Kaufman Independent School District is pushing for a bond that would cost taxpayers more than $387 million when factoring in interest.

It is a significant jump from the $170 million that voters will see on the ballot, which does not factor in estimated principal and interest debt.

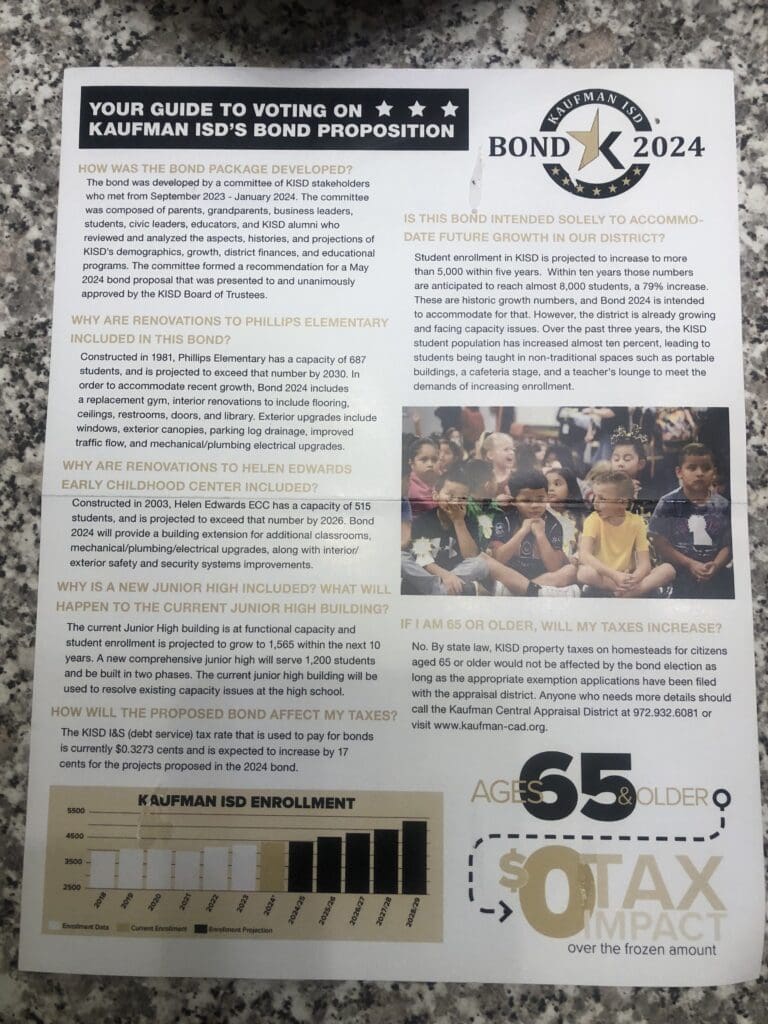

Kaufman ISD is specifically seeking funds for district-wide security projects, such as security camera upgrades, security film, and security fencing.

The district would also like to add classrooms to its aging Helen Edwards Early Childhood Center, which it claims is “at functional capacity,” and a new agricultural barn for Career & Technical Education Classes.

In addition, Kaufman ISD wants to construct a new campus for Norman Junior High School, which is currently at capacity, to serve 1,200 students.

Voters will see the following on their ballots:

Prop A—$170 million for designing, constructing, renovating, improving, upgrading, updating, acquiring, and equipping school facilities and authorizing the Board of Trustees to set tax rates to repay them.

Even without an explicit tax rate change, the local tax liability will be increased. Texas law requires school districts to highlight this by including “THIS IS A PROPERTY TAX INCREASE” on the ballot.

Additionally, Kaufman ISD already owes around $97 million in outstanding debt.

Larry Vrzalik, a Kaufman ISD resident, told Texas Scorecard that he has concerns with how the school district has handled the bond election thus far.

“I received a flyer in the mail touting the benefits of the bond. However, there was never a mention of an amount for the bond package,” Vrzalik stated.

Texas Scorecard reviewed the website that the QR code leads to, which notes the proposal’s cost.

In addition to Kaufman ISD’s bond, Kaufman County’s first Water Control and Improvement District is pushing for taxpayers to shoulder over $950 million in bonds.

Unlike school districts in Texas, counties and their water improvement districts are not required to issue a principal and interest debt projection.

The water district is looking to adjust the maintenance and operations tax and approve a $701 million bond for water, sanitary sewers, and drainage and storm sewer systems, as well as to refund past bonds.

Another pair of ballot propositions aims to adjust the M&O to approve $254 million for a road bond and refund past unpaid road bonds.

Kaufman County residents will see the following propositions on their ballots:

Prop A—$701,000 for water, sanitary sewer, drainage, and storm sewer systems and for refunding the district’s past unpaid water, sanitary sewers, drainage, and storm sewer systems.

Prop B—$254 million for roads and refunding the district’s past unpaid road bonds.

Prop C—Adjusting the M&O rate regarding water, sanitary sewer, and drainage and storm sewer systems to $1.00 per $100 per valuation of taxable property

Prop D—Adjusting the M&O rate regarding road facilities to $0.25 per $100 per valuation of taxable property.

Kaufman County has nearly $268 million in principal and interest debt.

Early voting for local bond elections runs from April 22-30, and Election Day is on May 4.