When the legislative session began with an over $31 billion budget surplus, some amount of property tax relief was almost certainly a given.

The battle between the House, the Senate, and Gov. Greg Abbott on how that relief would be distributed, however, proved a difficult one.

While property tax relief was a legislative priority of Abbott, the House and the Senate were at odds all year on their approach to property tax relief. While the House advocated for stronger appraisal caps, the Senate supported an increase to the homestead exemption.

Abbott, meanwhile, embraced a plan to use the money to help buy down—or “compress”—local school property taxes.

The two chambers could not come to an agreement before the end of the session in May, so Abbott put property tax relief on the agenda for the first special session.

The House quickly passed a bill to do just that—providing around $12.4 billion in relief solely in compression. They then adjourned “Sine Die” that day, meaning they would not return for the remainder of the special session—a move meant to squeeze the Senate into accepting their proposal.

The Senate, meanwhile, passed their own version with a smaller amount of compression but with an increase of the homestead exemption from $40,000 to $100,000, a move Lt. Gov. Dan Patrick said was meant to ensure more of the relief goes to homeowners rather than businesses.

The Senate remained steadfast in their push for a homestead exemption increase, with Patrick calling plans to eliminate the property tax “a fantasy.” He held a series of press conferences across the state, championing the Senate’s proposal.

No deal on the issue was struck until a second special session was called.

Following a month’s-long stalemate, House Speaker Dade Phelan and Patrick announced a compromise plan that includes the following:

- $7 billion in new compression of local school property taxes

- An increase of the homestead exemption from $40,000 to $100,000

- A “20% circuit breaker” appraisal cap on non-homesteaded properties under $5 million in value for a three year pilot program

- Increasing the exemption for the business franchise tax from $1 million to $2.47 million

While both Patrick and Phelan touted the agreement as historic property tax relief, others said the legislature missed an opportunity to put the state on a firm pathway to eliminate property taxes.

The legislation was quickly passed in July, with portions of the proposal being overwhelmingly supported by voters in the November constitutional election.

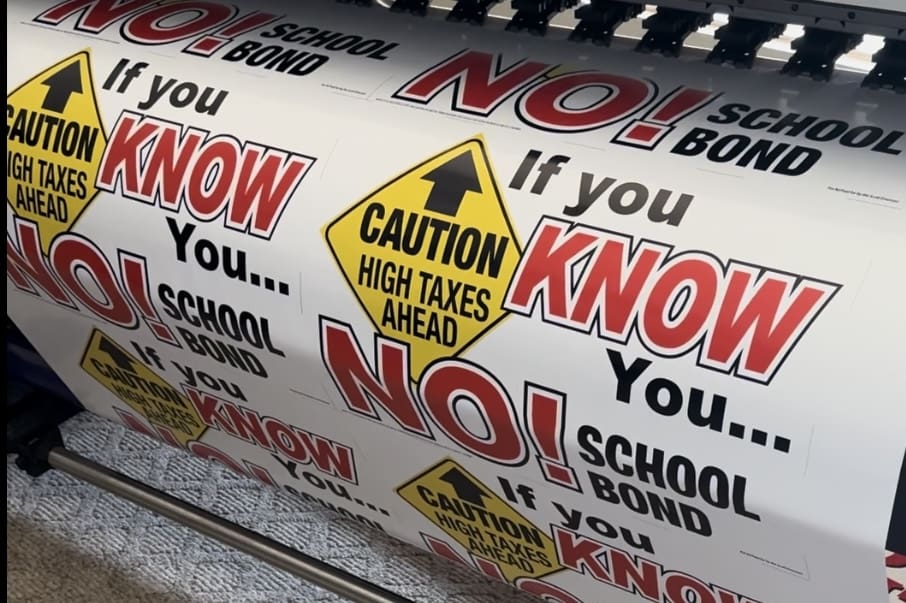

Still, organizations like Texans for Fiscal Responsibility say that while many Texans will see some temporary reductions in their tax bill, there is much more work to be done.

“The Texas Legislature had an historic opportunity this year with a $33 billion surplus to provide lasting property tax relief. Unfortunately, at just $12.7 billion in new tax relief passed this year, the second-largest new property tax relief package in Texas history, the Legislature squandered that historic opportunity,” said Andrew McVeigh, the organization’s executive director.

The Legislature must refocus their efforts on actually restoring property rights in the Lone Star State. Going forward, rising local government spending and debt must be reigned in, and all surplus tax dollars should be put towards compressing school maintenance and operations (M&O) taxes until they are eliminated completely. This is the first step in eliminating property taxes altogether, so Texans can truly own their home and land, and stop paying perpetual rent to the government.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!