“This is how it’s gonna work. I’m gonna take 20 percent a week. … We’re partners. You make the money, and I make sure you keep it.”

These are the words of Dwight Manfredi, a fictional mafioso in the Sylvester Stallone-starring series “Tulsa King.” Manfredi said these words to a business owner as he stole his enterprise and started extorting “protection money” from him.

While the arrangement in this fictional series is illegal, a similar corrupt system has been formalized in Texas law. School boards and their administrators favor certain businesses with special deals that lower their property tax bills by dramatically reducing the business property’s taxable value for a period of time. State taxpayers fill in the gap through this arrangement.

But school districts greedily grab even more money. They negotiate side deals with these businesses, where the district receives cash payments in return for the special favor of lower taxes.

This is all part of the corrupt Chapter 313 tax abatement system, which expired last month. However, certain state lawmakers are obsessed with reviving and rebranding their tested scheme.

Meanwhile, homeowners and renters across the state remain oppressed by skyrocketing property taxes.

Backstory

As detailed in Netflix’s documentary series, “Fear City: New York vs. The Mafia,” in the 1970s and ’80s, the criminal underworld dominated the Big Apple and threatened citizens, all in the pursuit of greed. The documentary makes a point of noting that the mafia benefited from tax reductions New York offered in an attempt to spur economic development.

The Texas Legislature has also set up a statewide system of corruption in the Lone Star State. Formerly known as Chapter 313, the Texas Economic Development Act set school boards up as mafia-like committees, able to give hand out special favors to those they choose. The favors in question are picking which businesses get lower property taxes in exchange for setting up shop in their area. State lawmakers chose to enact this system instead of lowering property taxes statewide.

High property taxes were listed as a reason why Intel did not finish building its plant in North Texas in the late 1990s.

The Texas Legislature set up school boards as mafia-like committees to pick winners and losers. They demand protection money from the businesses they sign deals with. These deals are so-called “supplemental payments.” School districts do this even though state taxpayers fill the gap left when businesses are exempt.

“School districts commonly require supplemental payments in return for the [value] limitation, which are allowed under the law subject to certain limits,” states a February 2021 paper from the Texas Taxpayers and Research Association. “These payments reduce the [business] taxpayer’s net tax savings and are excluded from consideration in state aid formulas [to the school district].”

This is on top of the fee businesses have to pay to school districts just to apply for this special deal.

“I think Chapter 313 is a scam on taxpayers, and it’s corporate welfare,” public policy specialist Bill Peacock told Texas Scorecard. “I think one of the most egregious parts about it is where the school district goes [and] makes these side deals, where they actually make more money off the deals than they would have gotten if they hadn’t given the abatements in the first place.”

It’s wrong.

State lawmakers felt this was so out of hand that they stepped in and capped the profits school districts could squeeze out of businesses as part of these corrupt tax abatement deals—but they did not end them. During Texas Scorecard’s investigation of this system, more kickback deals between businesses and school districts were uncovered.

On top of all this, research shows this corrupt system doesn’t substantially factor into whether or not a company will come to Texas. Prior to its expiration last December, the only checks on these education mafias were through the Legislature (which could have killed the program early) or the Texas comptroller (which must certify these deals).

Now legislators are trying to bring this all back.

Huge Payday

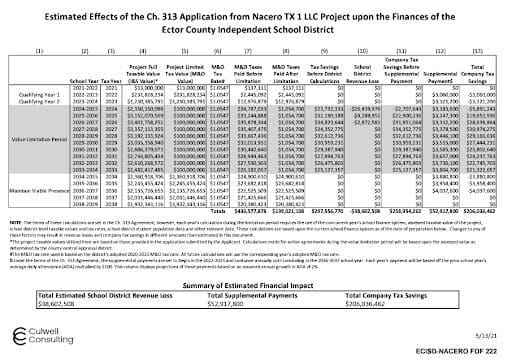

Most of the agreements examined in this piece are in the millions. The most egregious formalized extortion arrangement Texas Scorecard found was with Ector County ISD, located roughly 350 miles northwest of Austin.

