Leander ISD (LISD), a district near Round Rock, has refused to confront a debt addiction that’s bludgeoned taxpayers for over a decade. Instead, they’ve joined the Fast Growth School Coalition with the explicit goal of raising property taxes and removing legislative debt limits designed to safeguard Texas taxpayers.

Current state law limits the tax rate that ISDs can levy to fund their debt obligations. In order to avoid hitting that limit after years of reckless borrowing, LISD has issued capital appreciation bonds (CABs), which have abusive repayment schedules and gigantic balloon payments.

Since state law doesn’t require the disclosure of the interest cost on local ballot propositions, voters are passing propositions without seeing their total cost. To date, no district in the state has voluntarily adopted basic ballot disclosure.

LISD has already issued debt that will cost taxpayers 6 times more than the principal amount originally borrowed. In one instance, when principal and interest payments are totaled, $163 million in funds borrowed will cost LISD taxpayers nearly $1 billion over the long-term.

That’s a cumulative interest rate of over 500%.

But they’ve issued CABs more than once. A past issuance for $187 million carried a total price tag of $1.1 billion in total payments. Of the $3.5 billion in outstanding liability LISD taxpayers owe through 2049, it’s estimated that over $2.5 billion is interest expense alone.

That’s over $105,000 in liability per student…or over six times the state average.

Adding insult to injury, approximately 14% of debt purchases since 1997 have been for short-term consumables and operating expenses, items that should be paid for with cash flow from the district’s general fund.

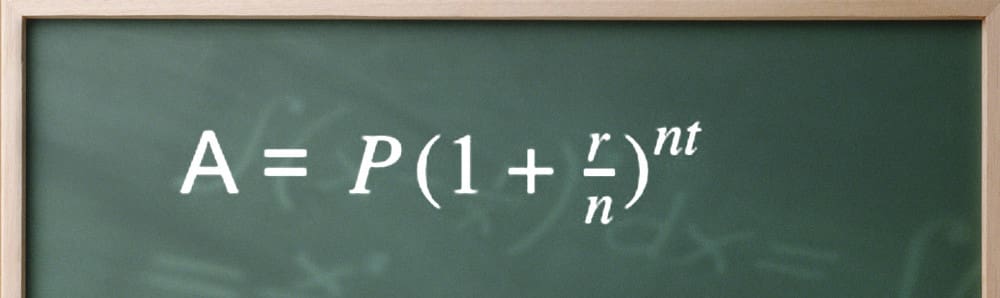

Using long-term debt with gigantic “balloon” payments to buy short-term assets is analogous to you financing a car over 25 years. On a traditional 5-year note at today’s interest rates, a $30,000 loan would cost $32,650 in principal and interest payments.

Using LISD’s financing terms, however, you’d pay over $182,000 for the same vehicle.

Requiring ballot transparency would force ISDs to disclose the principal and projected interest expense on the ballot. After all, it’s ridiculous to ask voters to approve a $163 million bond without telling them it will cost an additional $835 million in interest.

The effort by the Fast Growth School Coalition to raise property taxes is a deliberate distraction from the real problem; a lack of transparency, accountability and fairness for taxpayers in the debt process. Would you knowingly pay $182,000 for a $30,000 car?

You might if you weren’t shown the interest expense or other repayment terms.

Governments need limits because they’re spending someone else’s money, and so far, failure to address transparency and accountability has been a costly mistake. Texas taxpayers deserve to know the whole truth about their local debt when deciding on new bond proposals. After all, they’re the ones paying for it.

*For a complete list of reforms supported by TFR and the Coalition on Local Government, please visit this page.