A mafia-like system exists in Texas that empowers school districts to cut sweetheart deals for developers while the majority of taxpayers struggle.

Who’s being favored?

An investigation of these deals revealed the types of businesses benefiting include a foreign-owned company, a vaccine manufacturer, and a company that has done business with the Chinese Communist Party.

Much like the corruption in the Netflix documentary about the New York mafia, “Fear City,” Chapter 313, also known as the Texas Economic Development Act, sets up school districts and school boards as mafia committees to pick winners and losers. How? By extending millions of dollars of tax relief. Meanwhile, the vast majority of taxpayers remain burdened by ever-rising property taxes.

“I’ve been in business 39 years,” Craig Hundley of Johnson County told Texas Scorecard. “I’ve never had a person come to me [and say], ‘Craig Hundley, you’ve been in business 13 years. We want to give you a 10-year break on your property tax.’”

He noted how “totally unfair” this corruption is. “I think the whole system needs [to be] scrapped—and not scrapped at one location, but the whole state. They can entice business to their area in different ways. It’s very unfair to me and every homeowner.”

Fingers in Every Cookie Jar

Near the top of this frequent flyer list of these mafia-like deals is Corpus Christi Liquefaction, LLC, a liquid natural gas (LNG) production company. Corpus Christi Liquefaction has five existing agreements with the Gregory-Portland Independent School District. Additionally, they have three pending applications.

Corpus Christi Liquefaction also has an agreement with the Corpus Christi ISD.

One of the agreements made with Gregory-Portland ISD (#1179) was submitted in 2017 and scheduled to begin last year. This agreement provides for the property’s taxable value to be limited to $30 million for property taxes each year for the next decade as the company works to construct a liquefaction and storage facility in the area.

To qualify for this tax break, the company pledged to create 10 new qualifying jobs that exceed the average manufacturing wage in the county. They further promised to create 25 non-qualifying jobs, or jobs that merely satisfy the wage requirements of the county.

For a limitation agreement to be approved by the comptroller, the company must show that “the limitation on appraised value is a determining factor in the applicant’s decision to invest capital and construct the project in the state.” Since the stated purpose of Chapter 313 is to incentivize certain companies to invest in large projects in otherwise unfavorable economic zones, a company should not receive a tax limitation to invest in an area if they intend to invest in the area regardless of whether they received an incentive.

Unfortunately, applicants tend to play fast and loose with this requirement. As stated in an earlier article, only about 15 percent of companies requesting limitations would invest elsewhere if their application was denied.

All of the agreements submitted and approved by Corpus Christi Liquefaction include a certification that the limitation is a determining factor. However, a closer look at the financial statements of these applicants and their parent companies calls this finding into question.

For example, Cheniere Corpus Christi Holdings, LLC, is the parent company of Corpus Christi Liquefaction. According to their filings with the Securities and Exchange Commission (SEC), they reported no revenue until 2019, when they reported more than $1.4 billion. This increasing revenue trend continued into 2020 and 2021, when they reported $2.5 billion and $5.7 billion, respectively.

Furthermore, Cheniere Energy Inc. has a market capitalization of $39.19 billion. Although this information may not be dispositive regarding whether Corpus Christi Liquefaction needs this incentive, it certainly raises more questions than the district—or the Texas Legislature—appears prepared to answer.

Their application indicates that Corpus Christi Liquefaction has also sought incentives from San Patricio County and other entities. This is notable as San Patricio County is the same county whose economic development corporation lobbied for Tianjin Pipe Corporation, a company owned by the Chinese government, to invest in the area. Texas Scorecard previously reported on how the county sought to lure them by using similar means: tantalizing tax incentives.

Corpus Christi Liquefaction has done business with the Chinese Communist Party. Texas Scorecard previously reported on a sale and purchase agreement between the company (a subsidiary of Cheniere Energy) and China National Petroleum Corporation (CNPC), an oil and gas enterprise owned by the CCP.