They have a special deal with Nacero TX 1 LLC’s manufacturing project. That deal would limit the taxable value of Nacero’s property to $100 million, a total property tax savings of more than $206 million over the lifetime of the deal.

In exchange for granting this benefit, the school district is estimated to get a kickback of more than $52 million.

“This is making me sick inside,” Craig Hundley, a businessman in Johnson County, told Texas Scorecard. “I know plenty about the independent school districts. … They are an extremely corrupt organization.”

Information obtained from the Texas comptroller breaks down the payment schedule and totals.

Source: Ector County ISD

“Under the terms of the Ch. 313 Agreement, the supplemental payments are set to begin in the 2022-2023 and continue[sic] annually until concluding in the 2036-[2037] school year. Each year’s payment will be based on the prior school year’s average daily attendance (ADA) multiplied by $100,” the spreadsheet from Culwell Consulting reads. “This column displays projections of those payments based on an assumed annual growth in ADA of 2%.”

As reported by The Texas Observer, in 2010 the Texas Legislature felt the need to step in and restrict this extortionist “supplemental payments” to $100 per student per year, with a grandfather clause added to protect agreements already in place.

Texas Scorecard sent an inquiry to Ector County ISD and the Texas Education Agency, asking if this more than $52 million deal is in line with state law. “Yes, the $100 per student was included in all calculations and those figures are correct,” replied Michael Adkins, chief communications officer for Ector ISD. “Based on the agreement amendment just approved in December, the supplemental payments will not begin in 2022-23 but likely 2026-27 once operations begin. It is estimated payments should continue through 2040-41, setting up a very good revenue stream for ECISD’s students and families.”

This is advantageous for school districts because the supplemental payments are not subject to recapture funds sent back to the state.

“Recapture,” also commonly referred to as Robin Hood, refers to Texas’ wealth redistribution program among the state’s public schools. According to a report from the Texas Public Policy Foundation, when a school district exceeds “a designated level of property wealth per WADA (weighted average daily attendance),” that district is then “subject to wealth equalization measures.” In other words, local property taxpayers’ monies are “recaptured” and sent to poorer school districts.

The Texas Education Agency pointed fingers in their reply. “TEA’s role in Chapter 313 agreements is limited to facilitating payments provided for in TEC 48.254,” replied Jake Kobersky, TEA’s director of media relations. “Any questions related to the agreement you cite fall outside the scope of TEA’s purview and should be directed back to either the district or the Comptroller of Public Accounts.”

Kobersky provided a copy of the law TEA referenced:

Sec. 48.254. ADDITIONAL STATE AID FOR AD VALOREM TAX CREDITS UNDER TEXAS ECONOMIC DEVELOPMENT ACT. For each school year, a school district, including a school district that is otherwise ineligible for state aid under this chapter, is entitled to state aid in an amount equal to the amount of all tax credits credited against ad valorem taxes of the district in that year under former [emphasis Kobersky] Subchapter D, Chapter 313, Tax Code.

Ector County ISD is in the district of State Rep. Brooks Landgraf (R) and State Sen. Kevin Sparks (R). Texas Scorecard sent an inquiry to both their offices, asking what they knew about this deal and when did they know it. No response was received before publication.

Behind Closed Doors

During our investigation, transparency was a recurring issue. Here too, Ector County ISD shows up. They have a tax break deal with 1PointFive P1, LLC for a project to build a “Direct Air Capture Facility.” It is claimed this technology has the ability to remove carbon from the air and is part of the unreliable energy cult obsessed with eliminating carbon emissions.

The Texas comptroller’s “Economic Impact Analysis,” contained in their certification of the deal, stated the property’s taxable value would be limited to $100 million. For that favor, the company will pay the school district more than $11 million.

