Commissioners in Potter and Randall counties have proposed higher tax rates for the upcoming year.

In Potter County, commissioners are proposing a property tax rate of $0.69125 per $100 property valuation, which is above their “effective” tax rate, $0.66465 per $100 property valuation. The proposed rate will result in a revenue increase of just over $3 million from the previous budget year, or about 4 percent. Of that, over $550,000 is from new development, meaning current property owners would be shouldering most of the property tax revenue increases.

Hearings for the increases in Potter County are planned for September 9 and September 17.

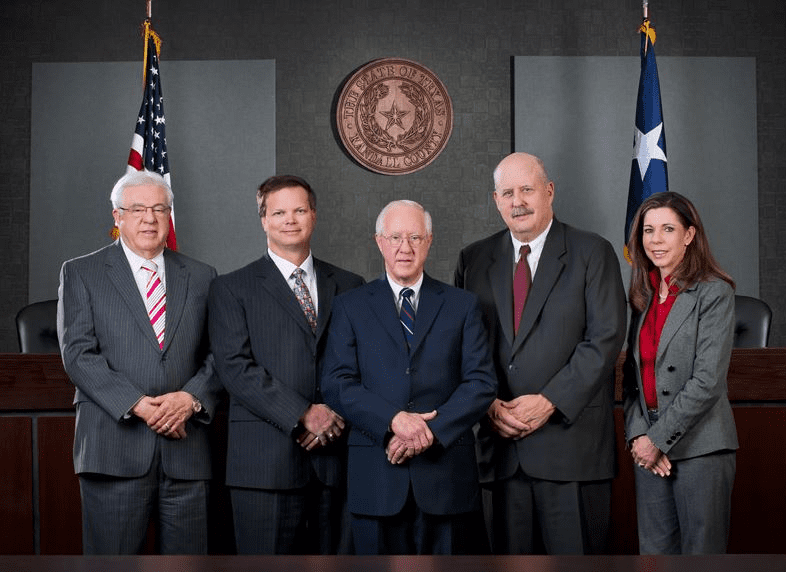

Meanwhile, in Randall County, commissioners are also proposing a higher rate than that which was levied during the previous year. According to a tax rate notice, commissioners are proposing a tax rate of $0.44126 per $100 valuation, up from the current rate of $0.42406 per $100 valuation.

In Randall County, a public hearing is planned for September 3, and the commissioners will vote on September 17.

The “effective” tax rate, also called the “no-new-revenue” rate, adjusts as property values change to keep taxpayers’ bills more or less the same from one year to the next, in the aggregate, though individual results vary based on valuations and exemptions.

Texas’ Truth in Taxation laws require taxing entities to calculate and publish their effective rate each year to ensure the public is informed of any property tax increases, because year-over-year rate comparisons are meaningless as they don’t account for changing property values.

Taxpayers still have time to voice their opinion on these proposed tax rates.