When examining the agreements between Corpus Christi Liquefaction and Gregory-Portland ISD, an exciting conclusion is buried in the hundreds of pages of technical jargon and “legalese.” The financial analysis done by the Texas Comptroller revealed that the construction of the liquefaction facility itself would not create enough revenue to offset the losses incurred by the District due to the tax limitation.

“For those documents that say ‘NO,’ there are two things being measured: tax levy projections (i.e., how much revenue is the government expected to collect from that singular business) vs. tax levy ‘loss’ (i.e., how much revenue is government expected to ‘lose’ from business, as per the agreement),” explained James Quintero of the Texas Public Policy Foundation. “Based on the examples provided, it appears that on a tax-only basis, the deals do not work well for taxpayers (i.e., costs exceed benefits).”

However, on the next page, another analysis shows that when accounting for the projected employment, personal income, and revenues of the project, these would balance out the district’s financial losses.

“For the documents that say ‘YES,’ the conclusion is reached based on including the value of anticipated economic gains from the project coming online, i.e., increased # of jobs, personal income growth, etc.,” Quintero said. “For obvious reasons, these numbers can be juiced to justify a governmental entity’s participation in an economic development agreement.”

This discrepancy is found in multiple agreements between Corpus Christi Liquefaction and Gregory-Portland ISD. These agreements are still relatively recent, so it is difficult to assess whether the company is keeping up its end of the bargain. The oldest active agreement (#296), which began in 2018, is progressing. According to the latest biennial progress report, the company had met and surpassed the outlined job creation requirements.

Texas Scorecard contacted State Rep. J.M. Lozano (R–Kingsville) and State Sen. Morgan LaMantia (D), who represent citizens in these districts, about these corrupt deals. No response was received by the deadline given.

Special Projects

Although energy companies make up a large portion of the 313 agreements submitted and approved by school districts and the comptroller, some companies have obtained approval for some rather unique projects.

One of these companies is Fujifilm Diosynth Biotechnologies Texas, a subsidiary of Fujifilm Corporation. This company specializes in gene therapy and vaccine production. Their agreement with the Bryan ISD does not begin until 2024. At this time, they will receive a $30 million taxable value limitation each year for10 years. To fulfill the terms of the agreement, they need only create 10 new qualifying jobs and 140 non-qualifying jobs, along with making a $310 million qualified investment for the project.

Texas Scorecard also reached out to this district’s legislators for comment but received no response from either State Rep. John Raney (R) or State Sen. Charles Schwertner (R–Georgetown) before this article’s release.

“As vaccine safety advocates, we know all too well that incentives for private corporations can easily lead to collusion,” Michelle Evans of Texans for Vaccine Choice told Texas Scorecard. “While that may not be the case with Bryan ISD and Fujifilm, it is nonetheless unethical for a private company to strong-arm local government into providing a financial handout, and equally unethical for the school district to give in at the expense of the taxpayer.”

Since the limitation period has not yet begun, assessing the company’s performance in meeting these requirements is challenging. As of 2022, no jobs or qualified investments have been made. As with the Corpus Christi Liquefaction agreements, the finding of the comptroller in this case likewise concludes that the revenue from the project alone will not be sufficient to offset the cost of the limitation, but the additional projected revenue, personal income, and employment benefits associated with the project will make this limitation worthwhile. It is unclear whether this will turn out to be the case.

Additionally, it is unclear whether this company really needs this limitation. According to the findings of the comptroller and the board, Fujifilm Diosynth Biotechnologies already owns a portion of land in College Station, Texas, and operates two existing facilities on the site. Their application claims that there is an alternate site in North Carolina that is competitive due to the lower property tax burden, but Fujifilm’s current presence in the state calls this claim into question.

This, together with Fujifilm Holdings Corporation’s market capitalization of $20.75 billion, should give taxpayers pause.

All it Takes Is One (or Two)

Another interesting agreement was signed in the Bellevue ISD with Triangle Brick Company, a brick manufacturing firm. However, this company is actually a subsidiary of a foreign company based in Germany, the Röben Group. Little information about this company can be found online, but the terms of their agreement with the district speaks volumes.

