VELO nicotine pouches are at the center of a legal battle after the State of Texas classified them as tobacco for taxation purposes. The case has worked its way to the state Supreme Court, where it is set to be heard in October.

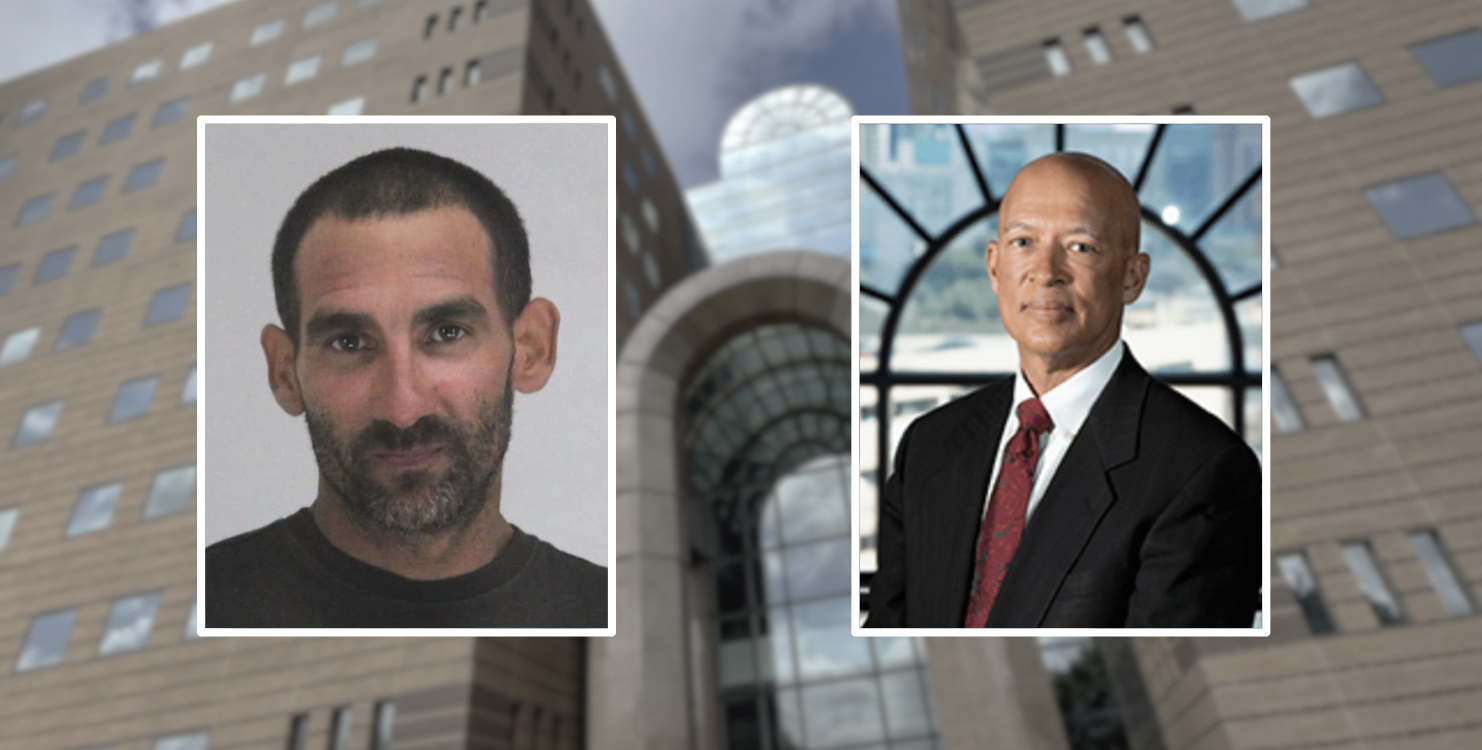

According to court filings, former Texas Comptroller Glenn Hegar announced in 2019 that he views VELO as a taxable tobacco product because it “contains nicotine, which is an extract of the tobacco leaf.”

