Texas lawmakers are aiming to stop some of the state’s highest-taxing government entities from holding elections when the lowest number of voters participate.

Senate Bill 1048 would require Texas school districts to hold all elections for school board trustees and for issuing bonds on November uniform election dates, when more Texans vote.

By far the greatest number of voters participate in November elections. But most school districts hold their elections in May, when the fewest number of people vote, explained State Sen. Pat Fallon (R–Prosper) on Tuesday as he introduced his bill in the Senate Property Tax Committee.

“Although Texans pay more property tax to their local school districts than to any other local subdivision, elections for the people who decide how to spend the bulk of their property tax dollars are when the fewest number of voters participate,” Fallon said.

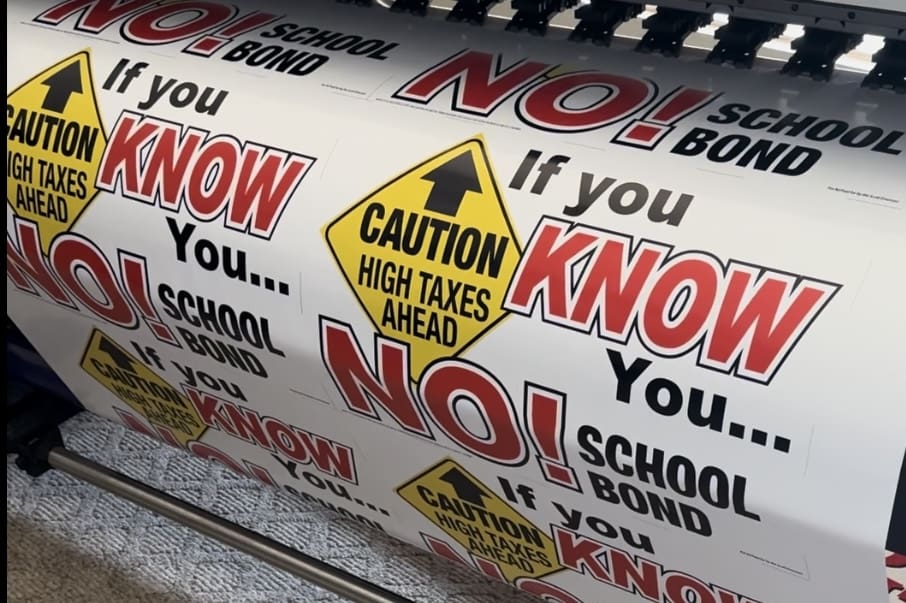

Worse, school districts often hold bond elections worth millions of dollars on “hide the vote” dates when no other elections are being held, reducing turnout even more.

Over 50 percent of registered voters participate in November elections, Fallon noted. In May, turnout can be as low as 3 to 6 percent. In special elections held on nonuniform dates, turnout can plummet to as low as 1 percent.

“If we hold our elections in November, we will get better participation, and our election results will better reflect the will of Texans,” he said. “I trust Texans to elect the folks at the local level, at the state level, and at the federal level.”

Fallon said his bill will also reduce “voter fatigue” that depresses turnout further. “We’re disenfranchising our own voters” with too many elections, he said, adding he believes Texas no longer needs the May election cycle.

State Sen. Paul Bettencourt (R–Houston), who chairs the Property Tax Committee, added “anything that touches the tax rate” should be a November decision, including property tax rate elections. Bettencourt’s property tax reform bill, Senate Bill 2, calls for all tax ratification elections to be held on November uniform election dates as well.

Very important public policy step that anything that touches a tax rate is part of a November election when more voters turn out. No more "dog days of summer" elections. #txlege

— Team Bettencourt (@TeamBettencourt) March 19, 2019

“We should not be afraid of the public,” Bettencourt said. “We should embrace the public’s ability to vote.”

Plano taxpayer Mike Openshaw agreed with Bettencourt and Fallon. “The more votes we get on an issue, the more certain we are of the public’s support,” he said.

Openshaw was one of two witnesses who testified in favor of SB 1048. No one spoke against the bill.

School district officials are expected to oppose the pro-taxpayer measure, with many trustees in districts across the state working in lockstep with the Texas Association of Schools Boards (TASB), the tax-funded lobbying group that represents school district interests. According to their advocacy agenda:

TASB opposes legislation that curtails tax ratification election (TRE) and bond election dates from current law, increases ballot language requirements, or creates additional requirements for voter-approved TREs and bond elections, such as voter turnout thresholds.

Tax-hungry school districts will always want rules that are most advantageous to their own interests: raising taxes. Passing SB 1048 will put lawmakers squarely on the side of Texas taxpayers.