In response to Texas Scorecard’s open records request for communications about this deal, records with redactions were received.

Below is a page from an email communication they delivered between the school district and the Texas comptroller in response to the comptroller’s requests for revisions or clarification. More than a page of this email chain was redacted by the school district.

Source: Ector County ISD

“The Public Information Act originated from the belief that Texans do not give their public servants the right to decide what is good for the people to know and what is not good for them to know,” James Quintero of the Texas Public Policy Foundation told Texas Scorecard after viewing this redaction. “That idea is just as true now as it was back then; but what’s changed is that we’ve allowed our transparency tool to be weakened through exceptions, loopholes, and other bureaucratic means. It’s time to restore the PIA back to its original form and empower everyday citizens with the right to know what their government is up to.”

Then there’s the tax limitation deal between Taylor ISD (36 miles northeast of Austin) and Samsung Austin Semiconductor, LLC. This deal has been widely criticized as an example of corporate welfare.

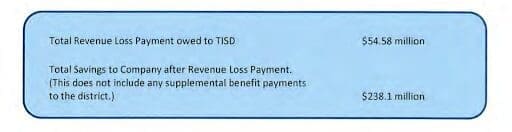

Records obtained by Texas Scorecard show the deal caps Samsung property’s taxable value limited to $80 million from 2024 to 2034. According to a calculation by third-party educational consultant Moak Casey found in the agreement itself, Samsung would save more than $238 million in property tax payments.

Source: Moak Casey

Out of those savings, Samsung would pay Taylor ISD more than $3.5 million.

Taylor ISD is in the district of State Rep. Caroline Harris (R) and State Sen. Charles Schwertner (R). Neither responded to Texas Scorecard’s questions about this deal before publication.

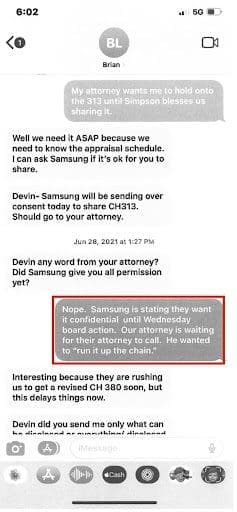

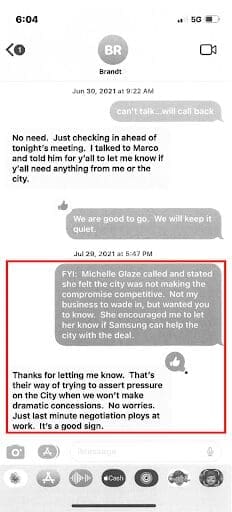

An issue of transparency showed up here as well. Texas Scorecard had requested communications in the possession of the superintendent and the board of trustees regarding this deal. Records received did not indicate who in the school district was communicating with whom. Within the communications are indicators that this deal was shrouded in secrecy.

Source: Taylor ISD

As two individuals discussed what to hide and publish about the deal, there was also a request to delete information shared between them about the agreement.

Source: Taylor ISD

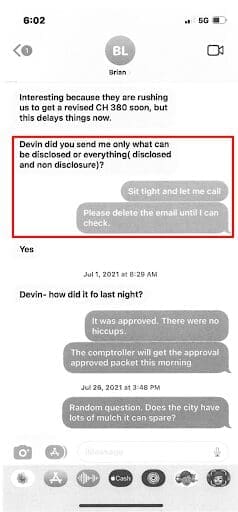

On top of that, redactions were made in a text thread about deal-making occurring behind closed doors between public servants and those outside the nation.

Source: Taylor ISD

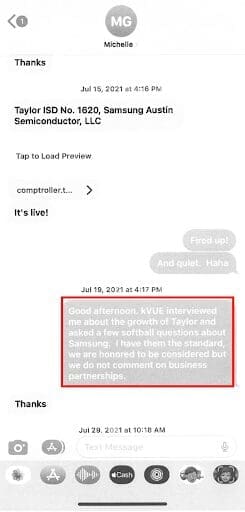

These communications also indicated little to no effort by establishment media to bring transparency and accountability into the deal-making process.