In August 2020, RJR Vapor Co., manufacturer of VELO, filed a lawsuit against the comptroller. It has since been assumed by acting Comptroller Kelly Hancock, in his official capacity, and Attorney General Ken Paxton. RJR Vapor reportedly paid the tax under protest and sued to recover the payments.

The specific issues presented to the Texas Supreme Court are whether VELO products are tobacco products, and, if so, whether the contested definition of “tobacco products” and its application by the comptroller are constitutional.

Texas’ Cigars and Tobacco Products Tax defines a “tobacco product” as “an article or product that is made of tobacco or a tobacco substitute.”

RJR Vapor contends that while VELO is made from tobacco, it is not made of tobacco.

“VELO products are not ‘made of tobacco’ because they contain no tobacco leaf,” RJR Vapor argued in court filings. Instead, it contended that “these products contain pure nicotine chemically extracted from tobacco.”

The state argues that the Court must tether itself “to the fair meaning of the text, not the hyperliteral meaning of each word in the text.”

RJR Vapor alleges the comptroller applied his understanding selectively, “taxing some—but not all—products within the class of tobacco-free oral nicotine products,” meaning the comptroller’s enforcement decisions violated the constitutional right to uniform taxation.

“Like VELO, e-cigarettes do not contain tobacco leaf but typically contain nicotine isolate extracted from tobacco. Yet the Comptroller has stated that e-cigarettes are not ‘made of tobacco’ because—even ‘though nicotine is a component of tobacco’—they ‘do not contain tobacco,’” contends RJR Vapor.

The state argues that “statutory context makes clear that the Tax does not apply to NRTs [Nicotine Replacement Therapies, such as e-cigarettes],” adding that “VELO products are not NRTs, and RJR Vapor has not argued otherwise.”

Additionally, the state warns of the potential consequences of not classifying VELO as tobacco.

“The Legislature uses this definition for several purposes beyond just levying this Tax. It has incorporated the definition into other statutes that prohibit the sale of ‘tobacco products’ to minors,” argues the state.

RJR Vapor responded, claiming the argument was baseless.

“The Comptroller’s central assertion is that the ruling makes it permissible to sell tobacco-free nicotine products to minors. But he overlooks (among other things) that federal law prohibits such sales and that the federal prohibition is vigorously enforced in Texas, including through contracts with Texas government entities,” said RJR Vapor.

The 250th District Court of Travis County—the trial court—ruled that VELO is not a “tobacco product” under the Tax Code, granting RJR Vapor a refund of $16,071.68. It also ruled for RJR Vapor on both constitutional claims, though it denied injunctive relief, which would have protected VELO from being taxed until the case is settled. The state appealed.

The Third Court of Appeals in Austin agreed that VELO is not a taxable tobacco product. It concluded that VELO is not “made of tobacco” because nicotine isolate is “a chemically pure substance” that contains “no part or traces of the tobacco leaf.” It also concluded VELO is not made of a tobacco substitute.

The court held that it lacked jurisdiction to address the constitutional claims, and the state appealed to the Texas Supreme Court on March 14, 2024.

The Court granted review on May 30, 2025. The case has been set for oral argument at 9:00 a.m. on October 8, 2025.

In 2023, multiple legislative bills were proposed to address the issue of nicotine pouch taxation. For example, House Bill 4353 would have imposed taxes specifically on “e-cigarettes and alternative nicotine products,” including nicotine pouches, by creating a new chapter in the tax code. None of the bills were passed into law.

According to Grand View Research, the “U.S. nicotine pouches market size was estimated at USD 4.09 billion in 2024 and is expected to grow at a CAGR [compound annual growth rate] of 29.6% from 2025 to 2030.”

Drugs have become a top issue in Texas of late. After vetoing a proposed ban on THC, Gov. Greg Abbott called a special legislative session, beginning July 21, to settle the product’s regulation.

The office of the comptroller told Texas Scorecard that the agency “will have no comment on this pending litigation.”

RJR Vapor, Hegar, and Paxton did not respond to Texas Scorecard’s request for comment in time for publication.

If you or anyone you know has information regarding judicial malfeasance, please contact our tip line: scorecardtips@protonmail.com.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!