Previously, Texas Scorecard reported on several school choice bills that have been filed ahead of the next Texas legislative session in January. While it’s unknown whether additional bills will be filed, the issue has certainly received a lot of attention lately.

Gov. Greg Abbott, Lt. Gov. Dan Patrick, and the Republican Party of Texas have all expressed their desire to implement reforms by which “funds follow students.” With the alignment of these powerful political forces, National Review and The Heritage Foundation have published articles highlighting the potential for meaningful school choice legislation in Texas, and notable advocates such as Sid Miller, Chris Salcedo, and Corey DeAngelis have likewise expressed optimism about the opportunity for this in the upcoming session.

The school choice programs described by the bills filed thus far could be loosely categorized as a tax-credit scholarship (House Bill 619 by Shaheen), a tax-credit education savings account (Senate Bill 176 by Middleton), and an individual tax-credit reimbursement (House Bill 557 by Vasut). These and other types of programs have been implemented in several states over the past 30 years or so, and a consideration of their merits is essential to determine what would be best for Texas.

The Problem

While Texas parents have the option to homeschool their children, pay for them to attend a private school, or enroll them in a state-funded charter school, those who choose one of these public school alternatives don’t receive the benefit of state funds allocated to the local school district, which also gets revenue from property taxes.

Directly or indirectly, every Texas resident pays for public schools through sales and property taxes, whether or not they have children who attend those schools. However, the state funding provided to each school district depends on the number of students enrolled. In effect, families that don’t utilize the public school system are shortchanged, and while some have the opportunity and means to pursue other education options, public school is the only choice for many students.

In many areas, it’s not a particularly appealing one.

Like the rest of the nation, Texas public school students exhibit declining proficiency in reading and mathematics. The state’s student dropout rate is one of the highest in the nation. Public school administrators and teachers brazenly push divisive political and sexual ideologies.

