Over a year after internet giant Amazon announced plans for a second headquarters, cities have finally ended their incentive arms race to lure the company after Amazon split its selection between New York and Crystal City (just outside of Washington, D.C.).

In order to lure Amazon, state and local governments fell over themselves trying to entice the multibillion-dollar company with tax breaks, cash grants, and other incentives borne on the backs of the existing tax base: residents and businesses alike.

In a moment of clarity, New York Governor Andrew Cuomo seemed to recognize what economists already know: high taxes and regulations drive business elsewhere.

New York’s package is valued at upwards of $2 billion, drawing criticism and prompting Governor Cuomo to justify the handouts, admitting, “It’s not a level playing field, to begin with. All things being equal, if we do nothing, they’re going to Texas.”

Businesses receiving these benefits exhort the investment and jobs they bring to a community, but often those jobs attract out-of-state talent, are low-skill jobs that pull employees from other job sectors in the community, and otherwise fall short of expectations.

Suggesting that the incoming company’s “investment” isn’t necessarily a good one, Jay Shambaugh of the Brookings Institution noted the incentives come at a cost to local businesses and start-ups. He raised concerns especially given the falling rates of entrepreneurship.

“If you’re a local retailer or small manufacturer or artist or writer or publisher, you’re watching as your city and state hands your tax dollars to your most ferocious antagonist,” said Stacy Mitchell, co-director of the Institute for Local Self-Reliance.

Texas currently offers the best opportunity for business.

According to CNBC, the Lone Star State ranks first and has claimed the top spot for four out of the last 12 years. Meanwhile, one in every seven jobs created in the U.S. during the 12-month period ending July was created in Texas.

As attractive as Texas is for business and entrepreneurship, it is no stranger to the same boondoggle of corporate handouts plaguing the Amazon fiasco. Reports are that Arlington, Texas offered a package of local incentives worth over $900 million (not including the state’s “deal closing” Enterprise Fund), and Dallas’ package was reportedly worth $1.1 billion. The details of many of these proposals are often hidden from public scrutiny, due largely to loopholes in Texas’ public information laws.

The upcoming 86th session of the Texas Legislature offers opportunities to curb the misguided practice of giving taxpayer-funded incentives to businesses who often don’t need or even significantly weight them in their final analysis. One incentive, known as the Chapter 313 tax abatements, is set to expire and will undoubtedly draw considerable interest from local governments, their “economic development” arms, and lobbyists for both.

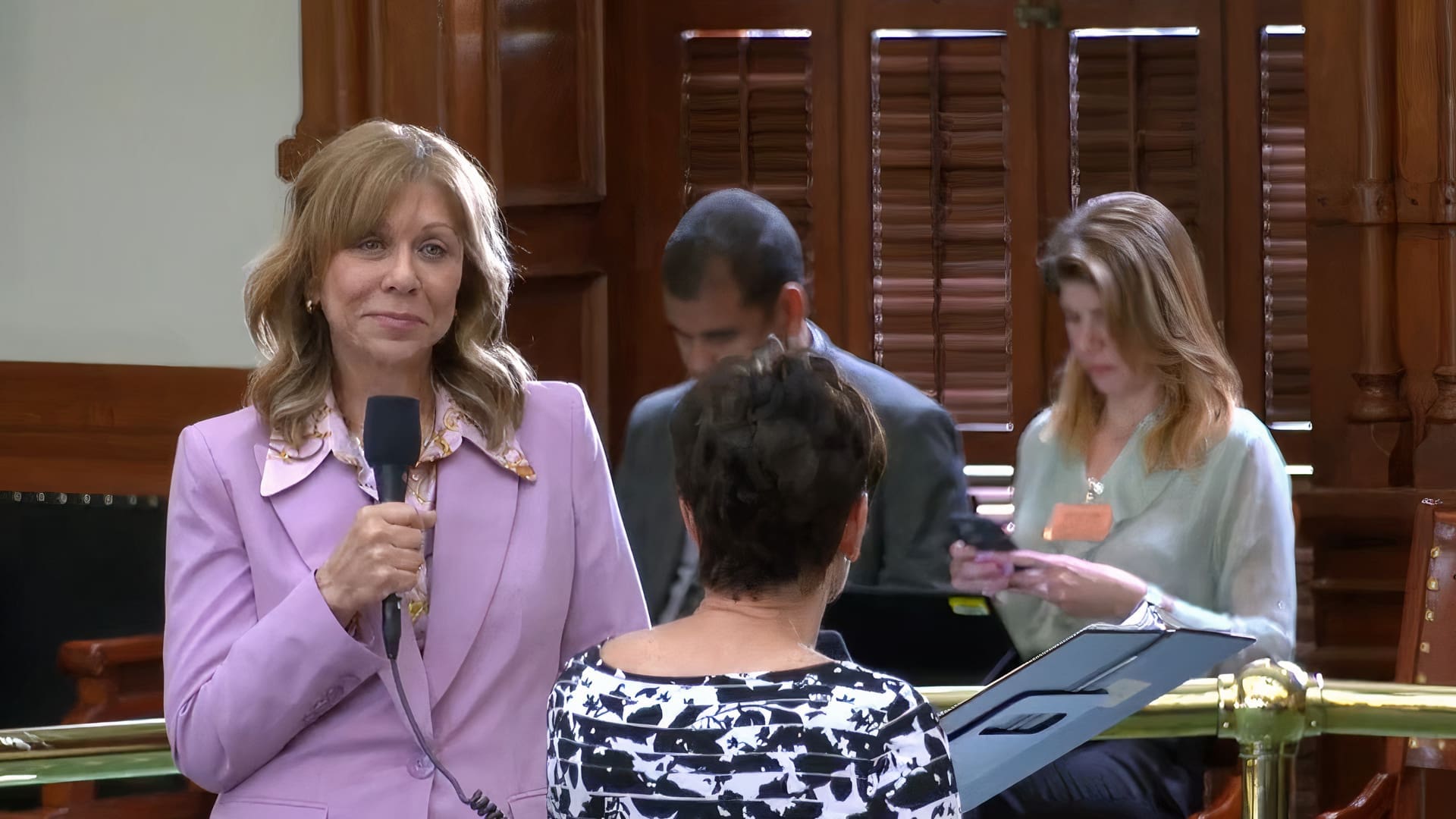

A battle to renew those incentives will be waged in the halls of the Capitol. Along with early indications that the Texas Association of (Big) Business will fight to secure $200 million in taxpayer funding for the Texas Enterprise Fund, the stage is set for a war between those who would support taxpayer handouts and those who believe the low tax and regulation Texas Model is sufficient to attract honest businessmen ready to compete on a level playing field.