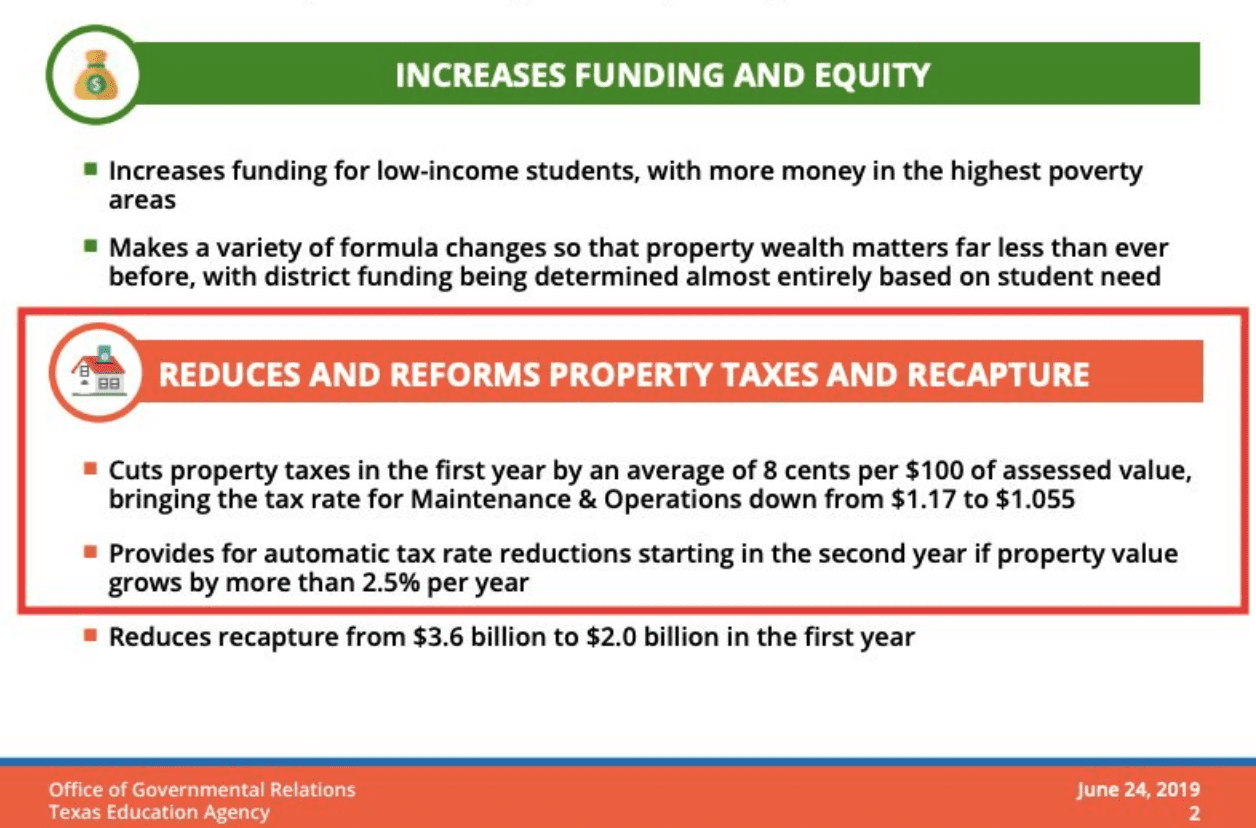

As a result of a recently passed state law, school property tax rates will be reduced in the 2019 tax year. Whether or not individual taxpayers will pay a lower tax bill will depend on the amount their property has increased in taxable value.

Although the exact rate reduction will vary from district to district, school tax rates across Texas are being reduced or “compressed” in 2019 due to lawmakers dedicating $5.1 billion to tax “relief.” The funds were appropriated in House Bill 3, which also included a massive increase in education funding, passed earlier this year by state lawmakers.

According to the Texas Education Agency, the average school tax rate reduction is 8 cents per $100 of property valuation.

On a home with a taxable value of $300,000, net of the school homestead exemption, 8 cents equates to $240 in annual savings. At Texas’ median home value of approximately $195,000, the annual savings equates to roughly $135.

Again, due to rising appraisal values, the 2019 rate reduction may not result in a lower tax bill for every property owner. It will mean tax bills will not increase as much as they otherwise would have if lawmakers failed to act. Local school districts still have the option of choosing to lower their property tax rates even further to offset these rising values by adopting their “effective” property tax rate—also called the “no-new-revenue” rate.

The Texas House and Senate originally dedicated only $2.7 billion of the state’s record $10.5 billion surplus for tax relief in each of their respective budgets. The “relief” was later increased in the Senate to $5.7 billion, during debate over House Bill 3.

In response to public pressure, State Sen. Paul Bettencourt (R–Houston) and other Senate Republicans insisted that more of the state’s historic $10.5 billion surplus be returned to taxpayers. Both chambers later agreed to $5.1 billion in conference committee.

Unlike Texas, other states automatically return surplus state tax revenue to their taxpayers.

Voters in Colorado passed a referendum in 1992 that forces all state surplus revenue—over and above population growth and inflation—to be automatically returned. Sadly for taxpayers here, state law in Texas contains no such provision.

Despite repeated efforts by the Texas Senate in 2015, 2017, and 2019 to impose similar spending reforms on state lawmakers, the Texas House has repeatedly refused to even debate the legislation.

In the 2017 special session, despite Gov. Greg Abbott backing a stricter spending limit, the bill was killed on a point of order on the House floor in violation of the chamber’s rules, at the behest of disgraced former Speaker Joe Straus.

The Republican Party censured Straus for repeatedly killing its own priorities, in addition to state spending limits.