With lawmakers coming to Austin with a $10.5 billion surplus, Texas homeowners were excited about the prospect of substantial property tax relief. While they eventually received what might be considered a down payment on tax relief, they narrowly staved off efforts by Republicans to increase taxes.

At the beginning of the 86th Texas Legislature, the Capitol was abuzz with comity and cheeriness. With House Speaker Joe Straus out of the way, conservatives believed their reforms could have greater success, and with Lt. Gov. Dan Patrick striking a gentler tone, establishment lawmakers were hopeful they’d be able to “get things done.”

Meanwhile, Texas’ booming economy had delivered record revenues to the state’s coffers. A $10.5 billion surplus was forecast by Texas Comptroller Glenn Hegar—a figure that House Appropriations Chairman John Zerwas (R–Simonton) described as “more money than we’ve ever had.”

That money could be used in two ways: increasing government spending or reducing taxes.

Most in the Texas Capitol wanted the vast majority to be spent on growing government, while most taxpayers wanted to cut their property taxes. The two were at odds. Each recognized that any money spent on the other item would necessarily decrease the amount available to spend on their preferred category.

Unfortunately for taxpayers, bureaucratic greed was initially made the priority.

Instead of competing amongst themselves as in previous sessions, Gov. Greg Abbott, Lt. Gov. Dan Patrick, and House Speaker Dennis Bonnen worked in unison on a plan to grow government—leaving very little left for property tax relief. Both chambers passed bloated budgets with only $2.7 billion, or 30 percent of the surplus, spent on lowering property taxes.

Their solution? A sales tax “swap,” which would later be shown to be a net tax increase.

“Texans are fed up with skyrocketing property taxes. At the beginning of the legislative session, the governor, lieutenant governor, and speaker laid out an agenda for property tax relief through the passage of Senate Bill 2 and House Bill 2 to limit property tax growth.

In addition to that effort, today we are introducing a sales tax proposal to buy down property tax rates for all Texas homeowners and businesses, once Senate Bill 2 or House Bill 2 is agreed to and passed by both chambers. If the 1 percent increase in the sales tax passes, it will result in billions of dollars in revenue to help drive down property taxes in the short and long term.”

While they declined to recommend a particular bill in their statement, many in the Texas Capitol took it as a tacit endorsement of State Rep. Dan Huberty’s (R–Kingwood) proposed constitutional amendment, House Joint Resolution 3.

As filed, that legislation provided for a dollar-for-dollar swap. Reports out of the Capitol, however, indicated Huberty was prepared for a committee substitute that would divert 25 percent of the sales tax increase towards increased teacher pay in an effort to gain Democrat votes—something that would be necessary given the two-thirds vote requirement to pass a constitutional amendment.

Conservatives quickly cried foul, noting that such a spending diversion would result in a $2.5 billion tax increase on Texans.

The chairman of the Senate Republican Caucus, State Sen. Paul Bettencourt (R–Houston), quickly fought back, telling KFYO’s Chad Hasty he didn’t think such a proposal could pass the Texas Senate.

“I don’t really see a tremendous appetite here in the Senate for that proposal,” said Bettencourt. “Because, you know, the first thing that economic conservatives would immediately want to know is, ‘Is every dollar gonna go for tax relief?’ and I haven’t heard that yet.”

But despite Bettencourt’s concerns, the Big Three pressed on with their attempts to implement the “swap” by attaching it to the school finance bill. Again, Bettencourt fought back and proposed that lawmakers cut spending and dedicate existing revenue inflows to tax relief rather than raise the sales tax on Texans.

“We’ve never had a tax swap that worked,” he said.

Lt. Gov. Dan Patrick quickly fired back, saying that he, along with Abbott and Bonnen, was still pursuing a sales tax increase.

.@GovAbbott, @RepDennisBonnen and I have agreed to consider a sales tax swap to buy down property taxes. The Senate is looking at all revenues sources to reduce property taxes, including a sales tax swap. @TeamBettencourt’s comments in opposition to a sales tax are his own.

