Collin County Commissioners Court gave preliminary approval to a $270 million budget that will increase property taxes for a second consecutive year, after years of keeping residents’ tax bills flat.

The proposed general fund budget is based on the near-maximum tax rate the county can adopt without voters’ approval.

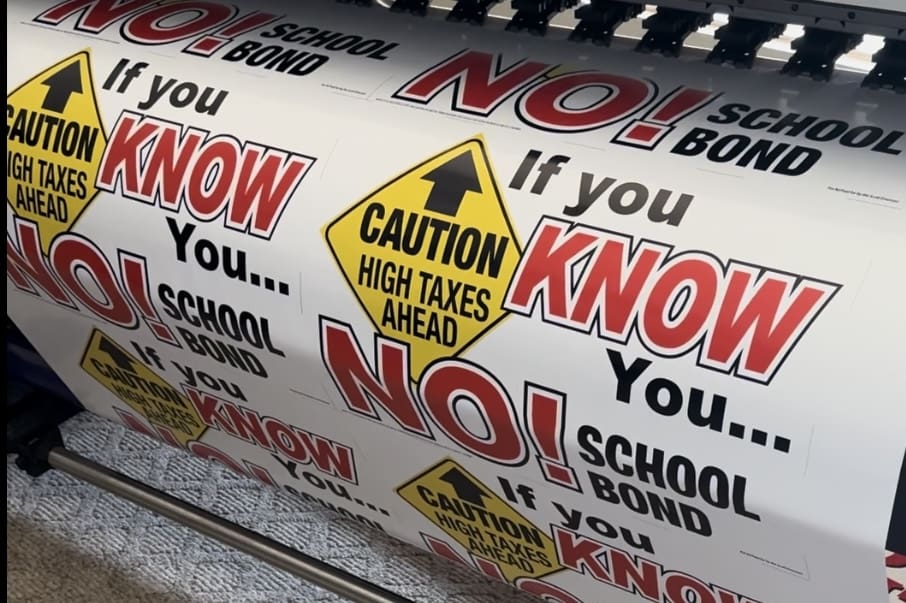

Commissioners also approved putting $683 million in property tax-backed bonds on the November ballot.

County Judge Chris Hill cast the lone vote against the proposed tax hike.

Judge Hill called Thursday’s budget and tax rate vote “stunning.”

“I am shocked that the county commissioners voted 4-1 to increase property taxes for a second year in a row,” Hill told Texas Scorecard.

The state legislature has adopted one of the largest property tax decreases in state history. Just this week, we learned that Tarrant County adopted the largest property tax decrease in county history. But our commissioners elected to adopt one of the largest property tax increases in Collin County history.

The FY 2024 budget proposal adopted Thursday is based on a tax rate that exceeds the voter approval rate—defined as a rate that raises property tax revenue by 3.5 percent.

A tax increase of more than 3.5 percent would normally require voter approval, but Collin County has an “unused increment” from prior years. Commissioners applied part of the one-cent increment to the proposed rate of about 14.9 cents per $100 of value.

Property tax reform passed in 2019 allows the county to “roll over” up to three years’ worth of “unused” tax-hike amounts below 3.5 percent and add them to the current tax rate without asking voters to okay the higher taxes.

Commissioner Susan Fletcher said Collin is “struggling to adequately fund county government and services” due in part to past low tax rates.

“I’m thankful we could return money to the taxpayers for so long, and we’ve shouldered the cost of inflation, but it is just no longer possible in this financial environment,” Fletcher said. “Each time we lower the tax rate further, those calculations get even more difficult to raise, when justified.”

A public hearing on the proposed budget and tax rate will be held on September 11. Commissioners will vote to adopt the budget and tax rate at the same meeting.

Residents can contact Collin County commissioners about the budget and tax rate.

The county is also proposing more property taxes to pay for projects included in five bond propositions totaling $683 million.

Voters will approve or reject the bonds, along with new property taxes to repay the bond debt plus interest, during the November 7 election.