Texas taxpayers could pay a high price for missing this November’s election.

Early voting is already underway in the statewide 2019 constitutional amendment election, a biennial odd-year election that traditionally draws low turnout. But if they go to the polls, many DFW-area voters will find more than just the state’s 10 proposed amendments to the Texas Constitution on their ballots—they’ll see proposals for up to hundreds of millions in new bond debt that must be repaid with local property taxes.

Also on the ballot are a handful of key local races for city and school district officials who make spending decisions that directly impact voters’ property tax bills, as well as tax rate questions.

Here are highlights of what local voters will be deciding, in addition to the statewide ballot propositions:

- Collin County MUD No. 2 – Propositions B and C call for a total of $511 million in taxpayer-supported bond debt.

- Princeton City Council – Three candidates are running for the open Place 2 council seat. Princeton’s incumbent mayor and the Place 1 council member are both unopposed.

- Texas House District 100 – Five Democrats are running in a special election to fill the unexpired term of former State Rep. Eric Johnson (D–Dallas), who was elected mayor of Dallas earlier this year.

- Addison – Propositions A-E call for a total of over $70 million in property tax-backed bond debt.

- Coppell – Proposition A asks voters to reauthorize, for four years, a 0.25 percent sales tax.

- Glenn Heights City Council – Mayoral and Place 2 races are contested; Place 4 and 6 incumbents are unopposed.

- Mesquite City Council – The mayor and all six council seats are contested. Place 3 Council Member Bruce Archer is challenging incumbent Mayor Stan Pickett.

- Richardson ISD – The district is transitioning to a “5-2” system, with five trustees selected from single-member districts and two chosen at large. Trustee positions for Districts 2 and 4 are contested; District 5’s incumbent is running unopposed. RISD will return to May elections in 2020.

- Sunnyvale ISD – The Texas Legislature required the district to lower its maintenance and operating tax rate this year by 7 cents, resulting in an overall school property tax rate of $1.45 per $100 valuation. The district is holding a Tax Ratification Election to move 7 cents from debt service to M&O, which will increase its operating tax revenue by 6 percent.

- Denton – The city’s four ballot propositions (A-D) call for a total of $221.5 million in property tax-supported debt, including $619,000 for “public art.”

- Flower Mound – Proposition A asks voters to reauthorize a 0.25 percent sales tax.

- Big Sky Municipal Utility District – Propositions A-F create the MUD and ask for over $251 million in bond debt plus a property tax of up to $1.20 per $100 valuation. Five director candidates are running unopposed.

- Northlake Municipal Management District – Propositions A-F confirm the district and ask for over $963 million in taxpayer-supported bond debt plus a property tax of up to $1.20 per $100 valuation.

- Smiley Road Water Control and Improvement District No. 1 – Propositions A-E call for over $692 million in taxpayer-supported bond debt plus a property tax of up to $1.20 per $100 valuation.

- Kaufman County – Propositions A and B call for a total of $154 million in property tax-backed bond debt.

- Kaufman County Assistance District No. 3 – Proposition A asks voters to authorize creation of the district and a 2 percent sales tax.

- Forney ISD – Proposition A calls for $623 million in taxpayer-supported bond debt.

- Tarrant County College District – Proposition A asks voters to approve $825 million in property tax-supported bond debt.

- Keller – Proposition B asks voters to reauthorize, for four years, a 0.25 percent sales tax.

- Aledo ISD – Proposition A asks for $149.9 million in taxpayer-backed bond debt.

- Arlington ISD – Proposition A asks for $966 million in property tax-funded bond debt.

- Azle ISD – Proposition A asks for $79.8 million in new bond debt.

- Keller ISD – Proposition A asks for $315 million in taxpayer-supported bind debt.

- Karis Municipal Management District – Propositions A-F confirm the district, which is within the city of Crowley, and ask for over $228 million in bond debt plus an unlimited property tax.

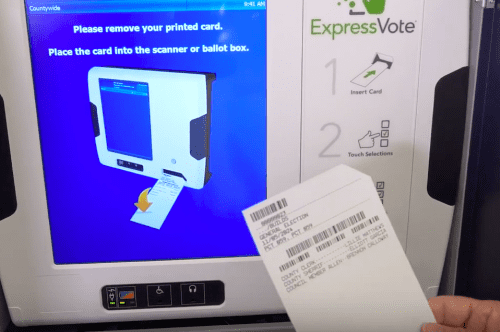

Voters in Collin, Dallas, and Tarrant counties will find something else at the polls they may not be expecting: all three counties are introducing new “hybrid” voting machines that combine paper ballots with electronic ballot marking and tabulation (Denton County already uses a hybrid voting system). In addition, Dallas and Tarrant are using Election Day countywide vote centers for the first time.

Texas for Fiscal Responsibility has compiled information and recommendations on the 10 constitutional amendment ballot propositions, along with a printable voter guide. Voters should check with their county elections office to learn what else is on their ballot and where they can vote, then go to the polls. Skipping this year’s election could turn out to be costly.

Early voting runs October 21-November 1. Election Day is November 5.