In exchange for a $20 million taxable value limitation, the company requested—and received—a job waiver, requiring them to create only two new qualifying jobs and 25 non-qualifying jobs. This paltry attempt at job creation, together with a $90 million investment, was deemed by Bellevue ISD and the Texas comptroller to be a deal that benefited Texas taxpayers.

Once again, Texas Scorecard got no response from State Rep. James Frank (R–Wichita Falls) or State Sen. Drew Springer Jr. (R–Muenster) about these deals in their district.

Want vs. Need

One of the most obvious examples of an applicant who does not truly need a generous tax limitation is Colorado River Project, LLC.

Upon first glance, this name likely does not ring a bell. However, this company is controlled by none other than Tesla, the electric car company run by one of the world’s wealthiest men: Elon Musk.

Their agreement with Del Valle ISD to construct an electric vehicle manufacturing plant provides an $80 million taxable value limitation for a 10-year period. In addition to their qualified investment, the applicant must create 25 new qualifying jobs and 5,000 non-qualifying jobs. Since this limitation does not begin until 2022, whether these benchmarks will be met is yet to be seen.

Texas Scorecard reached out to the legislators who represent citizens in the district—State Rep. Maria Luisa Flores (D) and State Sen. Judith Zaffirini (D–Laredo)—for comment. No response was received before publication. Texas Scorecard likewise contacted Del Valle ISD with a request for communication records pertaining to this agreement. The district released a handful of documents, and appealed the request to Attorney General Ken Paxton, requesting a ruling that would allow them to refuse to provide the remainder of the documents.

In their appeal, the district argued that releasing the documents would violate “deliberative process privilege,” as it would allow taxpayers to view how the district made these decisions. In their own words, releasing the documents might impact the “district’s practices and strategies for evaluating, negotiating, and approving future Chapter 313 applications, agreements, and resolutions.” Furthermore, they argued that the release of these communications would compromise the state’s competitive advantage in negotiating these investments.

Texas Scorecard reached out to James Quintero, policy director at the Texas Public Policy Foundation, for comment about the district’s excuses. He remarked: “Today’s Public Information Act is riddled with exceptions that deny the public access to information that is rightfully theirs. It’s time to restore this essential transparency tool to its original intent and revitalize public trust in government.” The Attorney General’s decision is still pending.

Claims made by Colorado River Project in their application, likely an attempt to encourage passage of the deal, appear suspect. They claim to be considering a competitive investment in Oklahoma, but no specifics as to comparative tax limitations or incentives are provided. In fact, Elon Musk’s statements on Twitter indicate an intention to invest either in Texas or Nevada.

A quick glance at what is provided tells a different story. Tesla, Inc. reported total revenues of $53.8 billion in 2021 alone, with a market capitalization of $474.38 billion.

It appears as though Tesla wants a tax limitation, but they don’t really need it.

Just Can’t Get Enough

For some companies, one agreement with a school district simply isn’t enough. In fact, for Samsung Austin Semiconductor, LLC, one agreement and nine other applications isn’t enough either. This company has been soliciting tax incentives left and right, and has been accepting as many as the city, county, or district will give out.

Samsung’s limitation agreement with Taylor ISD is set to begin in 2024, with the property’s taxable value being limited to $80 million. According to the agreement, its total taxable value for the district in 2019 was $1.3 billion.

In order to qualify, Samsung need only commit to creating twenty-five new qualifying jobs and 1,675 non-qualifying jobs, in addition to their qualified investment. They claim to be assessing competitive investments in Korea, Arizona, and New York, and that the heavy property tax burden in Texas makes it unfavorable compared to those, which have proposed incentives of their own.

However, this agreement features the same apparent contradiction in terms of whether or not the revenue generated by the project will offset the costs of the limitation to the district. According to an older agreement with Manor ISD, Samsung seems to be fulfilling all of its obligations.

However, whether or not that holds true for all ongoing and future agreements can’t be known as economic activity changes consistently. All the district, the company, and the comptroller can provide to Texas taxpayers is a projection.

