A battle is brewing over who will select a new board member for the troubled Tarrant Appraisal District, the agency responsible for setting property values used by local governments to calculate property tax bills.

Kathryn Wilemon, chair of the appraisal district’s board of directors, is being replaced.

Who chooses her replacement depends on how she is replaced: via a recall initiated last month by a local taxing entity, or by filling the vacant spot created by Wilemon’s subsequent resignation.

Texas’ tax code specifies completely different procedures for filling a vacancy versus conducting a recall.

“Let me be clear,” said Keller Mayor Armin Mizani, whose city initiated the recall. “We are prepared to take any legal action necessary to ensure taxpayers’ voices are not silenced.”

Tarrant County officials also threatened legal action if the appraisal district doesn’t proceed with the recall, which the agency’s top administrator has declared “canceled.”

The latest shenanigans surrounding Wilemon’s replacement are further eroding the public’s trust in TAD.

Timeline

Keller City Council voted to recall Wilemon on February 21, citing taxpayers’ complaints about the lack of accountability, transparency, and trust within the agency.

Wilemon resigned the next day, setting up the current battle.

At a special board meeting on March 3, which Wilemon presided over, appraisal district directors decided in a split 3-1 vote to declare Wilemon’s position vacant due to her resignation.

Chief Appraiser Jeff Law, who is appointed by the board, said at the meeting that neither the recall nor the vacancy process supersede the other. Yet he then sent a notice to Tarrant County taxing entities saying that the recall was “canceled” as a result of Wilemon resigning, and that the board would fill the vacancy created by her resignation.

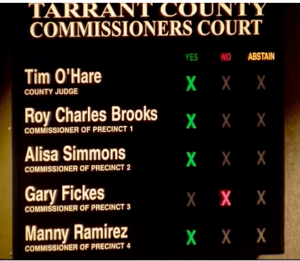

On March 7, the Tarrant County Commissioners Court—which controls a supermajority of recall votes—voted 4-1 in favor of recalling Wilemon, meaning the recall has succeeded.

Recall Rules

Keller and Tarrant County officials say they are following the tax code’s rules for recalling a board member, and that Law’s interpretation is wrong.

“The fact is, the vacancy on the Tarrant Appraisal District Board of Directors would not have happened but for the recall process upon which both the City of Keller and Tarrant County acted,” Mizani said.

Section 6.033(d) of the Texas Tax Code states, “If a vacancy occurs on the board of directors after the recall of a member of the board under this section, the taxing units that were entitled to vote in the recall election shall appoint a new board member.”

Mizani points out that nothing in the tax code says taxing entities lose their right to vote in a recall because a vacancy occurs afterwards.

There is also no provision in the code for the appraisal district to “cancel” a recall initiated by a taxing entity.

Tarrant County District Attorney Phil Sorrells said in a letter to Law on Friday that the county would “explore alternate legal remedies” if the appraisal district fails to allow the recall process to proceed.

It is Tarrant County’s position the recall process outlined in Tax Code section 6.033 prevails over the vacancy process of Tax Code section 6.03(l) under the present circumstances. The recall process allows taxing entities to exercise oversight of TAD Board Members who received their votes and ensures accountability. Allowing all taxing entities served by TAD who would not otherwise be eligible to participate in the recall process to nominate Ms. Wilemon’s replacement through the vacancy process renders an inequitable result.

Recall Versus Vacancy

Appraisal district board members are selected by local taxing entities such as cities, school districts, and county governments. The more property taxes an entity collects, the more votes it’s entitled to cast. Entities that vote for a board member can initiate a recall of that member.

Under the recall rules, only the entities that originally voted for Wilemon participate in the recall vote; if the recall succeeds, they choose the replacement to fill the vacancy for the remainder of Wilemon’s term (through December 2023).

Eight taxing entities, including Keller and Tarrant County, voted for Wilemon in 2021.

Under the rules for filling a vacancy, all 73 taxing entities in the county with voting privileges are allowed to nominate a replacement candidate, and the board picks one.

Administrator at Center of Scandal Now Retiring

As the recall fight unfolds between the taxing entities and Law, another key figure in the appraisal district’s troubles is stepping down.

Randy Armstrong, longtime director of residential appraisals, is retiring effective April 14—the day before residential property values are released to homeowners.

Armstrong and Law caused a scandal last year when they were caught using district resources to harass local realtor and tax consultant Chandler Crouch, who has helped thousands of Tarrant County homeowners protest their property appraisals free of charge.

Residents called for the officials to be held accountable for misusing their offices to target a private citizen, but Law and Armstrong only received brief suspensions as punishment.

Lost Trust

At last week’s commissioners court meeting, Colleyville City Councilmember George Dodson said that weak response—what he said amounted to two weeks of unpaid vacation—underscored how the board under Wilemon’s leadership has failed repeatedly to provide effective oversight of the agency, eroding trust among taxpayers and taxing entities.

“After attending TAD board meetings for three years, I don’t see any improvement in transparency,” Dodson said. “I don’t see how the taxing entities can put up with a board that only appears to be there to rubber-stamp every decision of the chief appraiser.”

Tarrant taxpayers’ concern now is whether Wilemon’s replacement, however chosen, will be an improvement.

“The public trust in TAD must be restored,” Tarrant County Judge Tim O’Hare said Friday. “Tarrant County taxpayers deserve transparency. We will use the authority of this office to see to it they get it.”