After a report was released showing asset managers for the University of Texas and Texas A&M University’s investment management company were voting in favor of resolutions to advance leftist policy, the entity’s leadership now says it is putting guidelines in place to stop political proxy votes.

UTIMCO—the University of Texas/Texas A&M Investment Management Company—asset managers cast 159 “woke” proxy votes, according to a report by the American Accountability Foundation.

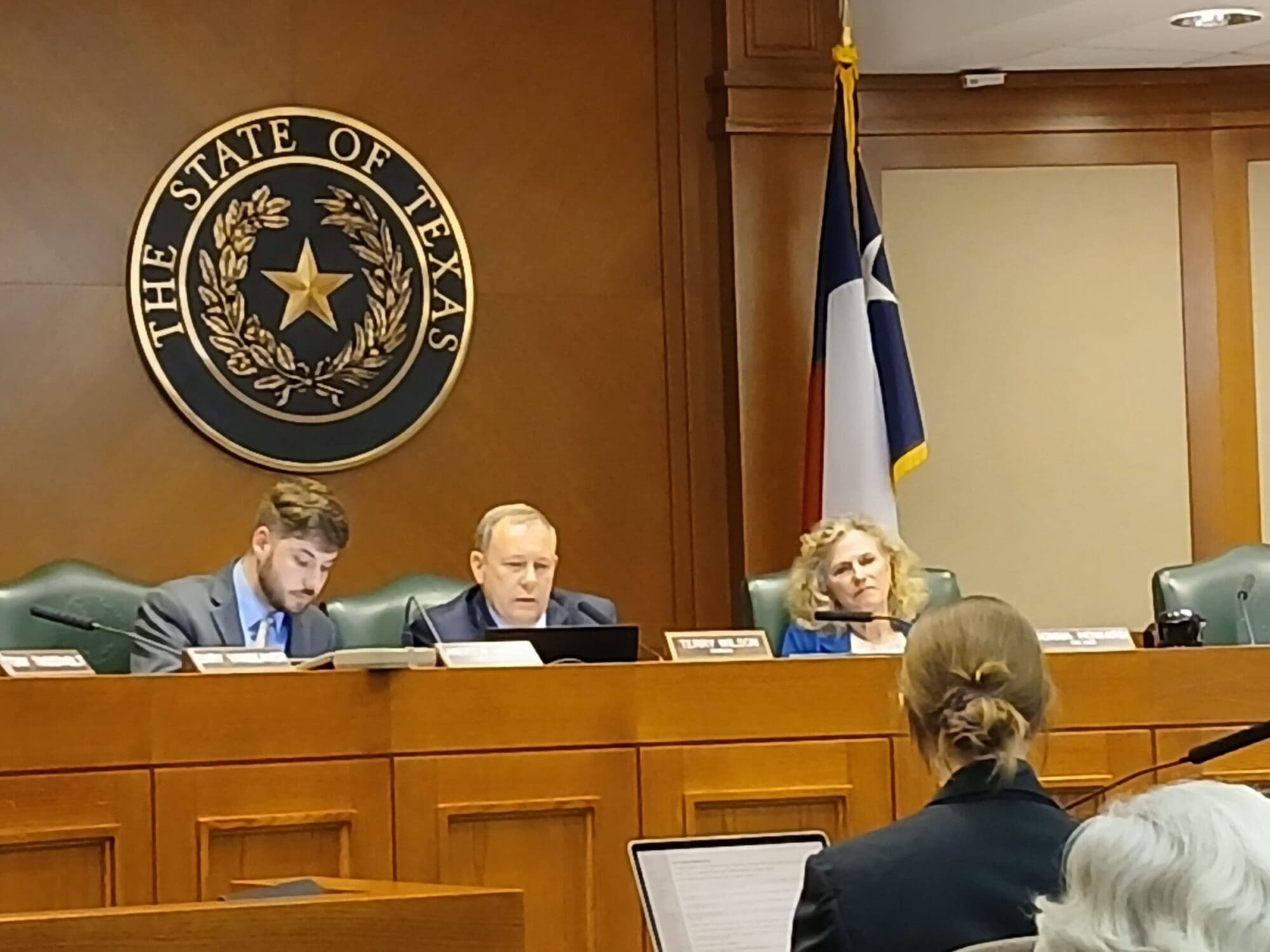

On October 17, Richard Hall, president, CEO, and CIO of UTIMCO, spoke at a Texas Senate Committee on State Affairs hearing on the entity’s policies regarding proxy voting.

“UTIMCO’s investment policy is set by the UT System Board of Regents,” Hall said, emphasizing that the policy is very clear.

“UTIMCO should vote proxies in a manner consistent with the unique role and mission of higher education as well as for the economic benefit of the endowment,” Hall said. “UTIMCO shall not invest the endowment to achieve temporal benefits of any purpose, including use of its economic power to advance social or political purposes.”

UTIMCO’s investments are managed by third-party firms, which have the authority to cast proxy votes. However, this authority is contingent on adherence to proxy voting policies.

“However, in the last several years we have seen an increasing number of shareholder initiatives seeking to use the proxy voting process to achieve social or political outcomes rather than economic outcomes that enhance shareholder value,” Hall said. “This was enabled by regulatory changes by the U.S. Securities and Exchange Commission in late 2021.”

Hall later said in his testimony, “I’m not happy with those votes. UTIMCO will do better.”

UTIMCO has been dedicated to improving policy guidelines, Hall continued. The most recent policy provision involves letting company managers and directors determine what is most likely to increase the value of a company and requiring that shareholders vote according to those recommendations. Hall said UTIMCO has begun implementing those guidelines in advance of future proxy votes.

“We’ve made it clear that any manager who does not agree to vote UTIMCO shares in accordance with these guidelines will lose the authority to vote UTIMCO shares,” Hall said.

UTIMCO is also considering pulling proxy voting from third-party managers altogether. To do this, Hall said, UTIMCO would have one of the nation’s leading proxy advisory services serve as an administrator and assist in implementing voting guidelines.

According to Hall, this solution “has the potential to be efficient, cost-effective, better controlled, and more accountable to the UT System Board of Regents.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!