— Office of the Lieutenant Governor Dan Patrick (@LtGovTX) April 25, 2019

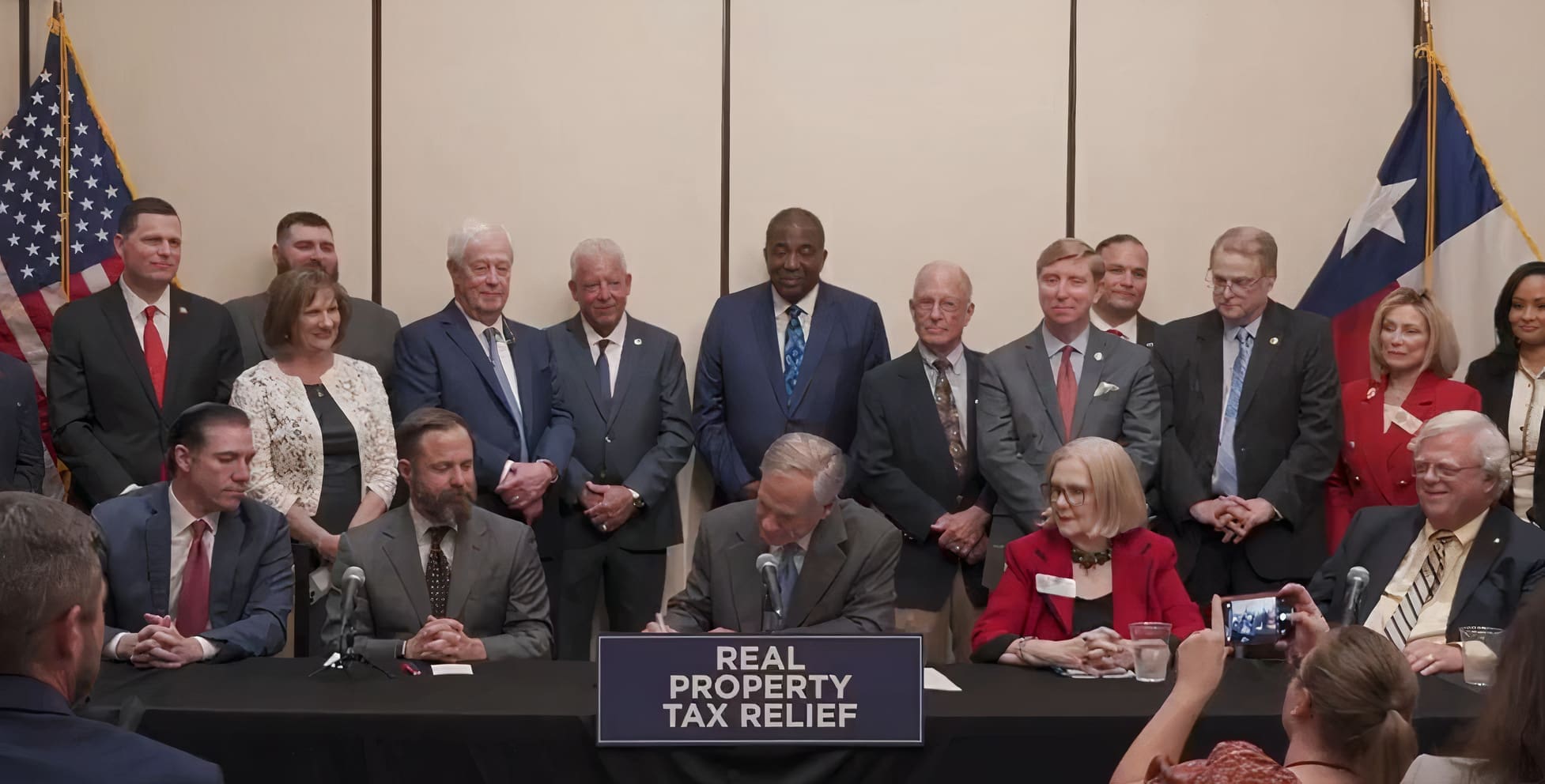

A few weeks later, Patrick, Abbott, and Bonnen escalated further at a joint press conference in support of the proposal in which they promised to answer questions from reporters.

While putting a sales tax increase in its current proposal would require two-thirds of the legislature’s approval, Lt. Gov. Dan Patrick indicated he would attempt to sidestep voters if the two chambers couldn’t reach that threshold.

“I hope we get enough votes to make this a constitutional amendment,” said Patrick, saying he expected voters to “overwhelmingly” support the proposal.

“If it doesn’t, we’ll make it happen anyway,” he added.

But after taking only a few questions, Abbott’s spokesman announced that the press conference was over—a move that surprised even the governor.

Texans would soon find out the reason for the cancellation of the event—newly released numbers from the Legislative Budget Board showed the majority of Texans would pay a net tax increase under the proposal.

According to the LBB’s figures, only those Texans with a combined household income of roughly $100,000 or more—only about 25 percent of Texas households statewide—would see a net tax cut. The remaining 75 percent of Texans would be on the hook for a net tax increase.

With that information in hand, taxpayers were furious—especially after realizing how much extra revenue lawmakers already had for tax relief from existing revenue streams.

The poll showed that 63 percent of Texas voters currently believe the government spends too much, and 58 percent of them believe they are currently taxed too much.

Voters were given two options: a tax swap for $10 billion in new taxes to lower property taxes, or a plan where legislators use $5.6 billion in existing revenue to lower property taxes. Republicans, Democrats, and Independents all preferred using existing revenue instead of a tax swap.

The $5.6 billion polled was a number used from previous estimates given publicly by Bettencourt on the potential relief available.

When voters were told that the sales tax would shift the tax burden of state government onto Texans earning less than $100,000, the ballot measure tanked in support. Republicans, Democrats, and Independent voters all strongly opposed the measure.

That day, Bettencourt called a meeting of the Texas Senate Republican Caucus excluding Lt. Gov. Dan Patrick, in which it is rumored he convinced them that Texans strongly opposed a sales tax increase.

The result was a legislative proposal carried by State Sen. Kirk Watson (D–Austin) that eliminated the sales tax increase and instead provided for additional property tax relief through spending cuts and redirecting existing revenue. The measure looked very similar to the proposals originally offered by Bettencourt, and it passed unanimously.

Less than three days after Patrick had announced the sales tax increase would pass regardless of blowback by lawmakers or voters, it was dead in the Texas Senate.

On the next day, it died in the Texas House.

While taxpayers were thrilled with Bettencourt for defeating the controversial tax increase and ensuring greater property tax relief, Abbott, Patrick, and Bonnen were furious. In retaliation for Bettencourt’s actions in defense of taxpayers and the state’s Republican majority in the upcoming elections, he was not appointed by Patrick to chair the conference committee of his own bill—the property tax reform package in Senate Bill 2.

To add insult to injury, Abbott disinvited him from the bill’s signing with the press.

Taking the high road, Bettencourt didn’t comment on the snub, saying only that he was glad taxpayers would benefit from the bill.

While the Abbott-Patrick-Bonnen tax increase was defeated this session, rumors from the Capitol as well as remarks from the Big Three themselves continue to suggest the issue will come back in the next legislative session.