Members of the Texas Senate Select Committee on Property Tax Reform recently traveled to Montgomery County for a hearing to discuss solutions to the ever-growing tax burden placed on homeowners by local governments. The committee heard hours of testimony from policy wonks, government officials, and taxpayers at the November 28 hearing, which lasted all day and well into the evening.

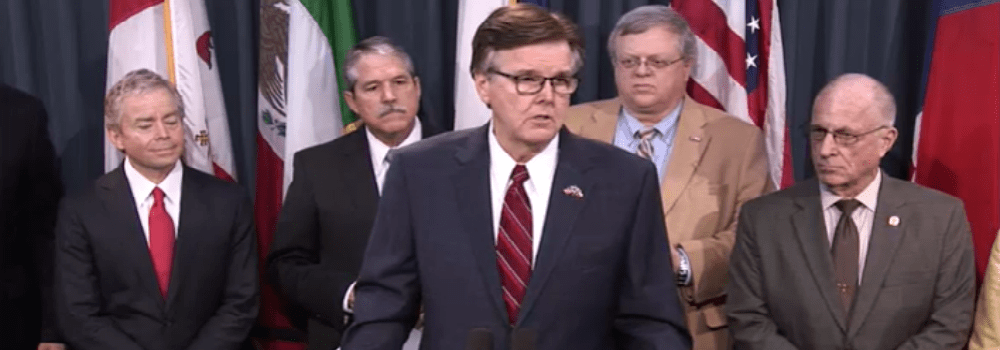

Montgomery County was a fitting location for the hearing since it is well-known for its corrupt county government, wasteful spending, and exorbitant property taxes. It is also the home of Lt. Gov. Dan Patrick.

Montgomery County Precinct 3 Commissioner James Noack was the only member of the commissioners court to attend. Tax Assessor/Collector Tammy McCrae, Lone Star Groundwater Conservation District board member Jon Bouche, and Hospital District board member Bob Bagley were the only other local officials who attended the hearing.

The committee, chaired by State Sen. Paul Bettencourt (R–Houston), addressed three major areas of property tax reform throughout the day: (1) lowering the rollback rate to shrink the growth of government, (2) making appraisal boards more accountable to voters, and (3) considering proposals to shift from property taxes to consumption taxes.

“No one should underestimate the resolve of Lt. Gov. Patrick to get this issue resolved,” said Bettencourt. “We are on a collision course with reality when taxing jurisdictions increase revenues by 10, 11, or 12 percent year over year. Taxpayers cannot keep up.”

A representative from Gov. Greg Abbott’s office outlined the governor’s plan to lower the rollback rate to 2.5 percent. Contrary to fear mongering by some local elected officials, lowering the rollback rate would not handicap the ability of local governments to provide needed services. It would simply state that if a government is going to raise taxes above that rate, it would be required to make its case to the public and get approval from the voters. Taxpayers would then have a mechanism to defend themselves against exorbitant property tax increases.

“You cannot let government grow at 7, 8, or 9 percent a year,” said Bettencourt. “People’s income just does not keep up with this.”

While lowering the rollback rate is an important component of property tax reform and curbing the out-of-control growth of government, it cannot be a standalone solution as it only solves part of the problem. It must be part of a broader, comprehensive reform plan. In some locations, it would have a significant impact; however, in other areas that do not experience growth in the tax rate, it would not be as helpful.

For example, simply lowering the rollback rate would not affect anyone in Montgomery County or lower anyone in the county’s property tax bill. Although the tax rate has remained largely the same in the last 10 years, property taxes have increased 133 percent over that period. While commissioners court keeps the tax rate the same, the Montgomery County Central Appraisal District has constantly raised the values of people’s homes, causing them to pay more in taxes.

This problem would persist even if the rollback rate were lowered to 2.5 percent because commissioners are keeping the tax rate the same, and they could keep bringing in more revenue without needing to raise the rate anywhere near 2.5 percent. Unless commissioners lower the tax rate enough to offset the rise in property values, they’re still raising taxes. Commissioners across the state are similar in this regard, as they hide behind the appraisal process to do it.

Reforms to the appraisal process discussed during this hearing included making the process more transparent, capping the growth of appraisals, and making the chief appraiser and/or appraisal board-elected positions.

Montgomery County Chief Appraiser Tom Belinosky objected to the idea of making his position elected, stating that appraisers are so unpopular that they would likely serve only one term since taxpayers would vote them out if they raised property values. Some in the audience murmured that this might not be such a bad thing.

An example from Montgomery County was brought up at the hearing that demonstrated how electing appraisal boards can bring accountability and significant change. State Sen. Brandon Creighton (R-Conroe) passed legislation last session changing the Lone Star Groundwater Conservation from an appointed board to an elected one. Citizens brought accountability to the rogue agency by electing a new board that is more transparent and is enacting policies almost completely opposed to the unpopular policies of the appointed board.

Another issue discussed was how appraisal boards often consist of elected officials from other government entities. In Montgomery County, two commissioners — a former commissioner and the chairman of The Woodlands Township — sat on the appraisal board at the same time. Reformers have argued that allowing local elected officials to tax and spend on one end, while also deciding at what value property will be taxed, is a conflict of interest and should be prohibited.

Montgomery County Republican Party Treasurer John Wertz called attention to the rampant spending of local governments as a major contributor to high property taxes:

“Please never lose sight of the fact that first and foremost, we have a spending problem at all levels of government … In fact, over the last ten years, while Montgomery County has nearly doubled in population, spending has increased over 400 percent.”

Reforming school finance is also an important component of property tax relief. This could include abolishing the state’s inherently unfair and dysfunctional “Robin Hood” scheme and replacing the school Maintenance and Operation property tax with a consumption tax or with existing state revenue.

“No matter what revenue source you use, you must have transparency and controls,” said Bettencourt.

Across the state, Republicans campaigned on property tax reform and have a clear mandate from the voters to pass it. Many of these reforms are enshrined in the Republican party platform. Since Republicans hold clear majorities in both chambers, if they fail to get the job done in the upcoming legislative session it will not be due to a lack of ability but a lack of will.