Governmental policies are primarily responsible for fueling the push for “environmental, social, and governance” investing—not private investor preferences.

The American Institute for Economic Research report states “Governments worldwide have imposed numerous ESG-related regulations, with many more in progress or under consideration.”

Additionally, while governments are propelling ESG forward, investors aiming to stay ahead of the curve are falling in line by divesting from “soon-to-be penalized” fields like oil and gas.

ESG is a form of “stakeholder capitalism.” This means that investments are prioritized based on social or political reasons instead of profit-based.

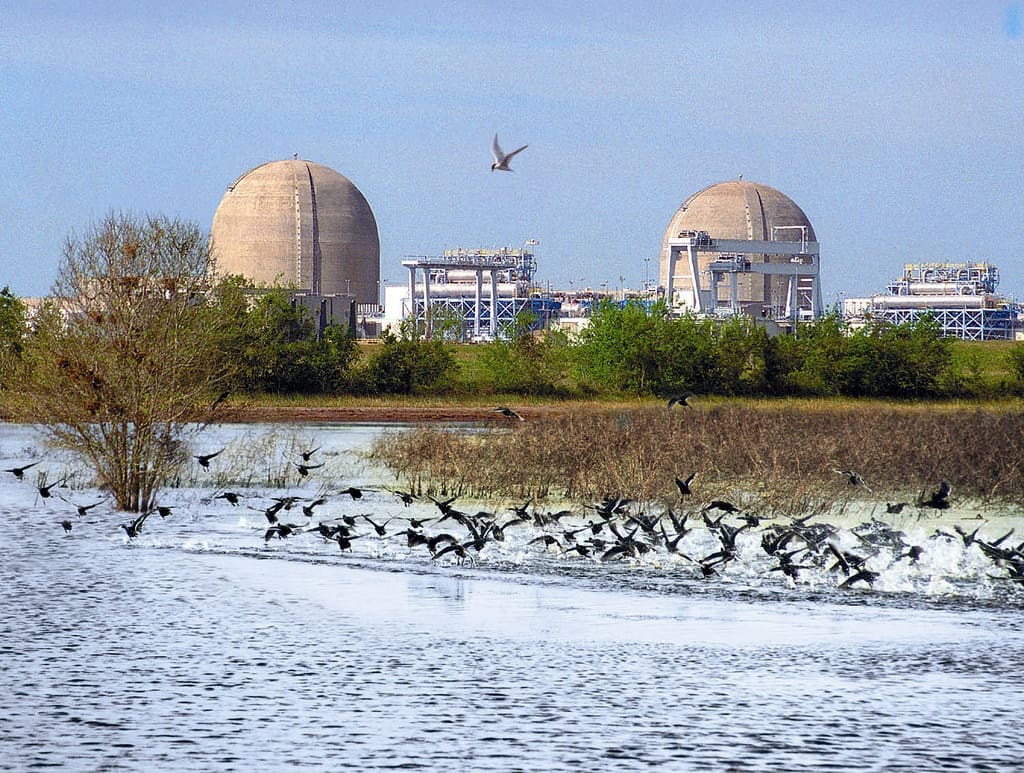

Texas has fought hard to block efforts to permeate the state’s economy with ESG. For example, back in March of this year, Texas pulled $8.5 billion from the financial behemoth BlackRock—which has violated Senate Bill 13 for allegedly using state funds to push ESG investments and boycotting energy companies.

Ironically, BlackRock has even admitted that its ESG activism has the potential to backfire and poses a serious risk to its profits. In the corporation’s own words, its activism tactics could come crashing down “if BlackRock is not able to successfully manage ESG-related expectations.”

However, some have speculated that BlackRock’s concern over its ESG activism catalyst has more to do with the company attempting to preserve its image rather than prioritizing its clients.

“BlackRock’s ability to attract and retain customers is certainly a valid concern for the company,” wrote Jason Isaac, Texas Public Policy Foundation’s Director of Life: Powered. “However, it pales compared to the financial devastation ESG could cause for unsuspecting lower- and middle-class Americans who can least afford it, who are entrusting their futures to BlackRock and assuming the company has their best interests at heart.”

“It’s clear BlackRock is trying to hide and change its language when discussing ESG. It’s ironic that BlackRock fears the exact tactics — public backlash, reputation damage, and losing clients — the ESG mob uses to coerce businesses into compliance with its political agenda,” Isaac continued.

Lt. Gov. Dan Patrick has assigned the Senate State Affairs Committee to “Study the impact of environmental, social, and governance (ESG) factors on our state’s public pensions, with a focus on proxy voting services.”

He also requested that the committee “Make recommendations to ensure our state’s pension systems vote and invest in accordance with their fiduciary responsibility to maximize profit” and “monitor the implementation of Senate Bill 13, 87th Legislature, relating to state contracts with and investments in certain companies that boycott energy companies.”

Patrick’s request signals that new legislation could be put forth next legislative session to curtail the effects of ESG investing.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!