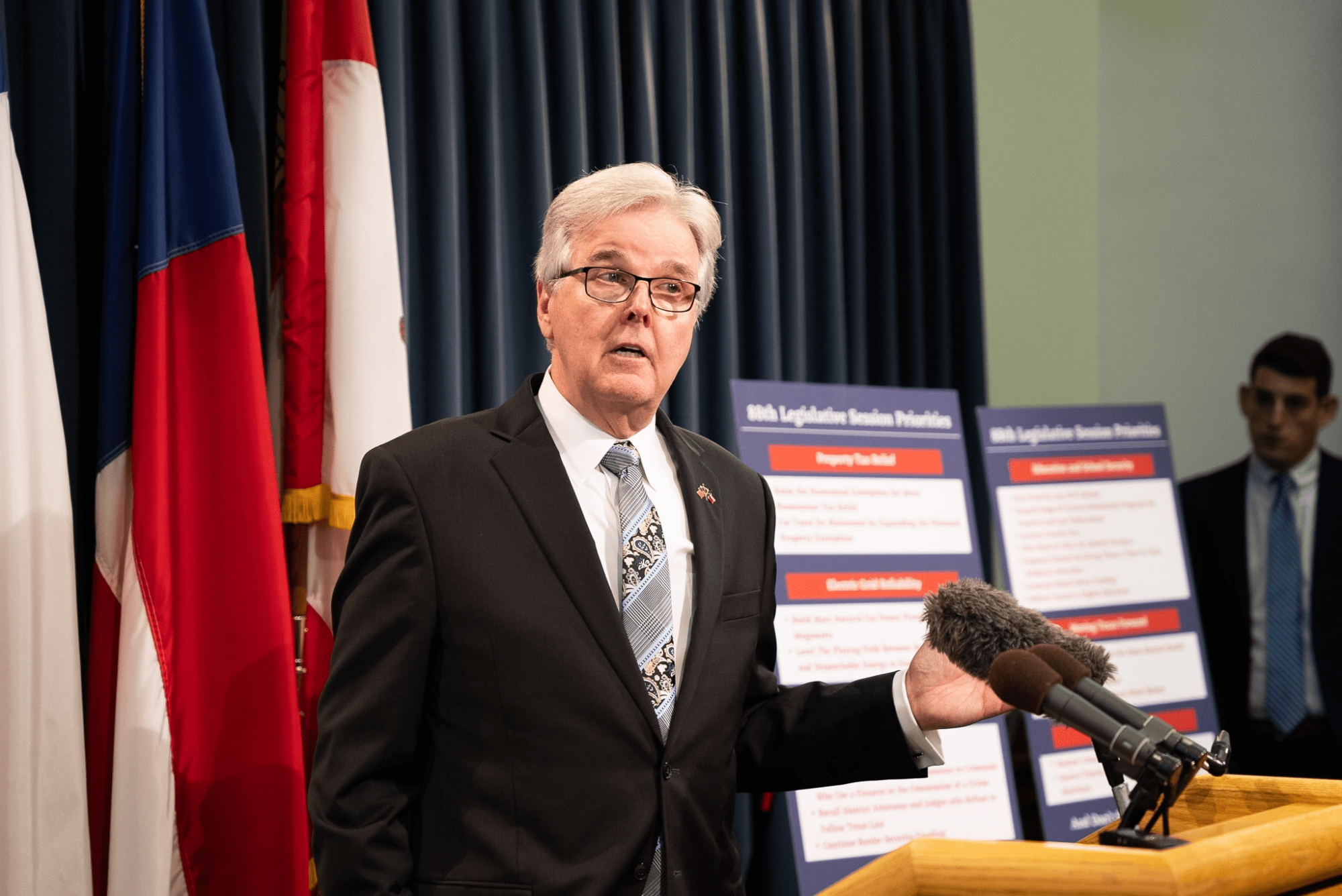

While tax cuts are dismissed as “gimmicks” in the Straus-lead House, Lt. Gov. Dan Patrick continues his push for property tax reform in the Senate. Consequently, county and local governments are terrified that their ability to indiscriminately grow government is facing stricter legislative limits.

Current proposals for property tax reform center around two approaches—the lowering of existing property appraisal and tax revenue caps. Appraisal caps limit the amount that property values can increase from year to year, while tax revenue caps limit the rate at which property tax collections can grow for local government. Both effectively limit the tax burdens Texans pay regardless of their nominal tax rate. Houston citizens passed such a taxing restriction for their own city’s government a decade ago.

Predictably, the anti-taxpayer association that lobbies for cities, the Texas Municipal League, has already begun to issue propaganda to city officials attacking these reforms. As we’ve previously reported, TML unconditionally opposes any state restriction on municipal authority, including their ability to tax, spend, or borrow.

Local North Texas liberals like Dallas County Judge Clay Jenkins (D) are on record playing the “blame the rich” card, claiming that a strengthened appraisal cap would mainly benefit wealthier areas. But both proposals would provide the same protections to all property-owners, regardless of their property’s value.

As usual, Jenkins couldn’t be more wrong. The lowest income earners, including those retired or living paycheck to paycheck, are the most disenfranchised by increasing property tax burdens. Renters also suffer from rent hikes resulting from landlords burdened with higher property tax payments.

The need for stronger taxing limits is indisputable. According to the Texas Comptroller of Public Accounts, property tax burdens levied by cities grew 58% faster than the combined rate of Texas’ population growth and inflation between 1992 and 2010. In other words, the burden of city government paid by each Texan grew faster than it should. As an aside, the burden of county governments grew nearly twice as fast (or 89% faster) than it should.

Although conservatives ideally aim to decrease the burden of local government, simply controlling its growth by keeping it the same size should be viewed for what it is—a practical compromise.

But big-government sympathizers, including many elected Republicans, appear intent on joining county and city politicians in painting commonsense reformers as right-wing whackos looking to “slash and burn” government. Fortunately for Texans supporting reform, the aforementioned facts expose TML’s claims for what they are—baseless fear-mongering.