As state lawmakers consider legislation to lower Texans’ school property taxes, economists at a conservative think-tank propose a plan to eliminate all property taxes in Texas by 2033.

Earlier this year, the Texas Public Policy Foundation released Lower Taxes, Better Texas, a plan for eliminating property taxes over time by using excess state revenue to buy down local school taxes—which make up the biggest part of Texans’ property tax bills—and moving to a system that funds local governments mainly with sales taxes.

An updated summary released Wednesday expands on that plan and focuses on three pieces of legislation filed in the ongoing third special session.

TPPF says their plan will “eliminate property taxes for every Texan by 2033 or sooner, while also making structural changes to the system that prevent year-to-year spikes in tax bills and rein in irresponsible local governments.”

“Texans will never experience the peace of mind that comes with owning their home until property taxes are eliminated,” said Vance Ginn, chief economist at TPPF. “Until then, Texans are simply renting their home from the government, always with the fear that taxes could become so exorbitant they can no longer afford to stay.”

Texas homeowners currently pay the sixth-highest effective property tax rate in the nation.

TPPF proposes a three-pronged approach to gradually reduce Texans’ property taxes to zero.

Limit State Spending

The Texas Legislature already passed a new state spending limit this year based on population growth plus inflation.

TPPF’s plan says any surplus general revenue above the new cap must first be used to reduce school maintenance and operations (M&O) taxes, which are essentially statewide property taxes. That will give taxpayers relief while also complying with the constitutional requirement for the state to fund schools.

Pass Legislation to Lower School Taxes

Senate Bill 1 and House Bill 90 are two proposals to lower school districts’ M&O taxes by using surplus state dollars to replace local tax dollars.

Senate Bill 1 by State Sen. Paul Bettencourt (R–Houston) proposes a one-time M&O tax rate buy-down in the 2022-23 school year of at least $2 billion—and as much as $4 billion, depending on the surplus estimated by the state comptroller. The measure would save the average Texas homeowner about $200-$400. SB 1 passed the Senate last week by a vote of 30-1.

House Bill 90 by State Rep. Tom Oliverson (R–Cypress) provides permanent property tax relief and would apply 90 percent of any state surpluses each year to buy down school M&O taxes.

Redesign the State’s Tax Code

The final step in TPPF’s plan is to redesign Texas’ tax code so that local governments are funded primarily by sales taxes.

House Bill 91 by State Rep. Andrew Murr (R–Junction) would create a committee to study the new tax model. According to TPPF, the result would be to “finally eliminate school M&O taxes after years of cutting them,” and future surpluses could then be used to cut sales taxes, giving Texans even more relief:

The combination of SB 1, HB 90, and an updated HB 91 would put Texas on a path to eliminate property taxes by 2033 or sooner. The elimination of property taxes should be combined with constitutional amendments when appropriate to prohibit local taxing entities from imposing new property taxes. Texas governments ought to provide this kind of fiscal framework to ensure all Texans can flourish and to deliver real peace of mind to Texas homeowners.

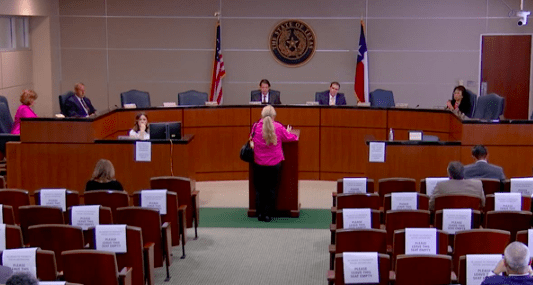

On Thursday, the House Ways and Means Committee held a public hearing on HB 90 and SB 1.

“I am for any type of property tax relief,” Houston resident Alexie Swirsky told lawmakers, noting the crushing impact of rising property taxes on Texas families’ budgets.

“One of the top reasons I was sent here by the people back home is to do something about property taxes,” Oliverson said. “This is the taxpayers’ money. We’re going to first give it back to them.”

“If we’re going to do this, let’s make it permanent,” he said, adding HB 90 only uses excess revenue not needed to fund everyday operations.

“It doesn’t take money away from any part of the budget,” said Dale Craymer with the Texas Taxpayers and Research Association. “We’re talking about gravy, not meat and bone.”

“This is not about defunding education,” said Ginn, who spoke in favor of both bills, adding they fully fund education while providing property tax relief. “That’s what Texans want.”

Ginn said three-quarters of Texans say property taxes are a major burden for their families.

“This is a step in the right direction for eliminating property taxes, and that would be a great day for Texas,” he added.