said other legislation already passed, including tax reform bills passed in 2019 that cap schools’ tax revenue increases and a state spending cap change in 2023, makes him “very optimistic” the state can continue to provide school tax relief in future.

Rod Bordelon, a tax policy director at the Texas Public Policy Foundation, testified in support of SB 1 but said TPPF has a similar plan that would permanently buy down all school M&O taxes over time.

He also said recent TPPF polling shows 76 percent of Texans believe property taxes are a major burden on their families, and more than 82 percent say it is a serious issue for Texas.

Only one person spoke against the bill, calling it a “direct attack on public education.”

SB 1 now moves to the full Senate for consideration and likely approval. Bettencourt said when he brings the bill to the floor, it will have amendments to protect taxpayers.

“We want the taxpayers to be the recipients of their money coming back,” Nelson said.

State Rep. Tom Oliverson (R–Cypress) filed similar legislation today, House Bill 90, that establishes a permanent formula for buying down school district M&O property taxes with surplus state revenue.

The bills are priorities for Lt. Gov. Dan Patrick and House Speaker Dade Phelan, and on Wednesday Gov. Greg Abbott added property tax relief to the agenda for the ongoing third special legislative session.