Voters in Rockwall Independent School District will again be asked to approve a property tax increase, one year after rejecting a larger school tax hike.

Rockwall ISD trustees unanimously approved a 4-cent tax rate increase for the 2025-26 school year during a board meeting on Monday, which was the deadline for placing items on the November 4 ballot.

The district’s proposed tax increase exceeds the voter-approval rate—the highest rate increase allowed by state law without a public vote—triggering a Voter Approval Tax Ratification Election, or VATRE.

According to the district, the proposed tax rate of $1.0669 per $100 of taxable valuation would increase the average homeowner’s property taxes by approximately $160 annually starting in 2025.

For this year, average tax bills would rise from $4,108 to $4,268.

That 3.9-percent tax bill hike assumes an 8-percent increase in property values, raising the average home value from $500,000 to $540,000. It also assumes voters statewide approve a November ballot measure to increase the homestead exemption by $40,000 to $140,000—essentially offsetting the rise in appraised values.

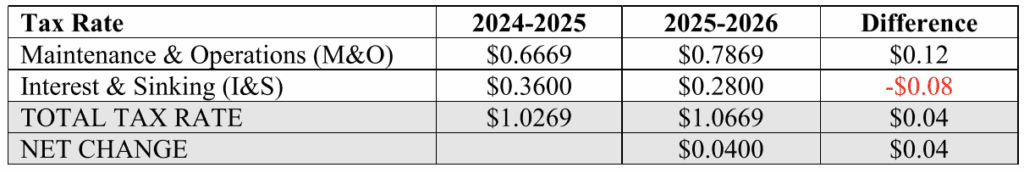

The proposed 4-cent rate increase includes an additional 12 cents in the Maintenance and Operations (M&O) rate, used to pay for operating expenses, and an 8-cent drop in the Interest and Sinking (I&S) rate, used to repay debt.

This is similar to a “swap and drop,” in which a lowered I&S rate is partially offset by a higher M&O rate, except in this case the net result is a higher total tax rate. While the M&O rate increase is permanent, the I&S drop is temporary until more bond debt is approved.

Rockwall ISD estimates that the tax increase would generate $16.5 million more every year for operating expenses.

Most M&O tax revenue goes to pay staff salaries and benefits.

Rockwall ISD’s most recent efficiency audit concluded that the district’s average staff salary of $63,142 is nearly $900, or 1.5 percent, below the average pay in similar districts.

State law requires districts to conduct efficiency audits before asking voters to approve a tax rate increase.

Trustees also approved salary increases for the 2026-27 school year totaling an estimated $10.5 million, contingent on voters’ approving the tax hike.

Teachers are already set to receive pay raises funded by House Bill 2, signed by Gov. Greg Abbott in June. The law allocates billions in state funds specifically to retain teachers and staff.

Several school employees spoke Monday night in favor of the tax increase and pay raises.

Last November, Rockwall ISD voters rejected a 12-cent tax rate increase, along with three bonds totaling $848 million ($1.5 billion with interest).

District officials are hoping voters will be receptive to a more modest increase.

The VATRE will be on the November 4, 2025, ballot as Proposition A.