All across Texas, local governments are preparing to pass massive tax increases on families struggling from job losses and diminished income as a result of the Chinese coronavirus and government-ordered shutdowns.

The response from Gov. Greg Abbott and other Republican lawmakers has been a swift condemnation, but thus far, the governor hasn’t used any of the power he wields in order to combat them. Citizens frustrated with their local officials are certainly justified, but here are three reasons why they should be more frustrated with Abbott and the Republican officials who empowered them.

1. Abbott and State Lawmakers Could Freeze Appraisals

Beginning in March, Republicans and Democrats alike have been writing to Abbott, requesting he freeze property tax appraisals to 2019 levels in order to save taxpayers from tax increases. If he were to do so, taxpayers wouldn’t have to worry about paying anything more in taxes unless their local government voted to increase the tax rate—something they’d likely be loath to do with so many out of work and losing income.

Abbott has thus far refused.

“We are not going to make any type of law modifying what a person’s home value is worth,” said Abbott earlier this month. “Instead, what is required is the local taxing entities are going to be required to have best practices to reduce their property tax rate so that it will not be punishing to these property owners.”

To be clear, the motivation for a lot of these local officials isn’t exactly pure. They think they can bill the federal government for the difference, hoping to make themselves look like heroes to the average taxpayer. Meanwhile, Abbott is absolutely right in that local taxing entities reducing rates is a better practice for taxpayers in the long term.

However, the governor’s opposition to freezing appraisals is likely rooted in political reality rather than an ideological dedication to “best practices.”

Indeed, Abbott is likely against freezing appraisals because it would blow a massive hole in the Texas budget. Such an action would force lawmakers to provide billions in additional state funding to school districts at a time when state lawmakers are already likely to have a massive budget deficit.

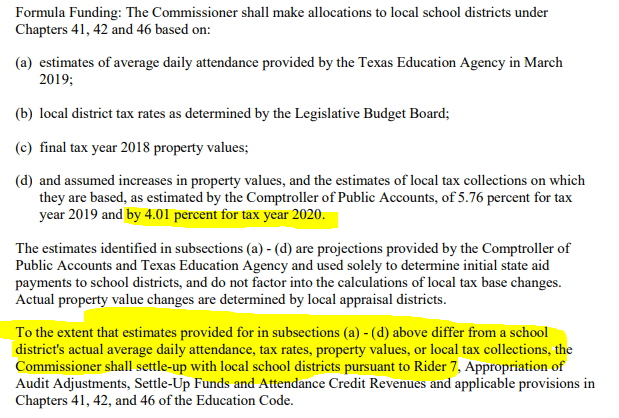

Under the budget passed by the Texas Legislature last year, state appropriators assumed a 4 percent growth in school tax collections in 2020 and would be liable for that in its entirety if school districts had frozen appraisals and frozen tax rates (near 0 percent growth).

Does Abbott have the power to unilaterally freeze appraisals? Would he need a bill from the Texas Legislature to do so? Is this the best way to provide tax relief?

All of these are good questions for which there’s considerable debate on the answer, but it doesn’t change the fact that Abbott and the Republican Texas Legislature could pursue this option if they so choose, even if it takes a special session to get it done.

2. Abbott and State Lawmakers Make the Laws, Not the Locals

“I brought you into this world, and I can take you out of it” is a saying most folks have heard their parents tell them during their childhood or have told their own children.

The saying speaks to a truth that actions have consequences and that the created are answerable to the creator. Such is absolutely the case with local governments—all of which are “creatures of the state” subject to the actions of the state government. We don’t think of the City of Houston, Flower Mound ISD, or Bexar County as state agencies akin to the Texas Railroad Commission, but they are.

Right now, local governments are preparing to use a loophole in Senate Bill 2 (the property tax reform bill lawmakers passed last session that limits local governments from increasing taxes more than 3.5 percent without securing voter approval) in order to raise taxes by 8 percent on struggling Texas families.

The City of Dallas announced today they would begin preparations to raise taxes 8 percent, and more are expected to join them.

Abbott and other Republican leaders are grandstanding against the proposed tax increases now, but it’s important to remember they wrote that loophole into the law when they passed it last year.

Texas Attorney General Ken Paxton says the loophole Texas lawmakers created applies only to physical disasters, not the economic disaster of the Chinese coronavirus. But to paraphrase the Big Lebowski’s Dude, “Yeah, well, that’s just like, [his] opinion, man.” Paxton will have to go to court and see if they agree before taxpayers are protected.

Meanwhile, Abbott could call the Texas Legislature back to Austin in order to remove the loophole altogether, effective immediately. Once in Austin, lawmakers could also remove local governments’ ability to ever raise taxes without government approval, or reduce their tax rates for them, or any number of other remedies.

3. Abbott and State Lawmakers Could Cut Spending, Provide Tax Relief

Despite calling on local governments to cut spending in the wake of an economic crisis, Gov. Greg Abbott hasn’t exactly done the same with the state government despite a consensus view that the state will see a significant revenue shortfall.

Last week, Abbott, Lt. Gov. Dan Patrick, and Texas House Speaker Dennis Bonnen announced cuts of 5 percent to some of the state budget, while leaving the majority entirely intact. That isn’t exactly strong and decisive leadership.

In comparison, Texas Agriculture Commissioner Sid Miller announced Wednesday that he is instructing his staff to go beyond the governor’s order and cut the agency’s budget by 10 percent across the board—double what was originally called for.

That’s a strong step by Miller, but the dollars he’s saved won’t provide any tax relief to struggling Texans without the Texas Legislature stepping in. After all, they make the laws, not the Texas Department of Agriculture.

Abbott could direct state agencies to make deep budget cuts and call the Texas Legislature back to Austin in order to cut the franchise tax, cut the sales tax, or provide some other form of tax relief.

Thus far, he’s refused to do so.

Conclusion

It’s easy to blame Democrats for tax increases, but Abbott and other state Republicans are responsible for empowering them. If Abbott and other Texas lawmakers are serious about putting taxpayers first, there are a number of options available to them.

Individual Texans can discuss what is the best way of providing tax relief, but we’ve elected Abbott and other leaders to make these decisions. So far, we’ve seen the governor struggle to make any decision.

Grassroots Texans have called on Abbott and other lawmakers to deliver tax relief that is measurable, benefits every taxpayer, and lasts for years to come. It’s what Abbott and other lawmakers promised on the campaign trail, and it’s why grassroots Texans elected them to public office.

Abbott and other Republican lawmakers have the power to provide real relief, they’re just choosing not to. And Texans are paying the price.