Texas’ previous corporate welfare program has been largely resurrected with a new name and some new guidelines.

Texas’ previous corporate welfare program has been largely resurrected with a new name and some new guidelines.

The 7th District Court of Appeals says a 2021 statewide constitutional amendment failed to inform voters of its tax implications.

The organization received $800,000 in federal grant money last year.

Harrison’s request follows the university’s decision to pay DEI proponent Kathleen McElroy—who voluntarily ended employment negotiations—$1 million.

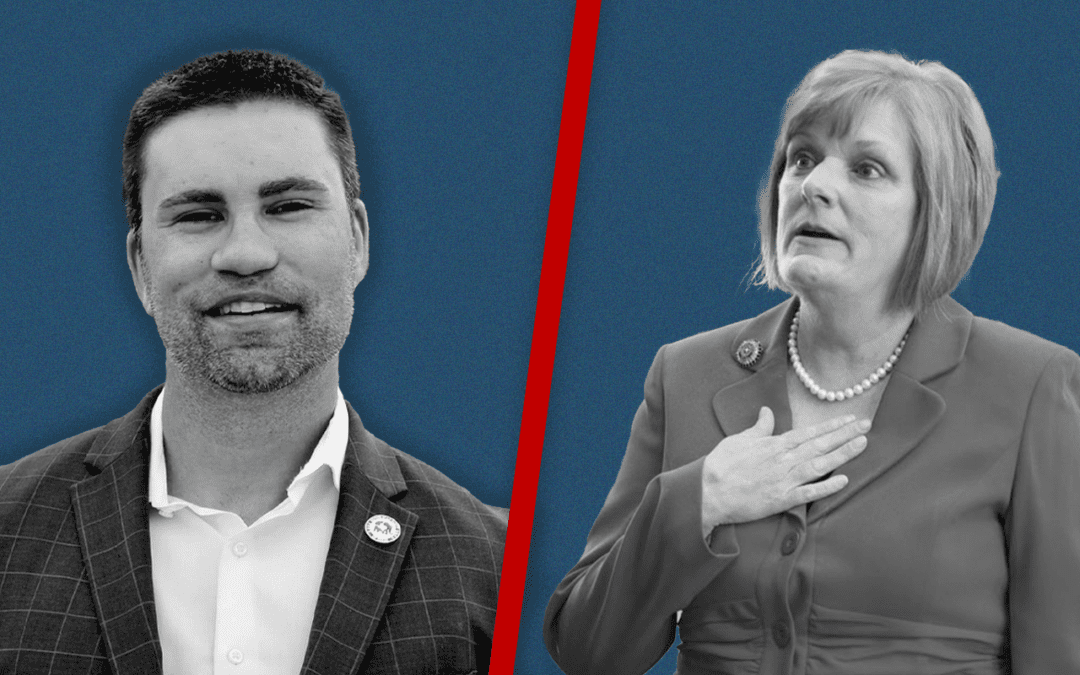

The Fort Worth-area seat is currently held by incumbent Republican lawmaker Stephanie Klick.

Although the LGBT employee resource group holds their pride meetings during lunch break, they still use taxpayer-funded government-issued devices to partake in such events.

Internal documents reveal TxDOT directors have been pushing DEI-related policies and practices on their employees.

The city has exploited a legal loophole to shortchange the drainage fund.

In an attempt to withhold records from the public, TxDOT has sent an open records request appeal to the Office of the Attorney General.

For some Texans, these ordinances stand as a warning to the rest of the state to protect their children.