A corporation whose apparent sole source of income is taxpayer-funded projects has donated to a PAC pushing for more taxpayer debt in a North Texas school bond election.

Earlier this year, board members of the Keller Independent School District unanimously approved a $315 million bond election this November. If passed, the hundreds of millions of debt would be added to the $1 billion debt burden already on the district’s taxpayers.

And this would only be the beginning of increased debt Keller ISD taxpayers would see. This bond is the first part of Keller ISD’s “Long-Range Facility Plan,” a 10-year proposal outlining 66 projects totaling more than $1 billion, for the purpose of “bringing Keller ISD’s facilities in alignment with the District’s core values.”

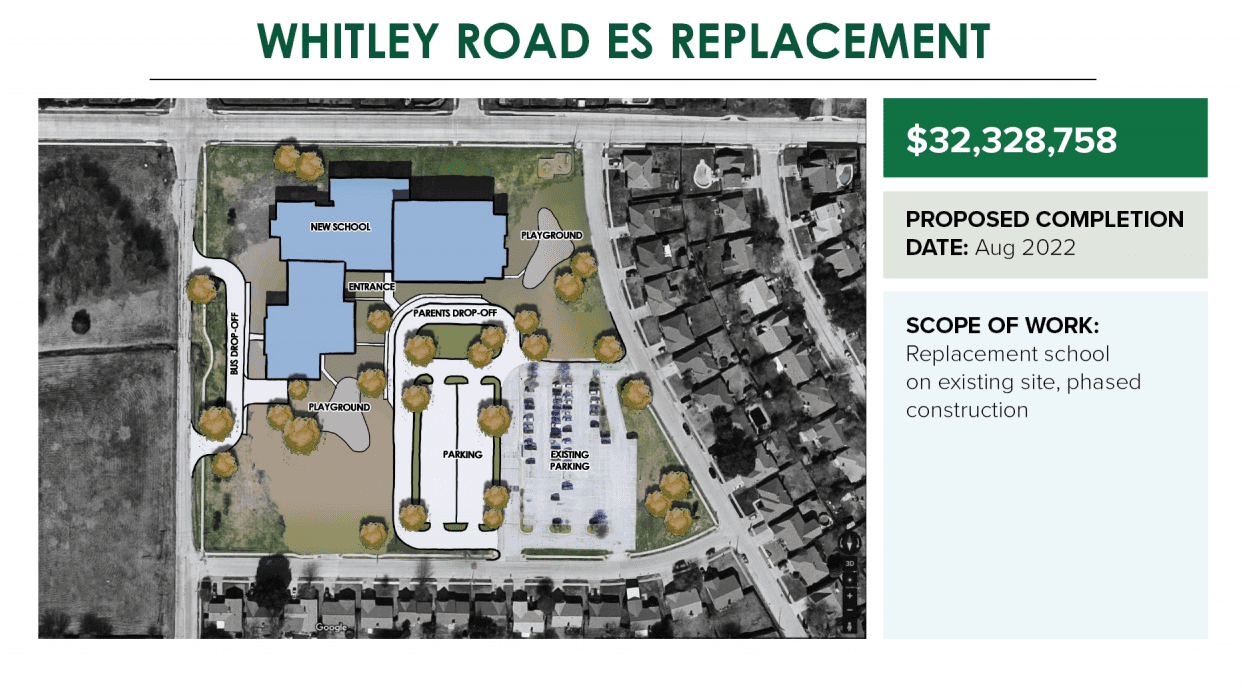

Almost half of the 2019 bond spending would go towards replacing four elementary school buildings with newer ones that are roughly the same size. Over $43 million would go to renovations and additions to existing schools, and over $70 million would go to “indoor extra-curricular facilities at high schools” and a new “science center.”

According to a filing at the Texas Ethics Commission, a construction company by the name of BTC has donated $5,000 to the “Vote For Keller ISD” PAC, an organization that is actively pushing for voters to approve the $315 million in new taxpayer-funded debt. BTC has previously done work for Keller ISD and, according to their website, their sole source of income appears to be taxpayer-funded projects such as work for Arlington ISD and Joshua ISD.

The type of work they do for these ISDs appears to be construction. BTC claims on their website they have “built hundreds of facilities, completed hundreds of successful projects and worked with top tier architecture firms for dozens of repeat customers.”

Part of the “Vote For Keller ISD” PAC’s marketing strategy to promote the bond is sending district voters mailers such as the one pictured below.

If the bond passes, BTC is a likely beneficiary of the construction and renovation contracts from the school district.

The PAC’s claim that the debt won’t increase the tax rate is misleading and has no relation to homeowners’ property tax bills. Yearly rate-to-rate comparisons are meaningless because if the tax rate isn’t lowered enough to offset increases in appraised value, homeowners’ actual tax bills will increase. Data from the Tarrant Appraisal District shows that from 2013 to 2018, the average district homeowner’s school property tax bill increased over 37 percent, from $2,932 to $4,029.

Schools in Texas were forced by the Texas Legislature this year to compress their property tax rates, thanks to $5.1 billion dedicated to “property tax relief.” Due to rising appraisal values, the 2019 rate reduction may not result in a lower tax bill for every property owner; it will mean tax bills will not increase as much as they otherwise would have if lawmakers failed to act. Local school districts still have the option of choosing to lower their property tax rates even further to offset these rising values by adopting their “effective” property tax rate—also called the “no-new-revenue” rate.

Data from TAD shows this year Keller ISD voted to adopt a property tax rate that will increase the average homeowner’s tax bills 0.42 percent from last year, $4,029 to $4,045. Overall, it is a 38 percent increase from 2013.

The more debt local governments like school districts take on, the higher residents’ tax bills must be, and elected officials will have less flexibility to lower homeowners’ tax bills.

Early voting is underway through November 1. Election Day is Tuesday, November 5.