After the Texas Legislature chose not to extend a massive corporate welfare program, one Republican lawmaker has filed a bill during the current special session in an attempt to push back the program’s expiration.

Chapter 313 of the Texas Tax Code allows school districts to offer large tax breaks for 10 years to renewable energy and other businesses. The tax breaks come at no loss to the school districts. Instead, the state supplements the lost revenue to the districts from sales taxes and other state-collected taxes.

The program has drawn criticism from the right and left; both the Republican Party of Texas and the Democrat Party of Texas have called for the abolition of Chapter 313 abatements and corporate welfare in their party platforms.

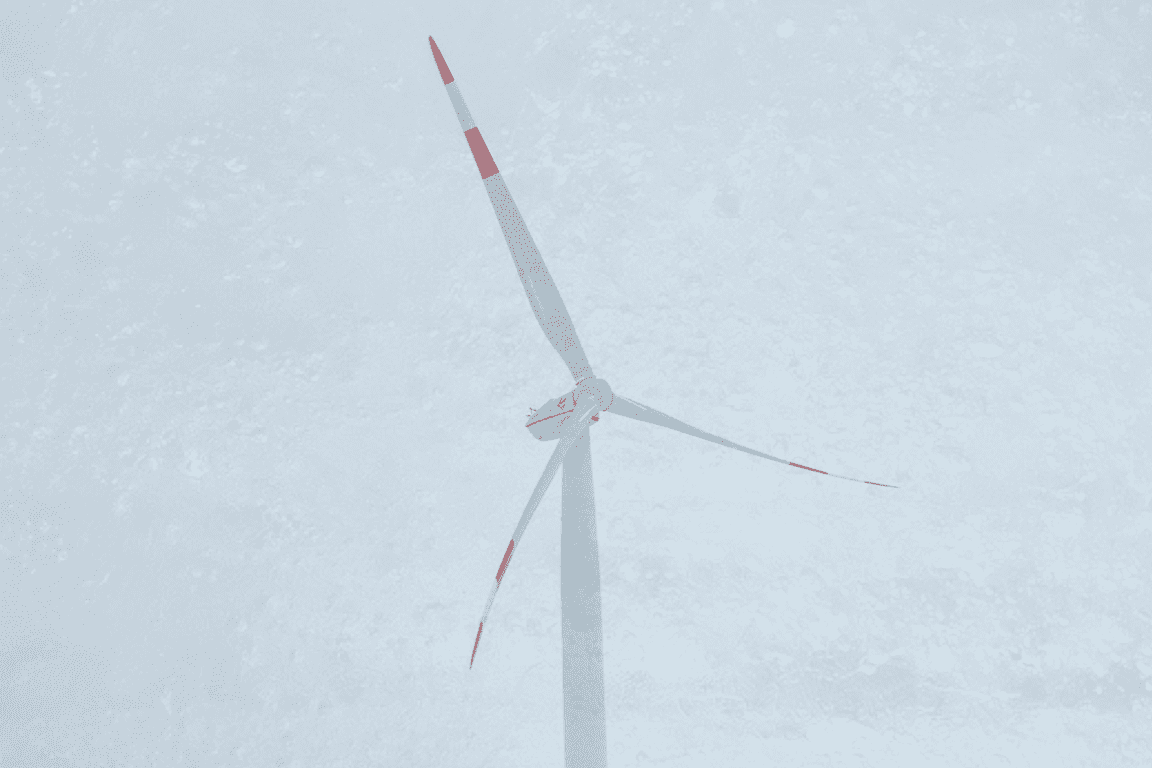

Renewed criticism was placed on the program this year, as many of the unreliable wind farms that failed during the February winter storm were beneficiaries of the scheme.

With the program set to expire at the end of 2022, two attempts were made during the regular legislative session earlier this year to keep the program going.

One effort by outgoing Republican Caucus Chairman State Rep. Jim Murphy of Houston would have not only extended the program for 10 years, but it also would have expanded the types of projects eligible for the subsidies to existing companies that are simply doing “renovations, improvement, and modernization.”

When that bill was considered in the Texas House in May, a bipartisan group of lawmakers worked to gut it, stripping renovations from eligible projects and proposing voter approval of 313 projects.

Those changes were deemed unsuitable by Murphy, who postponed his bill beyond the House’s deadline, effectively killing the legislation.

Another bill by State Rep. Morgan Meyer (R–Dallas) to extend the program for another two years, however, was approved by House members.

But when that bill reached the Senate, it met strong resistance.

State Sen. Brian Birdwell (R–Granbury) who sponsored the bill in the Senate amended it to extend the program for three years—to 2025.

During a committee hearing, State Sen. Lois Kolkhort blasted the program as having “run amok,” adding that she believed it was “time to start over with an absolute clean slate.”

While the bill made it out of committee in the Senate, it never received a vote, leaving the program set to expire at the end of 2022, before the next legislative session.

With the Legislature currently in its third special session, however, State Rep. Dan Huberty (R–Humble) has filed a bill proposing the program be extended through 2023.

Any bills passed during a special session must be on the governor’s agenda. So far, Gov. Greg Abbott has not indicated whether he will add extending the corporate welfare scheme to lawmakers’ list of must-pass items.