Voters in Granbury and Big Spring Independent School Districts defeated school bonds on their May 4 ballots after local residents organized “Vote No” campaigns against the property tax-backed debt proposals.

Granbury ISD’s single $161 million bond proposition ($315 million with interest) failed by about 400 votes, with 52 percent voting against.

This is the district’s third failed bond in three years.

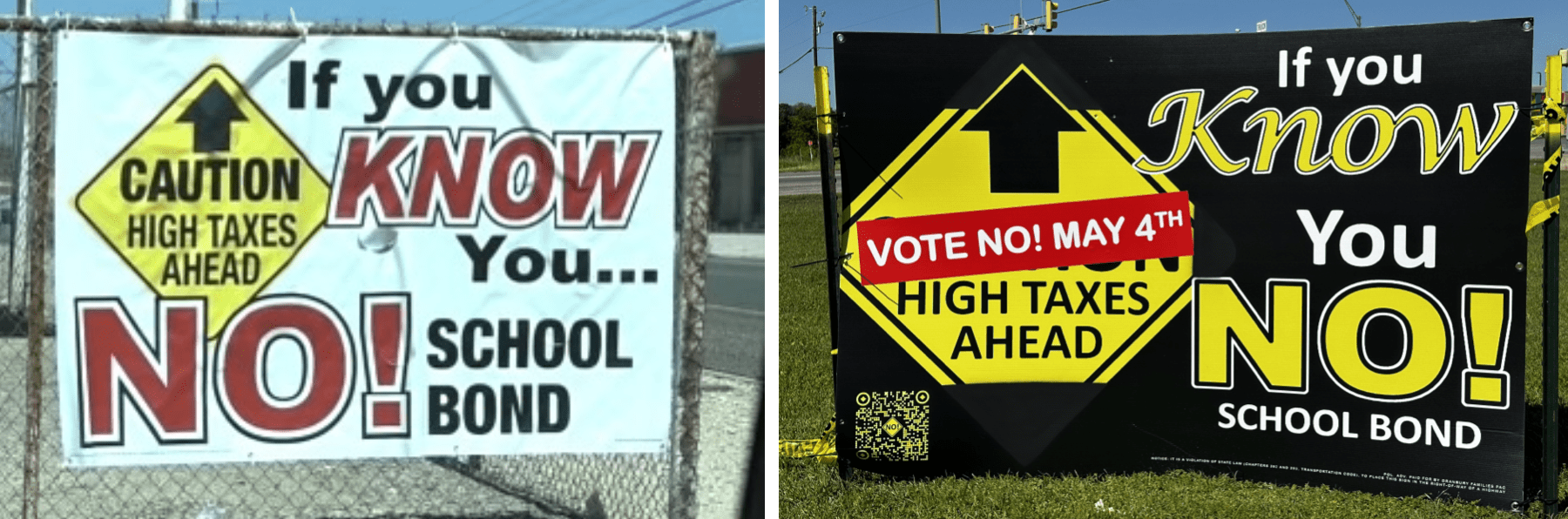

Bond opponents in Granbury ISD organized a campaign warning voters about the tax impact of the bond, using the slogan “If You Know, You No.”

Their campaign succeeded, despite local officials confiscating their campaign signs and arresting their “No Bond Bus Tour” driver over alleged invalid vehicle permits.

Big Spring ISD residents borrowed Granbury bond opponents’ campaign slogan and soundly defeated their district’s two bond propositions that totaled $219 million ($430 million with interest).

Prop A ($216.7 million) failed by 1,201 to 601 votes. Prop B ($2.3 million) failed 1,181 to 609.

In other school districts across the state, voters approved the biggest bonds on the ballot.

Georgetown ISD passed all four of its bond propositions, which will cost local taxpayers a combined $649 million ($1.2 billion with interest).

The district’s Prop A was the state’s largest single school bond on the May ballot at $597 million before interest. It passed with about 70 percent of the vote.

Georgetown ISD property taxpayers currently owe more than $951 million in bond debt principal and interest.

Mansfield ISD put five bonds on the ballot totaling $777 million and passed three.

The district’s Prop A was the second-largest school bond proposition in the state at $584 million before interest, and passed with 54 percent of the vote. Prop B also passed, while Props C, D, and E failed.

Mansfield ISD taxpayers currently owe $1.1 billion in bond debt.

Galena Park ISD passed the state’s third-largest school bond on May ballot, $530 million before interest, by a vote of 1,192 to 394.

According to the Texas Public Policy Foundation, nearly 250 bond propositions totaling $15.5 billion were on voters’ ballots statewide.

School districts proposed most of the bonds—183 totaling $9.9 billion in debt principal, all of which must be repaid with interest by local property taxpayers.

In fiscal year 2023, Texas local governments had $211 billion in property tax-backed bond debt, and the state ranked third in terms of total outstanding local debt behind New York and California.

Texas school districts currently owe $120 billion in voter-approved debt backed by property taxes.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!