A government entity with a history of mismanaging taxpayer monies is considering billing taxpayers even more.

When Tarrant Regional Water District announced a September 20 property tax hearing for citizens to voice their opinion, they failed to show the property tax rate they are proposing. Texas Scorecard asked TRWD for the proposed rate.

“TRWD’s current tax rate is 0.0287 cents per $100 valuation,” TRWD spokesman Chad Lorance replied. “The 2022 rate would remain the same, if approved by the board at the tax rate hearing on Sept 20.”

Because property values fluctuate, year-to-year comparisons of tax rates are meaningless. Data from the Tarrant Appraisal District shows the proposed property tax rate will hike TRWD’s tax bill for the average homeowner in Tarrant County by more than 7.5 percent from last year and 143 percent since 2013.

Lorance was asked what the no-new-revenue rate—the rate that, if adopted, would keep tax bills more or less stable in the aggregate—would be for the coming fiscal year. He didn’t provide it before publication.

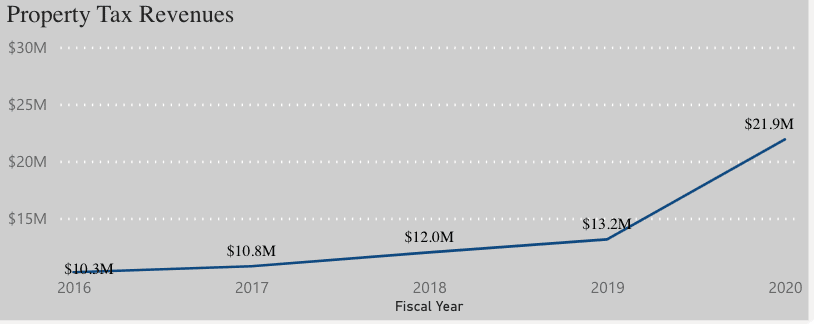

TRWD’s financial data shows the district saw dramatic property tax revenue increases last year while citizens suffered during the government-mandated economic shutdowns and restrictions. They took $21.9 million from taxpayers in 2020, more than double the amount in 2016.

A History of Mismanaging Taxpayer Money

“They’re finding a way to finance a failed project,” citizen Steve Hollern told Texas Scorecard. “This is just a total boondoggle, and for them to want to raise the taxes just because they can isn’t right.”

TRWD is the agency that manages Panther Island, the $1.2 billion taxpayer-funded real estate redevelopment project disguised as flood control. A 2019 programmatic review found the project cost taxpayers roughly $383 million as of 2018—with no aspect of construction completed. Last year, it was still in the design phase; as of this August, the project is reportedly still not close to being finished.

The Trump administration denied more federal taxpayer funding for Panther Island in 2020, instead providing only $1.5 million for a flood study. Last September, the TRWD refused to do the study.

J.D. Granger, son of Congresswoman Kay Granger (R–TX), was hired to oversee Panther Island despite having no prior experience or qualifications. From November 2018 to November 2019, he was paid more than $250,000. The programmatic review found he and retired TRWD General Manager Jim Oliver colluded to keep other officials in the dark on Panther Island’s status. Granger remains employed by TRWD.

This year, former TRWD Board President Jack Stevens ordered Oliver be paid $300,000—in addition to his salary of more than $323,000—before Oliver retired. The TRWD board reversed Stevens’ order, with current TRWD Board President Leah King alleging such a payment would violate the Texas Constitution. Oliver has since filed a lawsuit for the money.

TRWD’s hearing for citizens to voice their concerns about the proposed tax rate is September 20 from 11:00 am to 12:00 pm. The hearing will be held at the administration office, located at 800 E. Northside Drive in Fort Worth.