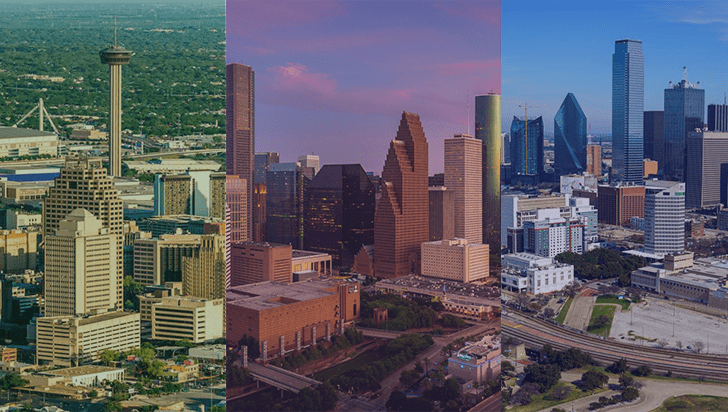

School district debts in Dallas, Houston, and San Antonio are alarmingly high at more than $7 billion. When you add these to the cities’ debts and other underlying governments, the combined debt each taxpayer must pay is $69,600. Change will only come when “citizen advocates” get involved.

Last year, citizen organization Truth in Accounting found Texas to be a “sinkhole state,” meaning $11,000 more would have to be taken from each taxpayer to pay off all state debts. Earlier this year, they found eight of Texas’ most populous cities went into 2020 as “sinkhole cities,” needing even more money from taxpayers to pay their bills.

TIA has since released an updated report of the per-taxpayer debt in three of those cities—Dallas, Houston, and San Antonio—adding in the debt obligations of “underlying government units for which city taxpayers are also responsible, such as school districts, and transit and housing authorities.”

“We only include underlying entities that city governments claim responsibility for in their annual financial reports,” TIA writes. “When the unfunded debt of these underlying government units is combined with the county, municipal, and state debt, city taxpayers are on the hook for much more than they think.”

After adding these units, per-taxpayer debt in Dallas, which TIA found entered 2020 in the worst financial shape of all Texas’ major cities, went up from $13,500 to $26,000. Houston’s went up from $11,600 to $24,400 per taxpayer, while San Antonio’s rocketed from $3,500 to $19,200—the highest spike.

“Texas’ largest cities are addicted to debt, and taxpayers should be terrified,” James Quintero of Texas Public Policy Foundation told Texas Scorecard. “If city officials don’t slow the borrowing binge, then urban Texans could soon see higher taxes, larger fees, and slower economic growth—all at the worst possible time.”

“Seeing the taxpayer burden for each resident of these major cities is devastating, but not surprising,” added Tim Hardin, executive director of Texans for Fiscal Responsibility. “Texas’ largest cities have continued unchecked for decades as taxpayers continually are left to pick up the pieces. There have been efforts from the state level to [curtail] the irresponsible budgets of some of our largest cities, but frankly, they have been lackluster, focusing more on political messaging than substantive change and reform.”

TIA found school districts and college districts in these cities have a combined amount of $5.3 billion in unfunded pensions due and unfunded post-employment benefits, and more than $2 billion in “other bills.”

Deep Dive

For all three cities, $11,300 in per-taxpayer debt is added from the state.

In the City of Dallas, the $26,000 per-taxpayer debt breaks down this way: $13,500 from the city, and $1,500 from Dallas Independent School District. Only Dallas/Fort Worth International Airport has a taxpayer surplus: $300. Neither Dallas County nor the college district was found to have a surplus or add to local taxpayers’ burdens.

TIA found Dallas ISD needs a total of $542.1 million to pay its bills, including more than $1.2 billion in unfunded pensions due and unfunded post-employment benefits. They also owe $606.7 million in other bills.

In Houston, the $24,400 per-taxpayer debt breaks down this way: $11,600 from the city, $600 from Harris County, $500 from Houston ISD, $300 from Metropolitan Transit Authority of Harris County, $200 from Spring Branch ISD, $200 from Alief ISD, $100 from Houston Community College, and $400 from the Port of Houston Authority of Harris County.

TIA found that all the school districts and the college combined need an additional $760.2 million to pay its bills. All of them have unfunded pension benefits and other post-employment benefits due, totaling more than $2.1 billion. They all also owe more than $1.4 billion in other bills.

The breakdown of San Antonio’s $19,200 per-taxpayer burden goes like this: $3,500 from the city, $1,500 from Bexar County, $100 from VIA Metropolitan Transit, and $100 from San Antonio River Authority.

The rest comes from school districts: $1,100 from Northeast ISD, $700 from San Antonio ISD, $500 from Northside ISD, $300 from Alamo Community College District, $200 from Harlandale ISD, and $100 from South San Antonio ISD. Edgewood ISD is the only one that didn’t add to San Antonio taxpayers’ burdens.

TIA found that all the school districts and the college combined need more than $1.3 billion from taxpayers to pay all their bills. All of them have unfunded pensions and other post-employment benefits, totaling more than $2 billion, and all owe more than $1 billion in other bills.

Solution

Hardin of Texans for Fiscal Responsibility says the only way this will change is if citizens get involved in local government.

“We should be thankful for organizations that provide transparency of these disturbing trends. But ultimately, it is on the taxpayers themselves to hold their representatives accountable,” Hardin said. “This goes for the state and local levels. We believe there are enough organizations that exist to assist taxpayers in advocating for true reform, but we are in desperate need of citizen advocates to fight for change.”

“We are hopeful this election cycle will be the start of a great movement toward more fiscally responsible governance.”

This article has been updated since publication.