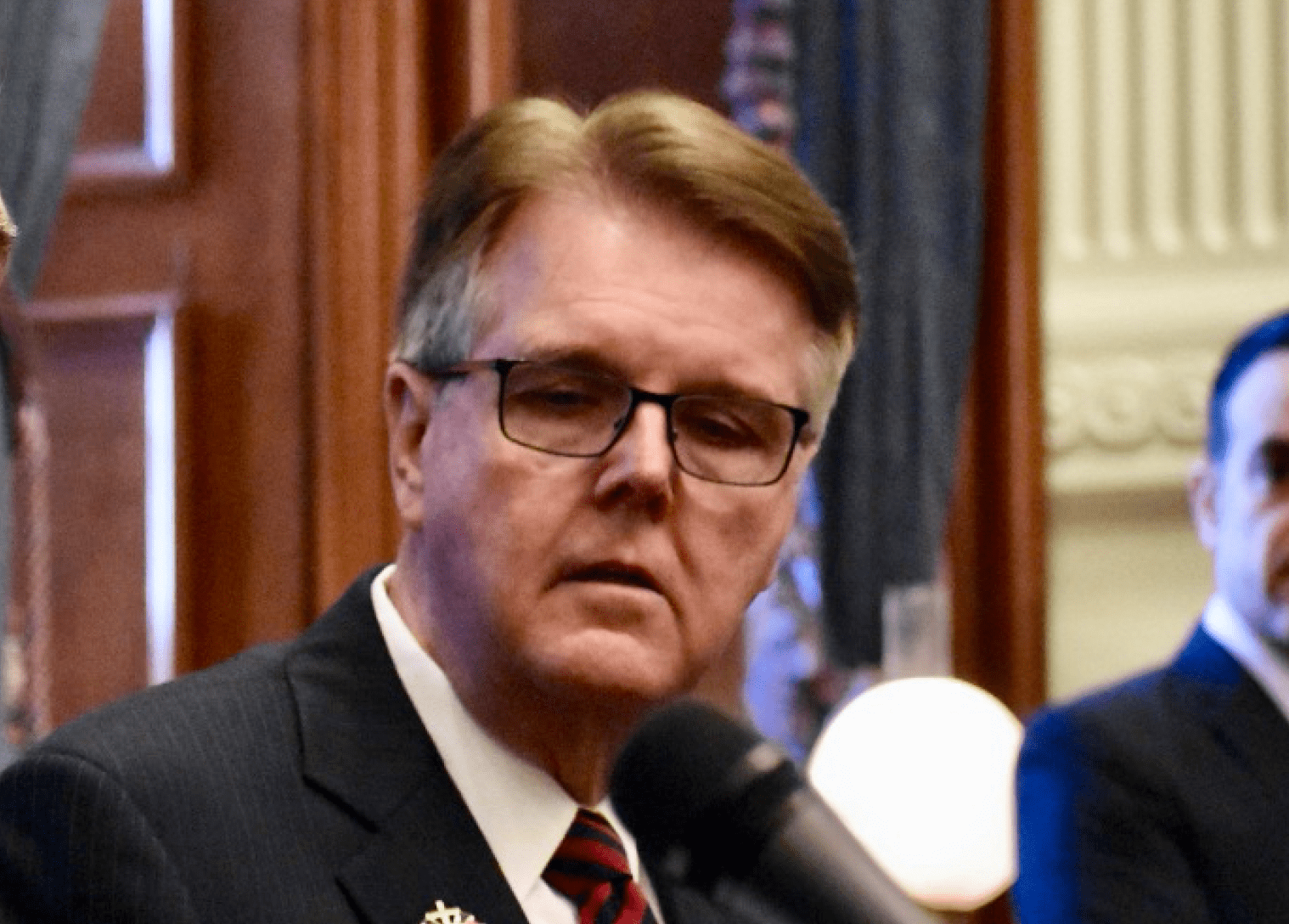

Legislation to protect taxpayers from skyrocketing property tax bills is currently being stalled by Senate Democrats and a lone Republican, State Sen. Kel Seliger (R–Amarillo), but Lt. Gov. Dan Patrick is signaling he’s had enough obstruction and will soon move to ensure the bill passes on the floor.

In an effort to curb the growth of Texans’ property tax bills and place more control in the hands of voters, Senate Bill 2 lowers the rate in which local governments—including cities, counties, and school districts—can raise property taxes before requiring voter approval to 2.5 percent.

Democrats predictably have been united in opposition to the pro-taxpayer legislation in the Senate since day one. Joining them is Seliger, a former Amarillo mayor, who has opposed the bill, saying it impedes local control by hindering the financial decision-making ability of local officials.

It’s worth noting that the local control they refer to is that of politicians, not voters, as SB 2 would, in fact, provide more local control at the hands of property taxpayers.

Given the rules and partisan makeup of the Texas Senate, Seliger has been empowered to prevent the legislation from coming to the floor and said he will maintain his blockade unless Lt. Gov. Dan Patrick and Senate Republicans cave to accept Democrat-backed amendments that would create numerous carve-outs and exemptions for taxing entities—further watering down the bill.

“I will not vote for something where local officials think that I have sold them out,” Seliger told one newspaper this week.

The West Texas senator’s stated allegiance is nothing new. He has an extensive record of siding with local politicians over citizens. Such votes include opposing measures that would prohibit red-light cameras, require a city to hold a public hearing if increasing fees, and force taxing entities to disclose taxpayer-funded lobbying contracts.

The opposition has not only earned him the title of the “most liberal Republican senator” on numerous conservative scorecards but has put him at odds on many occasions with fellow Republican lawmakers, including Gov. Greg Abbott, Lt. Gov. Dan Patrick, and House Speaker Dennis Bonnen, all of whom strongly support SB 2 publicly.

In the Senate, it takes 19 votes—or three-fifths of the membership—in order to take up any bill out of order. There are currently only 19 Republicans and, without Seliger or any Democrats supporting the measure, the bill has languished for weeks.

That could soon change, however.

On Friday, Lt. Gov. Dan Patrick suggested he would do away with the nicety of the three-fifths requirement and instead take up the regular order of business, of which SB 2 is towards the top of the list, if they could not reach 19 votes by Monday.

“I respect our Senate rules, but I do not intend to let a procedural motion stop the Senate from passing this important bill,” said Patrick. “The public doesn’t care about our procedural rules. They want tax relief, and they deserve it. Time is running out on our session.”

Patrick is right, and the truth of the matter is that he doesn’t need to change the rules in order to pass Senate Bill 2—he can do so by simply enforcing them.

SB 2’s companion, House Bill 2, was scheduled to be heard in the Texas House on Thursday before being postponed to Monday, April 15th.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!