Sales tax collections in the state for the three months ending in June 2018 are up 12.4 percent over the same period last year, a press release from Texas Comptroller Glenn Hegar announced recently.

“Sales tax revenue increased for almost all major economic sectors,” Hegar said. “The strong revenue growth was led by collections from the mining and manufacturing sectors. The construction, wholesale and retail trade sectors also saw strong gains.”

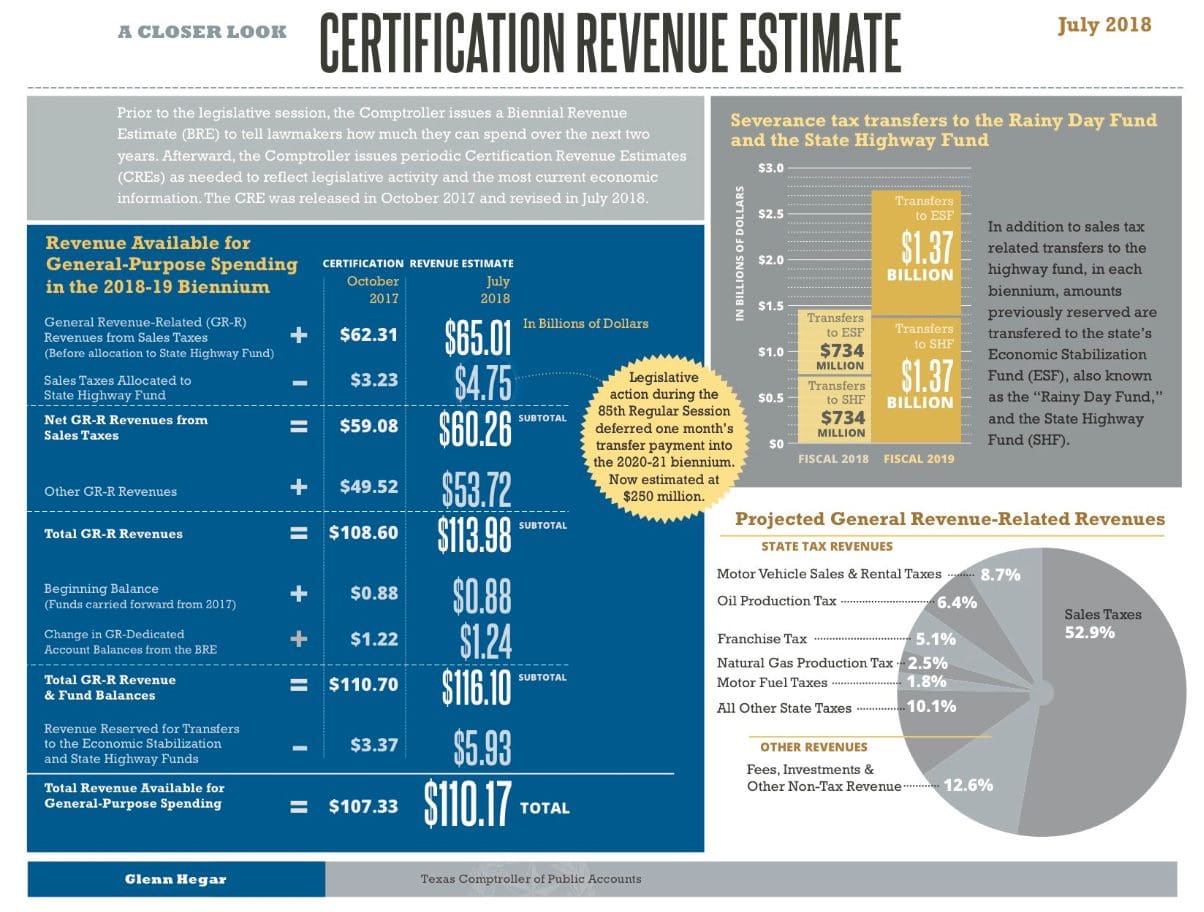

The net result is that state government will now have $110.17 billion in General Revenue-Related funds for the 2018-19 biennium. That figure represents nearly $3 billion more lawmakers will have to work with than previously anticipated by the Comptroller in his Certification Revenue Estimate from October of last year.

Additionally, revenue from other major sources also rose in 2018, including motor vehicle sales and rental taxes (up 4.5 percent), motor fuel taxes (up 4.2 percent), and oil and natural gas production taxes (up 69.2 percent).

Hegar attributes the growth in sales tax receipts to stimulative effects of federal tax reform and increased federal spending (though he cautions deficits may dampen growth). While optimistic in the near term, Hegar goes on to mention risks the state faces that could wipe out any gains.

“[T]here are significant downside risks to the forecast … Federal policy affecting such trade, including a withdrawal from the North American Free Trade Agreement (NAFTA), would directly harm the state’s economic growth. Escalating tariffs also pose a potential threat to trade and the Texas economy and could harm some of our state’s leading industries while slowing our economic growth.”

Finally, Hegar warns that sudden swings in oil prices could result in revenue collections falling short of his new forecast.

The extra revenue comes at a time when lawmakers are facing a host of fiscal needs that will require addressing in supplemental appropriations.

Among those are additional funding for Medicaid, costs incurred by the destruction of Hurricane Harvey, a statutory dedication to the State Highway Fund, and a response to mounting pressure to control the growth of local property taxes.

Adding to budget writers’ woes are concerns of a potential credit downgrade if the state doesn’t act to shore up deficiencies in state pensions and the health system for retired teachers.

“This is welcome news — and another sign that our efforts to spur economic growth are working,” said chair of the Senate Finance Committee, State Sen. Jane Nelson (R-Flower Mound). “Between Harvey and other supplemental needs, the upcoming budget will be a challenge — but this additional revenue will make a big difference.”

The property tax issue is one that Gov. Greg Abbott has made personal, aiming to limit the amount cities are allowed to raise taxes without voter approval. Measures seeking to accomplish that goal met with failure in the last regular session and during a special session in which Abbott declared property tax relief a top priority.

Last week, the Texas Public Policy Foundation released a report showing that property taxes in Texas can be phased out completely in 11 years using surplus state revenue.

With so many items to address, finding savings in the budget and prioritizing critical spending needs will take center stage when the legislature reconvenes in January.