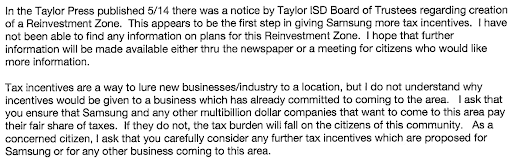

According to documents Texas Scorecard received from Taylor ISD in response to a public information request, taxpayers expressed concern about these mafia-like deals. One taxpayer wrote to the board of trustees, saying:

Source: Taylor ISD

Another echoed the sentiment:

Source: Taylor ISD

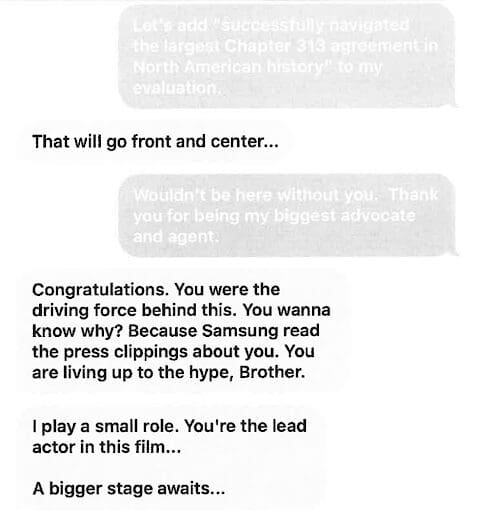

These concerns do not seem to faze the main players involved in the facilitation and approval of these agreements. Texas Scorecard also obtained the following text messages from Taylor ISD in response to the same request. They illustrate the self-aggrandizing attitude of the “public servants” who call the shots in Texas schools:

Source: Taylor ISD

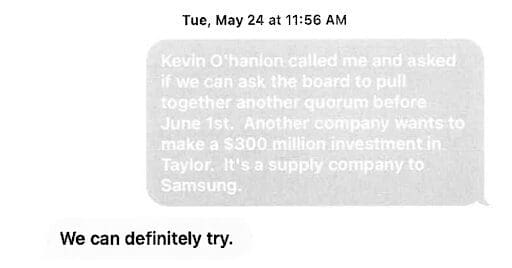

Another text thread from Taylor ISD shows how quickly the district leaps at the opportunity to hand out more special deals to certain companies (in this case, Samsung) while leaving others in the dust:

Source: Taylor ISD

Despite these successes, Samsung did not think one type of these mafia deals was enough. The company is also party to another six tax abatement deals with the city of Austin, the city of Taylor, Travis County, and Williamson County. All of these agreements are active, and some are not set to expire for the next 2-3 decades.

Source: Texas Comptroller

The Samsung investment was lauded by public servants at every level of government. Governor Greg Abbott (R) said “companies like Samsung continue to invest in Texas because of our world-class business climate and exceptional workforce.”

This attitude was echoed by Lt. Gov. Dan Patrick and State Sen. Schwertner.

“Samsung’s $17 billion capital investment in Taylor, creating 2,000 direct jobs, is welcome news for the Central Texas community and the Texas economy as a whole,” Patrick stated. “I was happy to support this project because I know that when the Texas economy thrives, Texans thrive.”

“This state-of-the-art facility represents a transformational investment in this community and thousands of new, high-paying jobs for the citizens of Williamson County,” Schwertner said. “The economic growth and opportunity brought on by today’s announcement will ensure that Williamson County remains one of the best places in America to live, work, and raise a family for decades to come.”

Texas Scorecard reached out to the offices of Senator Schwertner and State Rep. Caroline Harris (R), who represent the district. No comment was received prior to publication.

In reality, it would seem that these companies, Samsung in particular, aim to take advantage of as many special deals from as many school districts, cities, and counties as possible, all in the name of “investment” and “innovation.”

These officials are all right about one thing: This move is certainly transformational, but not in the way they’d expect. It ignores the facts that state taxpayer monies are redirected to help fund these special deals, and only those whom public officials choose are temporarily rescued by Texas’ heavy property tax burden—while the rest suffer.

In Part 3 of this series, Texas Scorecard will explore specific cases of the formalized extortion occurring within this mafia system.