Because of irresponsible spending practices by elected officials, Texas is $97 billion in debt. Texans can change course by demanding answers and better budgeting practices.

Sheila Weinberg, founder and CEO of Truth in Accounting (TIA), finds Texas keeps two sets of budget books; one says the state has $13 billion in savings, and the other says the state has more than $100 billion in debt. Combining the information from the two budget books, Texans owe a grand total of $97 billion. According to Weinberg, state legislators have made decisions based on the first book instead of actual debt numbers.

How could the debt be so high, considering the Texas Legislature is required to pass balanced budgets? Weinberg said it’s because “most balanced budget calculations” don’t include the benefits elected officials promise to state employees, like pensions, because they’re paid in the future.

“[The calculation] only includes the money that comes in versus the money that goes out,” she explained. “If they had to truly balance the budget … include all the actual cost? Then they would have had to raise taxes or they would have had to cut spending, and these people might not get re-elected.”

Promises Not Kept

Founded in 2002, TIA is on a mission to “educate and empower citizens” with what their governments are really doing with taxpayers’ money. What Weinberg’s found is Texas officials haven’t been putting aside enough money to keep promises they’ve made to state employees.

“What the state Legislature, and governors, have chosen to do in Texas is to balance their budgets by not paying even the minimum payments for their pension and retiree healthcare plans,” she said. “Right now, they’re paying those benefits out of past contributions. But the state only has, for their employment retirement plan, 66 cents set aside for every dollar that they have promised.” As of 2019, Weinberg said the Teachers Retirement System has only set aside 75 cents for every dollar promised. “They, in essence, charge [the] compensation costs to the pension credit card.”

Weinberg notes that last year, the plan’s actuaries calculated $985 million should have been paid into the state’s pension “credit card”—but the Legislature only contributed $736 million. “They shorted the plan by $249 million,” she said. “Why would you make these employees those promises and not put any money aside to pay them?”

Texas’ True Budget

Can Texas’ budgets truly be considered balanced? Weinberg doesn’t think so. “To me, as an accountant and as a normal business person would think, when you balance your budget in a business, your revenues equal your expenditures. But when governments balance and calculate their budgets, they only include ‘here’s the money we get and here [are] the checks that we write.’ If they choose to not properly fund their pension plan, they can still claim their budget is balanced.”

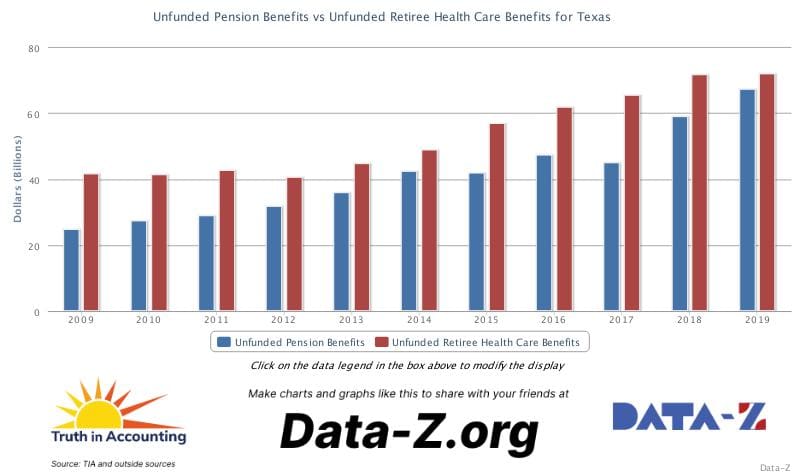

More data from TIA shows that since 2009, unfunded pensions in Texas have been a steadily growing problem.

In 2009, Unfunded Pension Benefits (UPB) in Texas stood at more than $24 billion, while Unfunded Retiree Health Care Benefits (URHCB) were at more than $41 billion. In 2019, UPB exploded to more than $67 billion, and URHCB close to $72 billion.

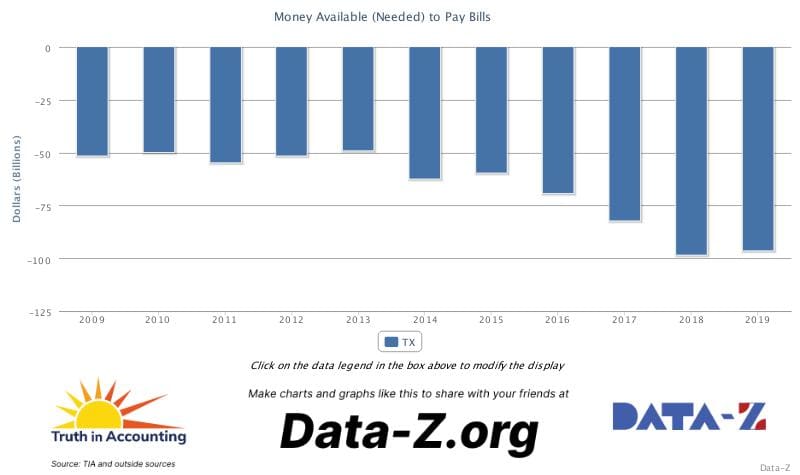

This has affected Texas’ balance sheet. As of 2019, the state needs more than $96 billion to pay its bills, compared with needing more than $51 billion in 2009.

Texas doesn’t seem to be changing course in the near future, according to a note Weinberg saw in the state’s financial report. “In essence, they’re going to continue to short the pension plans through 2025, and then at that point, they’re going to start funding them more properly,” she said.

2021 Legislative Actions

Weinberg discussed what effect two actions the Legislature took in the 2021 regular session will have.

Senate Bill 321, signed by Gov. Greg Abbott, shifts the default to a “cash balance” that limits the complete amount that can be paid to state employees. Retirees will be given a choice: Take the full amount upfront, or take a percentage of it each month. It also allows state legislators to start receiving benefits while in office once they meet certain requirements. “The ability for legislators to double-dip in the future is an example of the infamous reform that creates greater instability for the plan,” Weinberg commented after reading reporting on the law. “[SB 321] does not do anything to reduce the unfunded pension liability that exists today. It is only for future employees.”

The Legislature also capped state spending at the rate of population plus inflation, with an exemption to pay for recovery from disasters declared by the governor and tax relief. “Anything that reduces spending or increases revenue helps with the cash shortfalls. On the surface, this bill would limit future spending increases,” Weinberg said. “It is interesting that the bill does not take effect until 2024-2025. What are they waiting for?”

Where Texas Is Headed

Weinberg was blunt. “Just look toward Illinois. Their bond rating is so low, they’re paying high interest on the money that they have to borrow,” she said. “They don’t pay their vendors on time. For example, here in Illinois, at one point in time, the state police almost ran out of ammunition because the vendor was not getting paid for six to 18 months.”

On the opposite end of the spectrum is the state of Utah, which earned an award from TIA for how they budget. Weinberg asked the state’s budget director why Utah is different. “She facetiously said, ‘Well, here in Utah, we only promise the services and the benefits that we can afford.’”

For Texans not wanting their state to be in the same situation as Illinois, Weinberg advises pulling up TIA’s Financial State of Texas report, asking your state representative and state senator, “Please explain to me how we have a balanced budget requirement, but the state debt continues to increase?”

With Gov. Greg Abbott expected to call multiple special sessions of the Legislature, Weinberg also has advice for what items citizens should ask him to put on legislators’ to-do list. “One, let’s clean up our balance ledger requirement. Two, let’s figure out a plan to fully fund our pensions and fully fund our retiree healthcare liabilities. Pay what the actuaries say we should be paying into those plans.”