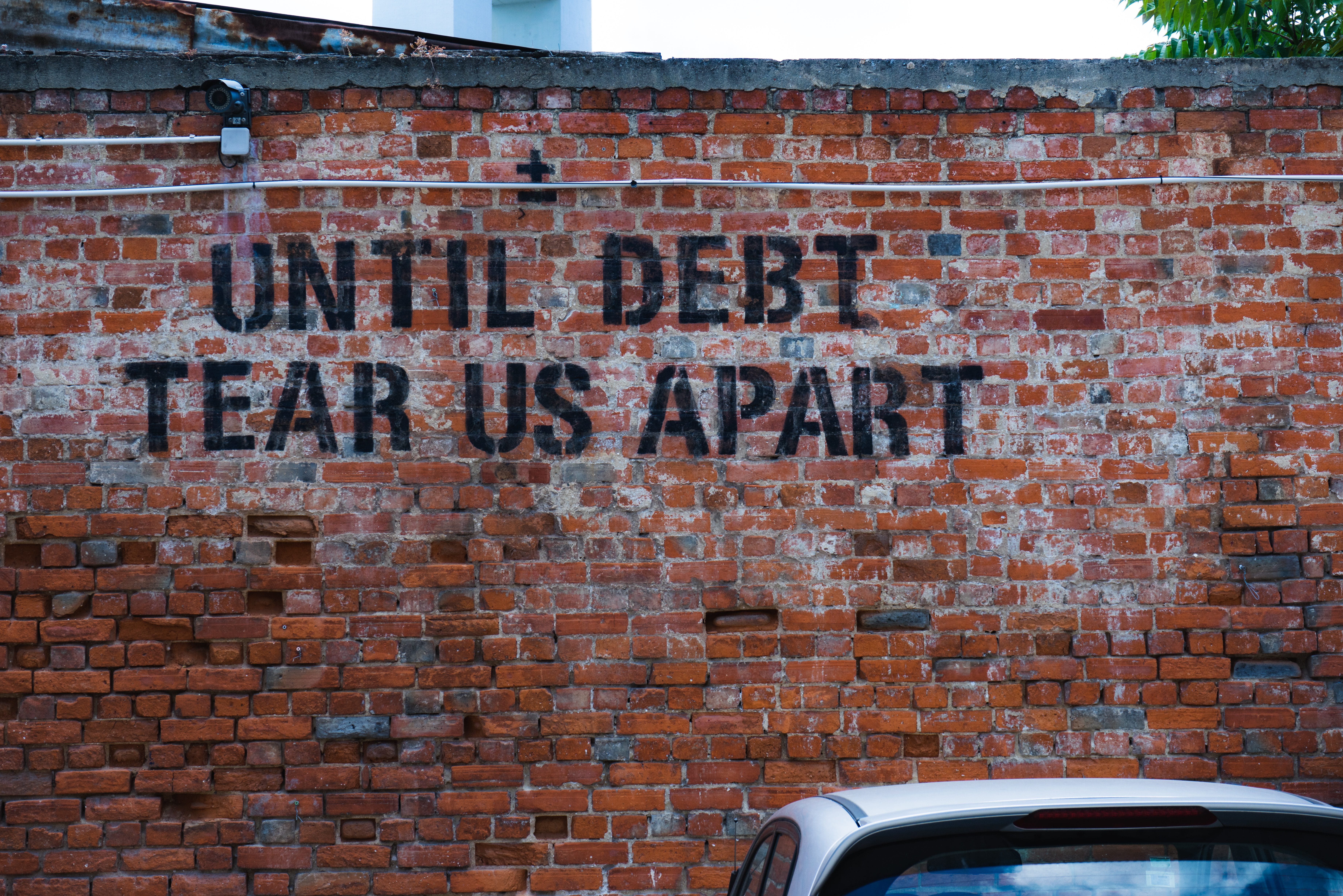

As Texans suffer the economic effects of government shutdowns and restrictions, a publication for local officials encouraged county governments to hike taxpayer debt. This comes as Texans wonder if the Legislature will force local officials to deliver property tax relief.

Texas County Progress, a publication of County Judges and Commissioners Association of Texas (CJCAT), featured an article in late 2020 encouraging county officials to increase taxpayer debt to pay for “routine capital items” such as “Law Enforcement Vehicles,” road repair, and radios.

Texas County Progress’ publisher boasts a membership of every county judge and county commissioner statewide. The association’s purpose can be found on its website:

[T]o promote the interests of county government through continuing education and active participation in governmental affairs.

TCP’s article finds most counties pay for routine capital items in cash, but the writers push for using “tax notes” instead, which are short-term borrowing tools.

The article says these tax notes must receive approval from Texas’ attorney general and “may be an attractive investment opportunity for local banks, which may offer good borrowing rates to the county.”

James Quintero, policy director for Texas Public Policy Foundation’s Government for the People Campaign, disagrees with this solution.

“Instead of using tax notes to finance routine capital items, counties should be setting aside adequate funds on an annual basis to cover the cost of future expenses,” Quintero said. “Or, even better, cut spending and redirect those monies.”

He’s not alone in his opinion. In 2015, Texas Comptroller Glenn Hegar (R) decided not to use short-term debt for the state for the first time in 30 years. He credited the state’s strong financial position at the time for the ability to make such a move.

“Most Texans know that avoiding unnecessary debt simply makes good financial sense,” he said then. “Whether it’s the state budget or a household budget, it’s the responsible thing to do.”

Despite the passage of property tax reform in 2019, homeowners are still facing the threat of being taxed out of their homes. As a portion of county property taxes goes towards repaying debt, hiking these burdens would hurt efforts to provide property tax relief.

With Texans facing economic hardship statewide following government mandates in response to the Chinese coronavirus, Quintero argues now is not the time to consider increasing taxpayer debt.

“Hard times have forced Texas families to tighten their belts and delay making major purchases,” he told Texas Scorecard. “Yet many local governments appear unfazed by today’s economic carnage, continuing to tax and spend like normal. Some are even using short-term borrowing tools to finance large capital expenditures.”

“Such disregard threatens to make a bad situation worse,” he added. “Now more than ever, local officials need to exercise extreme prudence with our tax dollars.”

The 87th Texas Legislative Session runs through May 31. It remains to be seen what action state lawmakers will take to compel local officials to deliver property tax relief.