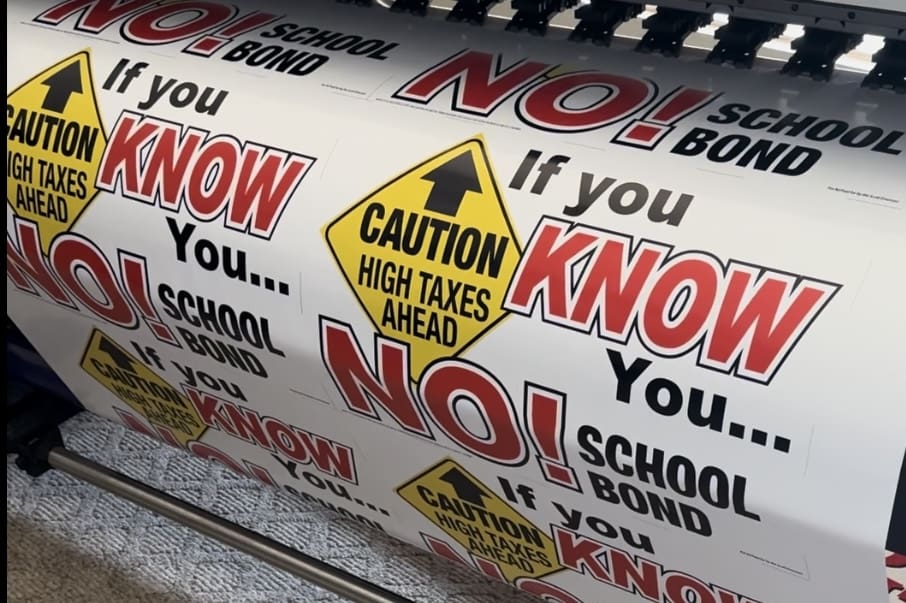

Denton school board trustees voted unanimously to put a $750 million bond proposition on the May ballot.

If passed, the mega-bond will be the most expensive in Denton Independent School District history. District property taxpayers are already on the hook for $1.4 billion in total bond debt.

Bond proponents say the district can borrow the unprecedented amount without raising its tax rate. That’s because DISD anticipates collecting more tax revenue at the current rate as its property tax base grows – and it’s asking to borrow and spend as many of those taxpayer dollars as it can.

The $750 million bond proposal includes spending for “new schools to accommodate growth, new campuses to replace aging schools, capital improvements, upgrades to safety and security systems, and updates to facilities used for extracurricular activities.” The biggest project in the package is a brand-new $194-million Denton High School campus.

The $750 million bond proposal includes spending for “new schools to accommodate growth, new campuses to replace aging schools, capital improvements, upgrades to safety and security systems, and updates to facilities used for extracurricular activities.” The biggest project in the package is a brand-new $194-million Denton High School campus.

DISD’s board and staff hand-picked a 56-member Citizens Advisory Committee (CAC) to assess the district’s facilities needs and make recommendations to the board.

“Our committee was focused on growth, capacity, and equity across the district,” said Jeff Williams, co-chair of the CAC. The district currently has about 29,000 students enrolled on 41 campuses. Enrollment is projected to top 37,000 in 10 years.

The CAC also assessed the district’s bond capacity, using financial projections to determine just how much the district could borrow given the current tax rate and anticipated tax base growth.

The CAC also assessed the district’s bond capacity, using financial projections to determine just how much the district could borrow given the current tax rate and anticipated tax base growth.

District officials say that the property tax rate is going to stay at $1.54 per $100 valuation for now.

“Thanks to continued growth in our area, the taxable assessed values of homes in our district, and our current tax rate structure, we are able to call an election that will have no effect on our total tax rate,” said DISD’s superintendent Dr. Jamie Wilson.

While the rate remains the same, tax bills paid by property owners are going up along with their appraisals.

Growth in the tax base allows the district to claim that it’s not raising taxes – as it did in last year’s Tax Ratification Election (TRE) – even as it collects and spends more tax revenue.

A mere 1,733 district voters turned out to vote for the 2017 TRE, which included a “tax swap” that reduced the amount of tax dollars going to pay off debt.

Trustees’ latest proposal for $750 million in taxpayer-financed spending and debt tops the district’s past three bond packages combined. DISD voters approved a $312-million bond package in 2013, $282 million in 2007, and $152 million in 2004.

The 2018 bond election is set for Saturday, May 5.