Fiscal year 2023 has already seen over 1.9 million encounters at the southern border.

Fiscal year 2023 has already seen over 1.9 million encounters at the southern border.

With the tenuous process of redistricting on the horizon and the ongoing lack of quorum in the Texas House of Representatives, many lawmakers are already getting re-election challenges.

The Texas House of Representatives has gone 35 days without a quorum, leaving many Texans wondering when Republican leadership will act to compel absent Democrat lawmakers to return.

President Joe Biden—who has been hiding from the public during international crises—reportedly took time to applaud the mask mandates.

“Local governments will take every opportunity they can to expand their powers, and the Legislature needs to make it clear that when that happens, they are willing to act.”

Her comments were in contrast to recent actions taken by the party since Chairman Allen West was elected to lead the Texas GOP in July of last year.

As the newly sworn-in president wasted no time in signing harmful executive orders, the Texas attorney general spared no time in promising to stand against them.

Biedermann’s “Personal Protection & Safety Act” would allow anyone who can legally possess a firearm to carry it without a special permit.

Texas Scorecard examines Texas’ highest-paid lobbyists.

Voters in four of the most populous counties in House District 68 have already faced two special elections in late 2020, on top of the November general election.

Texas Scorecard examines Texas’ highest-paid lobbyists.

“This is how Cancel Culture works, it is rooted in hate.” –Robert Pratt

Odessa Republican State Rep. Brooks Landgraf claims his colleague sprung a surprise vote on members. Records show otherwise.

Texas Scorecard examines Texas’ highest-paid lobbyists.

Only one of the chamber’s 17 committees will be chaired by a Democrat.

The San Antonio Express-News reports that numerous school districts in San  Antonio and around the state are preparing to ask their voters to approve tax rate increases. One such district is San Antonio ISD which is on the verge of seeking a tax rate increase even though its superintendent admits it "has been running inefficiently, with one-third of its available facility space going unused."Â

Antonio and around the state are preparing to ask their voters to approve tax rate increases. One such district is San Antonio ISD which is on the verge of seeking a tax rate increase even though its superintendent admits it "has been running inefficiently, with one-third of its available facility space going unused."Â

In what is either a rare act of political honesty or an unbelievable admission of dereliction of duty, or both, State Rep. Fred Hill (R-Richardson) swore under oath that he doesn’t know anything about the state’s existing spending limit.

In what is either a rare act of political honesty or an unbelievable admission of dereliction of duty, or both, State Rep. Fred Hill (R-Richardson) swore under oath that he doesn’t know anything about the state’s existing spending limit.

Odd, considering he has served for years on the extremely powerful Legislative Budget Board – the 10 appointed members of which are specifically charged by the Legislature to “Adopt a constitutional spending limit.†In fact, that is the first responsibility listed on the LBB web site!

“I do not have any involvement in the development or calculation of the State spending limit,†swore Mr. Hill on August 7, 2007.  (Taxpayers and voters would be excused if they break into a little swearing of their own at this point.)

You might recall a few weeks ago I noted that the Legislature’s new $3 billion-over-10-year cancer fund was probably not going to accomplish much more than spend a lot of your money. Not my opinion, but that of scientists actually in the field. "(T)he question is how to get the best bang for your buck. I don't think that's done by politicizing diseases and putting them on the ballot," said the chief of staff at Ben Taub Hospital.

Here’s a nice little scam floating around school districts: claiming credit for cutting taxes when they haven’t.

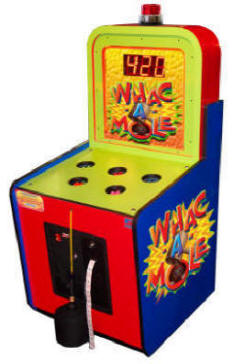

Fighting tax-and-spendoholics is like playing Wack-A-Mole at the arcade. You knock them down, only to find they pop right back up. The lesson? We have to move faster and hit harder.

Fighting tax-and-spendoholics is like playing Wack-A-Mole at the arcade. You knock them down, only to find they pop right back up. The lesson? We have to move faster and hit harder.

Last legislative session, taxpayers were successful in stopping tax-and-spendoholics from increasing the taxes to fund further boondoggle spending on more light-rail and other mass transit pork (the only thing “mass†is the cost – mass transit fails to actually relieve congestion, dollar for dollar). But, hey, those trains are fun at Disney World…

State Sen. John Carona says in today’s Dallas Morning News that Texas must “stop the diversion of gas tax funds for other uses.†That’s welcome news. While the state’s constitution currently requires transportation funds to be used for transportation expenses, “transportation†is a constantly-expending term.

State Sen. John Carona says in today’s Dallas Morning News that Texas must “stop the diversion of gas tax funds for other uses.†That’s welcome news. While the state’s constitution currently requires transportation funds to be used for transportation expenses, “transportation†is a constantly-expending term.

According to the Morning News, almost a third of Texas’ gasoline tax revenues for transportation have been “diverted†away from true transportation projects.

Advocates of big government rarely let facts get in the way of their pursuit of growing budgets. Such is the case with Waco Tribune-Herald editor John Young, whose weekly column is very often devoted to the worship of government (of the activist variety) and the damnation of conservative, free market principles.

The headline in today's Houston Chronicle says it all: City union asks for property tax relief. My heart leapt for joy: Bureaucrats are now joining the call for tax relief!

But then I read the article… They don't want property tax relief for all taxpayers, only for government employees. Acting in true-to-bureaucratic form, the city employee union there is looking for a new taxpayer-funded program that would pay the property taxes of city employees. The audacity almost makes the head spin.

The Houston Chronicle reported over the weekend that medical professionals are skeptical that the legislature's new $3 billion "cancer fund" will accomplish much more than spend $3 billion of the taxpayers' money.

But, don't worry, it was created with the best of intentions… State Rep. Senfronia Thompson (D-Houston), summed it up nicely in her quote to the Chronicle that "she'd ‘like to sit back and tell my grandchildren I had something to do with the cure.' "

An elected official (a Republican, no less) told me yesterday he doesn't mind paying taxes because it is "the price of freedom." His doe-eyed statement was wrong on a great many levels, practical and philosophical. First and foremost, freedom's price has been paid — again and again — by the blood of patriots on battlefields near and far, not collected by revenue agents.

Â