Farmersville officials are proposing a double-digit property tax increase for the coming year to help balance the city’s budget.

The proposed tax rate is the highest allowed by state law without a public vote and will raise the average homeowner’s 2025 property tax bill by 15 percent.

The higher tax rate would result in the average Farmersville homeowner paying $2,201—an extra $297.

Farmersville City Council members discussed the proposed budget and tax rate for the 2025-26 fiscal year during a meeting on Monday.

A $9.8 million general fund budget is based on the voter-approval tax rate of about 84 cents per $100 of taxable valuation. Any higher tax rate would require approval by city voters.

The proposed rate of $0.8369 includes $0.6029 for maintenance and operating expenses and $0.234 for debt repayment.

If city council takes no action on a new tax rate, the rate defaults to the no-new-revenue rate of $0.8272, which would collect the same amount of tax revenue from the same properties on the tax rolls in 2024.

City Finance Director John Lawrence explained that the rates are significantly higher than the current rate of $0.6767 because last year the city council approved adding $30,000 exemptions for homeowners who are 65 and older or disabled and freezing their taxes.

The new property tax rate would generate about $2.45 million in property tax revenue for the city’s general fund. Sales taxes and other fees make up the rest of the city’s general fund revenue.

Police, fire, and administration account for the bulk of general fund expenses. City officials propose spending more on all three in the coming year.

Lawrence said the proposed budget had been revised to include $120,500 to pay for an assistant city manager from June to September 2026.

To offset the added expense and maintain a balanced budget, he proposed cutting some travel and training expenses, decreasing double-digit raises for the fire chief and fire marshal, and reducing staff raises from 5 to 3 percent.

“We hope this is a conservative budget, but we’ve got a lot of work to do,” said Mayor Craig Overstreet.

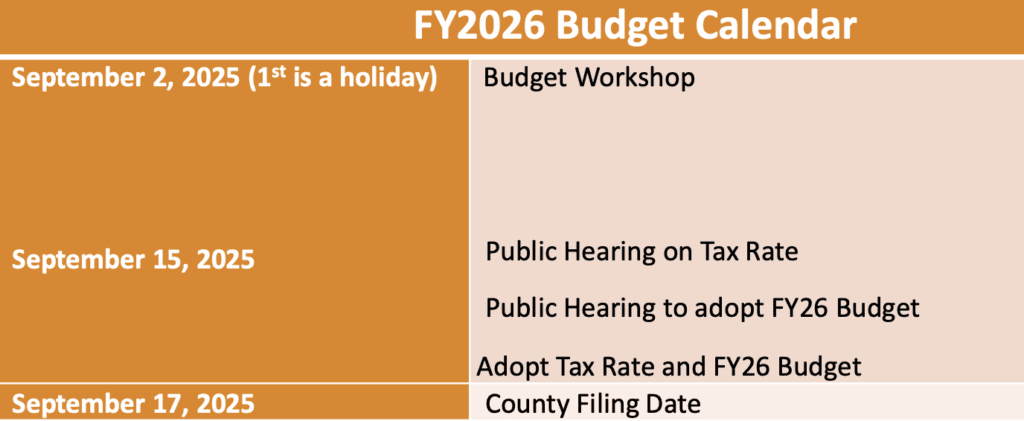

Another budget workshop is scheduled for September 2.

On September 15, the city council will hold public hearings on the tax rate and budget and then vote on adopting both.

Comments and questions about the budget and tax rate can be directed to Farmersville City Council members.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!