The Texas House Committee on Ways and Means heard public testimony Wednesday on a proposal that would potentially give taxpayers property relief if enacted into law.

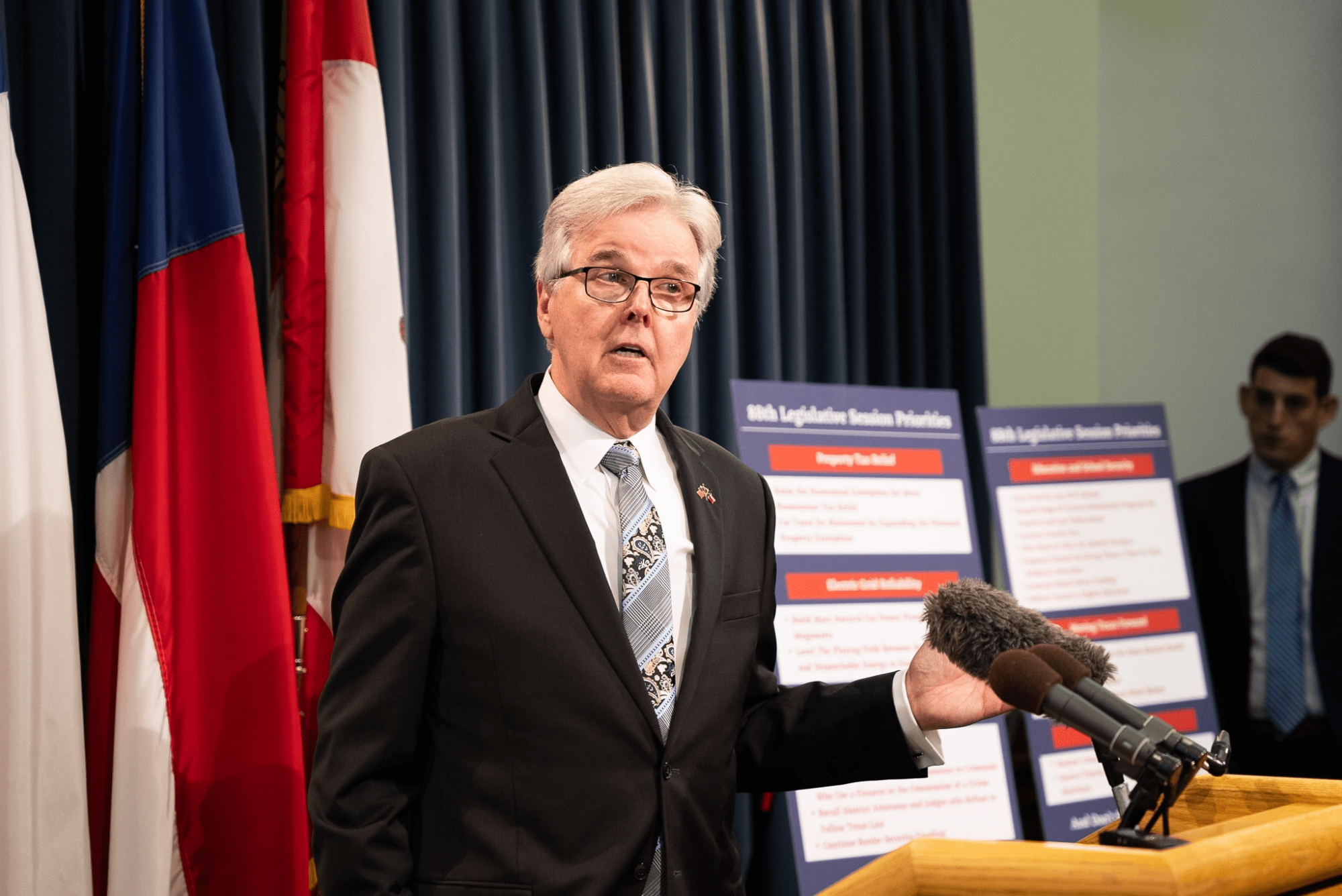

State Rep. Charlie Geren (R–Fort Worth) detailed House Bill 705, a bill that would eliminate the maintenance and operations portion of the property taxes imposed by counties who opt in by swapping it with a sales tax of a proportional nature.

The state currently caps the sales tax that a taxing entity may impose at 2 percent.

The amount of testimony for, on, and against was mostly proportional in the hour and fifteen minutes offered before Chairman Dustin Burrows (R–Lubbock) recessed the committee.

One self-identified taxpayer testifying on his own behalf was Don Dickson, who said, “The property tax, to me, is the most punitive type of tax.”

“This bill is a more-fair way of doing things,” Dickson said. “This is something that really needs to be looked at. Please, please consider passing this bill … so that taxpayers get the relief that they so desperately need,” he closed as the room broke out into applause.

Testifying on the bill was Jim Allisson, general counsel of the County Judges Association.

“You could easily tweak this bill to include all counties,” Allison said. He encouraged the committee to look at finding a way to allow smaller counties who do not currently generate enough economic activity to replace their property taxes in their entirety, in order to be able to collect a sales tax that would equal a reduction in property taxes—not unlike the counties with the higher retail base – but as a partial buydown contributing to relief.

Such a proposition, however, is met with skepticism from taxpayers, who fear that, without eliminating property taxes, an additional sales tax would only exacerbate their overall tax burden.

In testimony against the bill, it was suggested that as many as 80 percent of taxpayers in some places would be negatively impacted by the swap, while only 20 percent—predominantly families with incomes of over $150,000—would come out ahead.

Others implied that if revenue generated was not equal to the entirety of the property tax revenue that was collected before the implementation of the sales tax equivalent, some taxing entities would need to make reductions in police and fire or emergency services, a tired line becoming increasingly popular among those buffing any form of property tax reform or relief this session.

With the safeguards that were recommended in committee put in place, the legislation could prove to be one option in delivering real property tax relief, but taxpayers will have to demand that the proposal come alongside reforms to limit local government spending. Otherwise, they will merely trade one exorbitant tax for another.