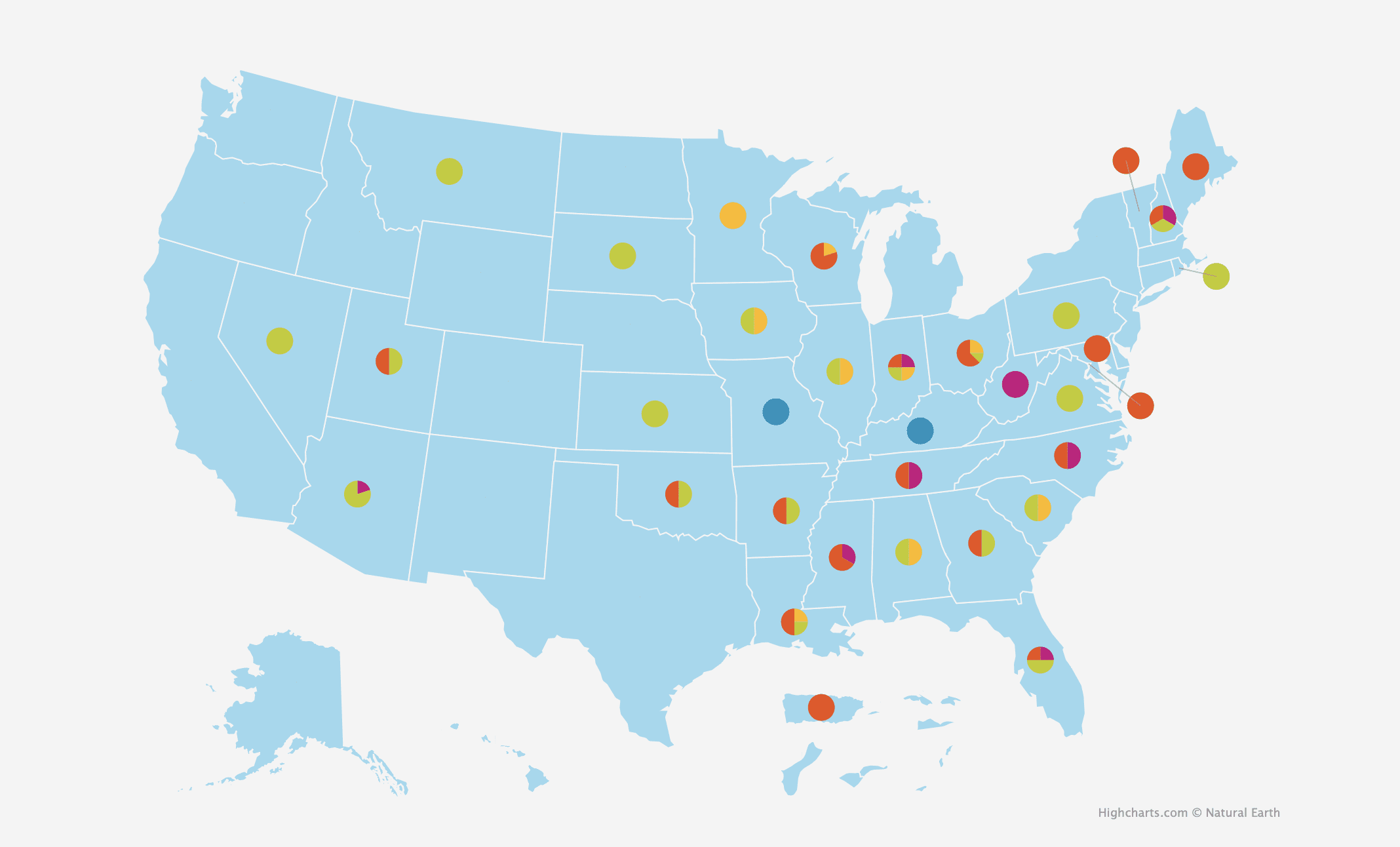

As nationwide enrollment figures show, the demand for an alternative is high.

Charter Schools

Charter schools are by far the most prevalent public school alternative in the United States, with more than 3.7 million students attending more than 7,800 schools in 43 states. Publicly funded but privately run, most charter schools focus on a certain subject or method of instruction, such as fine arts, STEM, classical education, or customized individual learning. While studies have determined there is no significant difference between public and charter schools in the areas of student attendance, behavior, or achievement, they have found that families of students who attend charter schools are generally more satisfied with their experience than those of students who attend public schools.

However, charter schools typically receive less funding than traditional public schools, and although most don’t have any admission requirements, many have long waiting lists, as the number of charter schools is capped in some states. Furthermore, families who enroll their children in charter schools are still required to fund the local public schools through their taxes.

For these reasons, charter schools are not a one-size-fits-all solution for parents averse to enrolling their children in the public school system. While public schools meet the needs of some students, school choice advocates insist families should have access to alternatives that provide flexibility and tap into state funding.

Vouchers

Voucher programs are the oldest of these publicly funded alternatives; as such, they have received the most scrutiny. As the name suggests, these programs provide eligible students with vouchers for a certain amount that can be used as payment for private school tuition. Typically, their value is equivalent to all or a portion of the average amount of funding the state provides to public schools for each student. In Texas, this amount was $4,381 last year, less than half the average cost of private school tuition in the state.

According to the EdChoice, there are currently 29 voucher programs operating in 16 states, Puerto Rico, and Washington, D.C. Nearly 304,000 students are enrolled in these programs, and the average voucher is worth $6,263. Ohio, which has five distinct voucher programs, boasts the highest student enrollment (69,991) in the country, followed by Florida (58,628), Wisconsin (48,919), and Indiana (35,698).

Tax-credit Scholarships

Although they haven’t been around as long as vouchers, tax-credit scholarships are the most widespread school choice program in the country, with 26 programs available in 21 states and a total student enrollment of approximately 325,000. These programs offer individuals and companies the opportunity to reduce their state tax liability by providing credits in exchange for donations to the program, which fund scholarships for eligible students to attend the private school of their choice.

