by Brandon Waltens | Aug. 30, 2019 | State, Uncategorized

Despite currently being investigated by the Texas Rangers Public Integrity Unit, Texas House Speaker Dennis Bonnen is trying to woo lobbyists and high-dollar donors with an upcoming fundraising dinner. The price for dinner with Bonnen? $10,000 a plate. In the...

by Jacob Asmussen | Aug. 29, 2019 | Local

Pflugerville City Council is about to take $84 more from the average homeowner next year—but one look at how city council is spending that money raises questions about if they really need more. The city council recently proposed their new property tax rate for next...

by Brandon Waltens | Aug. 29, 2019 | State, Uncategorized

After State Rep. Stephanie Klick (R–Fort Worth) denied members a meeting of the Texas House Republican Caucus, which she chairs, State Rep. Tony Tinderholt (R–Arlington) is asking her to reconsider the decision. On Friday of last week, 30 members of the Texas House...

by Destin Sensky | Aug. 29, 2019 | State

Democrats have typically had the edge over their Republican counterparts at creating narratives and framing battles in the public debate at large. But as of late, it appears they could stand to do a better job of picking their battles. In today’s outrage culture and...

by Cary Cheshire | Aug. 29, 2019 | Local

The Williamson County Commissioners Court unanimously adopted a $393.8 million budget this week, a move which will increase the average homeowner’s property tax bill. The budget, which is broken down into $221.05 million in general spending, $45.05 million for roads...

by Robert Montoya | Aug. 29, 2019 | Local

The City of Coppell has proposed a property tax rate that would see the city’s average property tax bill for homeowners jump over 6 percent in one year, from $2,193 to $2,337. According to data from the Dallas Central Appraisal District, the city’s average property...

by David Vasquez | Aug. 29, 2019 | Local

The city of Brownsville is proposing a new tax rate which is above the “effective” tax rate and would amount to a tax hike for property taxpayers. The “effective” tax rate, also known as the “no-new-revenue” rate, is the rate at which a taxing entity will acquire...

by Robert Montoya | Aug. 29, 2019 | Local

The City of Bedford has proposed a property tax rate that would increase the city’s average property tax bill for homeowners over 9 percent from just last year, from $1,142 to $1,252. Data from the Tarrant Appraisal District shows that Bedford’s average property tax...

by Robert Montoya | Aug. 29, 2019 | Local

Companies under contract with the Tarrant Regional Water District for a secretive water marketing campaign are now revealed to be RO Two Media, LLC and Charlie Uniform Tango. Both have offices in Dallas. Last month, Texas Scorecard discovered that the City of Dallas...

by Cary Cheshire | Aug. 29, 2019 | Local

As cities across Central Texas prepare to raise taxes, one town is going against the grain with a different proposal: letting citizens keep more of their own hard-earned cash. Leander City Council, with a freshly elected reform-minded majority, is preparing to pass a...

by 1836 Studios | Aug. 29, 2019 | Texas Scorecard Podcasts

Episode 100: Catch up on the latest from around the Lone Star State with Texas Scorecard’s Brandon Waltens, Jacob Asmussen, and Robert Montoya. Political comedian Tim Young is back with his take on media elitism. Empower Texans CEO Michael Quinn Sullivan has...

by Thomas Warren | Aug. 28, 2019 | Local

Taxpayers in Canyon can expect to pay more in property taxes with the city commissioners’ proposed tax rate. According to information released from the City of Canyon, commissioners are proposing a property tax rate of $0.44993 per $100 valuation, which is...

by Michael Quinn Sullivan | Aug. 28, 2019 | Commentary

House Speaker Dennis Bonnen’s actions are threatening the future of Republicans in the Lone Star State. He has been caught in repeated lies yet refuses to retract his false statements. Meanwhile, the state’s GOP officials are standing idly by—choosing the convenience...

by Thomas Warren | Aug. 28, 2019 | Local

Members of the Panhandle Groundwater Conservation District board of directors have voted to advance consideration of a possible 7.9 percent increase in property tax revenues. According to information from the PGCD, directors voted 7-0 to consider increasing tax...

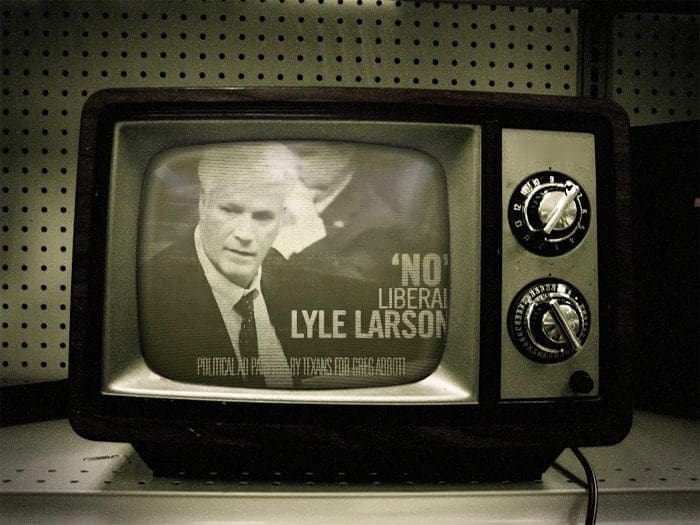

by Brandon Waltens | Aug. 27, 2019 | State

In February of 2018, Gov. Greg Abbott told voters in northern Bexar county to dump State Rep. Lyle Larson (R–San Antonio) in favor of challenger Chris Fails as part of his effort to replace liberal Republican legislators with more conservative opponents. “Lyle Larson...

by Robert Montoya | Aug. 27, 2019 | Local

Dallas County is proposing a property tax rate that would raise the county’s average tax bill for homeowners over 8 percent. Data from the Dallas Appraisal District shows that from 2013-2018, the county’s average property tax bill for homeowners increased 48.7...

by Robert Montoya | Aug. 27, 2019 | Local

Tarrant County commissioners are proposing a new property tax rate that would raise the county’s average property tax bill for homeowners over 9 percent from last year. Even worse, data published from Tarrant County concurs with data from the Tarrant Appraisal...

by Grant Hillman | Aug. 27, 2019 | State

In the decades following the “counter-cultural” social revolutions of the 1960s, the Republican Party has claimed to have cornered the market, not just on conservative political ideologies but on self-identified Christian voters as well. The peak of the...

by Sam Samson | Aug. 26, 2019 | Federal

When politicos talk about religious voting demographics in America, they often focus on the “evangelicals” that dominate the electoral majority in the Bible Belt of the American South. This religious group has become a major factor that can tip the scales in favor of...

by Jacob Asmussen | Aug. 26, 2019 | Local

Georgetown homeowners: You’re paying hundreds of dollars more per year in taxes so your city council can make corrupt deals—and this year, you’re about to pay even more. Georgetown City Council is preparing to approve their budget for next year, one that will force...

Page 648 of 1,014FIRST<—...1020...647648649...660670...—>LAST