Source: Taylor ISD

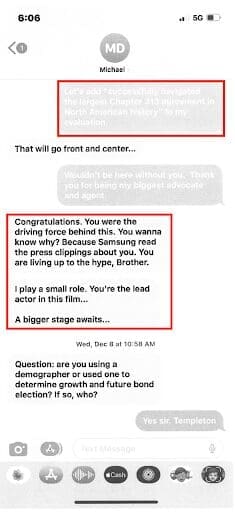

All the while, this deal apparently not only stuffs the pockets of the school district, but it will also elevate the status of those involved.

“Let’s add ‘successfully navigated the largest Chapter 313 agreement in North American history’ to my evaluation,” the text thread begins.

“A bigger stage awaits…” was the reply.

Source: Taylor ISD

Meanwhile, taxpayers were left in the dark in a deal that apparently was completely unnecessary. “Tax incentives are a way to lure new businesses/industry to a location, but I do not understand why incentives would be given to a business which has already committed to coming to the area,” concerned taxpayer Joan Maxfield emailed on May 16, 2022. Texas Scorecard obtained this and other communications in response to our open records request to the school district. “I have not been able to find any information on plans for this Reinvestment Zone. I hope that further information will be made available either through the newspaper or a meeting for citizens who would like more information.”

She was not the only upset citizen.

“Samsung made a PROFIT of 232.8 billion U.S. dollars last year, a record and those profits are expected to rise yearly with the chip shortage,” Tim Mikeska wrote in a May 23, 2022, email. “This is no longer a negotiation tool, this would be considered a GIFT to a major multi billion dollar corporation.”

Mikeska also noted that there seemed to be apparent collusion between the school district and the Taylor City Council on this deal. “The City of Taylor has received legal advice that now says that the 2nd reading on the Taylor City Ordinance regarding this same reinvestment zone is no longer needed if it’s passed by TISD,” he wrote. “This means if TISD approves this new property into the zone, the City ordinance will pass without a 2nd reading, with zero discussion and zero votes.”

Records of communications in possession of the superintendent and board of trustees appear to confirm the city’s involvement for some time. It also reveals apparently tough negotiations taking place out of view of citizens.

Source: Taylor ISD

A search found a Michele Glaze employed as Samsung Austin Semiconductor’s head of communications and community affairs. Texas Scorecard contacted her about this text message. No response was received before publication.

According to the Texas comptroller’s website, Samsung has applied for nine more special deals with Taylor ISD.

More Formalized Extortion

The above was merely a taste of these protection money arrangements across the state as part of the corrupt 313 mafia system.

In February 2021, the school board of Baird ISD in Callahan County, roughly 200 miles northwest of Austin, granted a 313 agreement with Ranchland Wind Project II, LLC, developed by Enel Green Power North America. Texas Scorecard obtained records of this agreement, and documents related to it, in response to an open records request.

Baird ISD is in the district of State Rep. Stan Lambert (R) and State Sen. Phil King (R). Neither responded to our requests for comment before publication.

Within these records is the Texas comptroller’s certification of the deal.

The agreement states that Ranchland proposed a more than $131 million investment in the district. However, they estimated the project would create only three jobs and would saddle Texas with yet another unreliable “wind energy facility.” The 313 agreement gave Ranchland a $20 million property tax abatement that started on January 1, 2022, and would end on December 31, 2031.

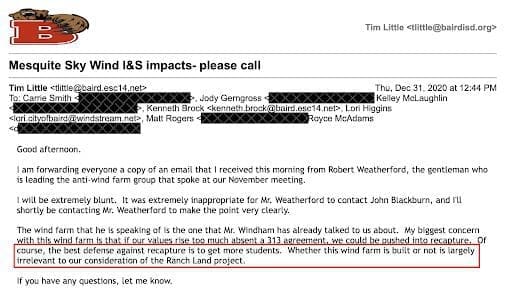

As found in similar deals, the school board even waived the job requirement for this project. In fact, internal Baird ISD communications indicate that the district wasn’t even concerned whether Ranchland built the unreliable wind farm or not.