The nation’s largest tax-credit scholarship program is Florida’s, with 106,505 students receiving financial aid. Arizona’s program, established in 1997 as the nation’s first, has 89,002 students enrolled, while Pennsylvania’s has 66,924. Nationwide, the average tax-credit scholarship is $3,715.

Education Savings Accounts

The most recent innovation in the school choice movement is education savings accounts (ESAs), the first of which was established in Arizona in 2011. This type of program is the most flexible of the state-funded public school alternatives, as families are free to use the financial assistance they receive for any qualifying educational expense, not just private school tuition. So far, 10 states have authorized ESA programs, five of which did so in only the past two years. School choice opponents have unsuccessfully challenged the legality of Arizona’s, Florida’s, and West Virginia’s ESA programs, but Kentucky’s is on hold pending review by the state supreme court.

Although most ESAs are funded through disbursements from the state allocation for each public school student, lawmakers in Kentucky and Missouri established programs that are funded by donations made in return for tax credits, like the one State Sen. Mayes Middleton’s (R–Wallisville) Senate Bill 176 would create. Depending on the program, expenses that qualify for payment from student accounts include tutoring, online classes, curriculum materials, school supplies, transportation services, and college admission tests, to name just a few.

As of January 2022, 30,992 students were receiving financial assistance through ESA programs, nearly all of whom were enrolled in those operated by Florida and Arizona. With the recent authorization of several new programs, however, this figure is expected to increase significantly.

Established in 2014, Florida’s Family Empowerment Scholarship Program provides 18,585 special needs students with $10,267 in average annual funding, which is about 90 percent of the total state and local allocations for each public school student.

Arizona’s Empowerment Scholarship Accounts program, the nation’s first ESA, was established with the intent to benefit students who are economically disadvantaged, attend a failing public school, or receive specialized services—about 23 percent of all students in the state. In September of this year, however, eligibility was expanded to all Arizona students. The program currently has 11,775 enrolled, and each receive an average of $7,000 every year. Students with special needs receive even more.

Like Arizona, West Virginia’s Hope Scholarship Program is also available to every student in the state. Unless a student is in kindergarten (in which case he or she is immediately eligible), the only requirement is having attended a public school for all of the previous year or at least 45 days of the current year. The program funds participating students at 100 percent of the state allocation for each public school student, which was about $4,600 during the 2020-21 school year.

Shortly after the Hope Scholarship Program was authorized, opponents sued the state, seeking to block the program’s implementation on the grounds that it interfered with the just and efficient administration of public schools as guaranteed by West Virginia’s constitution. On October 6 of this year, however, the West Virginia Supreme Court ruled that the newly created ESA program does not violate the state’s constitution, clearing the way for its implementation.

Individual Tax Credits and Deductions

Finally, nine states allow taxpayers to claim tax credits or deductions to their income for educational expenses when they pay state income taxes. However, with the exception of South Carolina, where 13 percent of all students are eligible to participate in its education reimbursement program, the average tax credit claimed in these states is less than $1,000, and the average deduction is less than $5,000, providing little financial assistance for most program participants. In 2020, taxpayers in these states submitted 388,189 returns claiming tax credits and 343,314 returns claiming deductions.

Conclusion

Clearly, the school choice movement has made significant inroads throughout the nation, and there are signs that it’s gaining momentum.

Like most of the country, Texas students have the option to attend state-funded charter schools; while thousands thrive in this environment, it’s not the best fit for everyone. Unlike the majority of other states, however, Texas does not offer any other public school alternatives that receive public funding.

The status quo could be coming to an end, though. With the support of the state’s most powerful politicians, and the recent proliferation of Education Savings Accounts in several states, Texas lawmakers appear willing to consider new school choice proposals.

While the odds for expanding school choice in Texas look better than ever, the weeks following the start of the next legislative session on January 10, 2023, will provide greater clarity on the issue.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!