Source: Baird ISD“Whether this wind farm is built or not is largely irrelevant to our consideration of the Ranch Land project,” wrote Superintendent Tim Little in a December 31, 2020, email. “My biggest concern with this wind farm is that if our values rise too much absent a 313 agreement, we could be pushed into recapture. Of course, getting more students is the best defense against recapture.”

In other words, this school’s public servants are giving a special favor to a business and appear not to care whether or not the business even follows through.

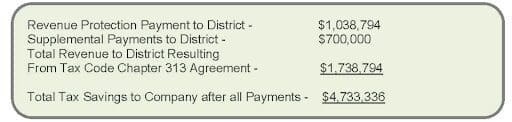

In return for this special favor, Ranchland would pay Baird ISD $700,000 in “supplemental payments.”

Source: Baird ISD

These numbers were found in a “Summary of the Financial Impact” of the deal by Jigsaw School Finance Solutions. It was within the 79 pages of records received in response to Texas Scorecard’s open records request.

Another goodie added on to sweeten this deal even more was that parent company Enel Green Power “allocated $10,000 to scholarships to be managed and distributed by a local entity.”

Baird ISD stands to turn a nice $700,000 profit, and Ranchland gets tax savings of more than $4.7 million. Meanwhile, the rest of the taxpayers get stiffed.

There is also $1.03 million marked as a “Revenue Protection Payment,” which Brent Bennett of the Texas Public Policy Foundation explained to Texas Scorecard. First, he pointed to page 34 of the Baird proposal.

In any year of the limitation period where state and local funding with the full project value exceeds the total state and local funding produced when the limited value is used, a Revenue Protection Payment is indicated for that year.

“In other words, because of the school-funding formulas, the district would not get hit with a loss of recapture funding during the project’s first year if the project was assessed at its full value. The recapture hit would come in subsequent years,” Bennett explained.

Bennett clarified the relationship between “recapture” and “Revenue Protection Payments” in the Baird ISD deal. “If the school district denied the [313] application and the project was assessed at its full value, the school district would get a million-dollar boost in its first year before being wiped out by the recapture hit in the following years (this is what Table 3 is trying to show),” he said. “The company pays the school district that difference in the first year to make sure there is no year where the school district is losing money by accepting the agreement.”

In 2019, TPPF described how the state’s public education financing system and this mafia system could hurt taxpayers statewide.

“[Property poor] districts retain a funding guarantee even when they willfully limit their tax base under Chapter 313. Like their wealthier counterparts, these districts receive substantial payments instead of taxes and hefty application fees that do not influence wealth equalization calculations,” their report states. “So poorer districts continue to draw from the state despite receiving supplemental payments and making a local decision to reduce the taxes they will collect. This leaves state finances—and wealthier, Robin Hood districts—on the hook for property-poor districts’ decisions.”

What Next?

Not only is there limited transparency regarding these tax abatement deals, but many of the records Texas Scorecard reviewed need to be more digestible.

As state lawmakers seek to resurrect and rebrand the expired Chapter 313 corruption machine, questions abound as to whether or not they will require maximum transparency in these dealings and ease of understanding for hard-working taxpayers.

In Part 4 of this series, Texas Scorecard will explore how the system state lawmakers created is helping those advocating values destroying Texans’ culture.

This article has been updated since publication. A vendor’s summary of Ector County ISD’s deal with Nacero TX, LLC states that “supplemental payments are set to begin in the 2022-2023 and continue annually until concluding in the 2036-3037 school year.” In fact, it concludes in the 2036-2037 school year.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!