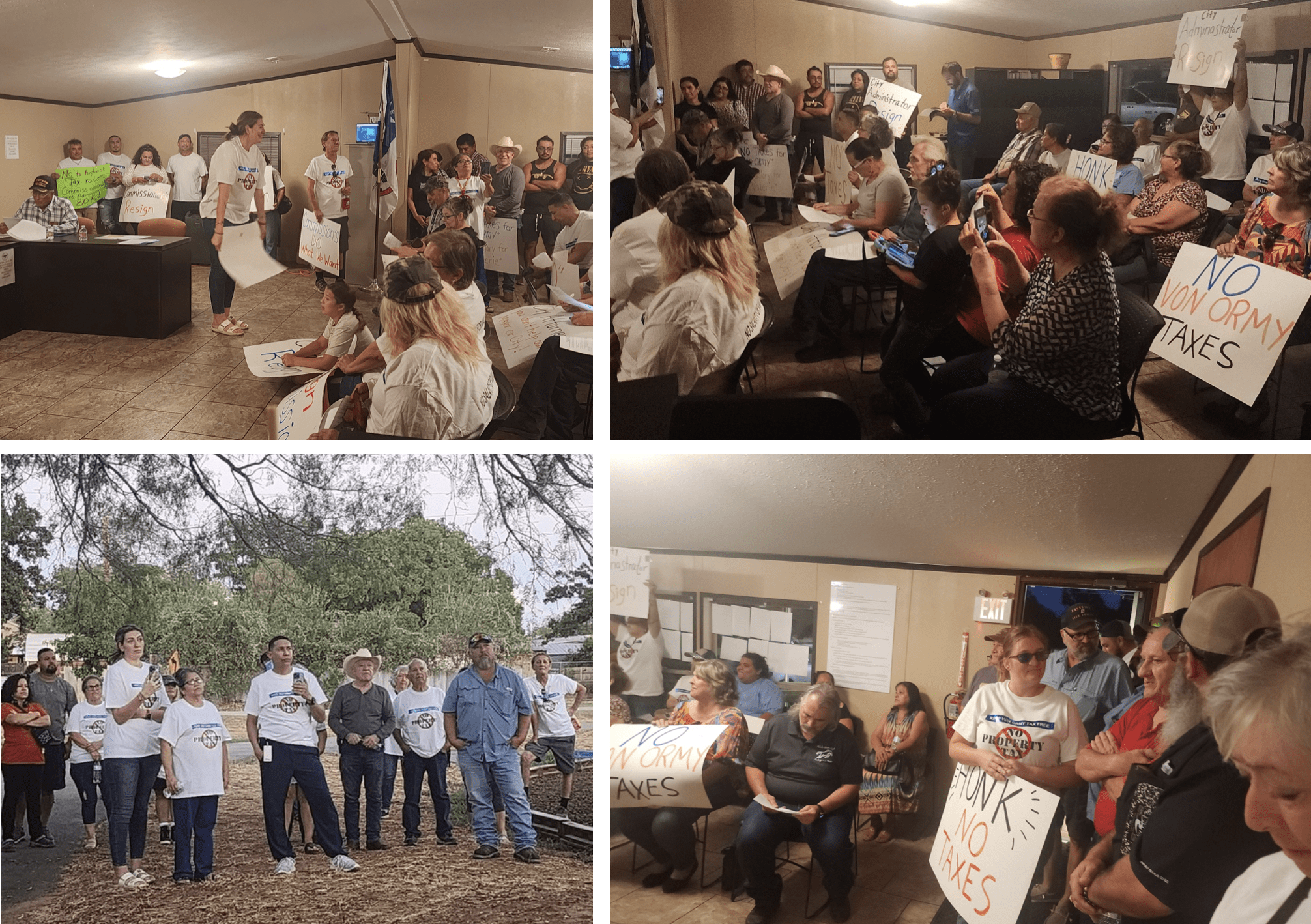

VON ORMY—Citizens of Von Ormy, Texas, fought off efforts to impose a property tax on city residents after overwhelming numbers showed up at a public hearing to oppose the plan.

“What a turnout! Von Ormy residents came out in force to ensure that our city remains property tax-free!” said attorney Art Martinez de Vara, the city’s first mayor.

“The people have spoken,” he said. “Von Ormy remains the only city in Bexar County to enjoy no property taxes, and one of only a handful in the state.”

The small city of about 1,200 people was incorporated in 2008 as a “liberty city.” The intent was to avoid annexation by the city of San Antonio while offering citizens and businesses limited government regulation and taxation.

Martinez de Vara advocated for incorporation and, as mayor, committed to minimize and eventually eliminate residents’ property tax burden as the city became established.

Von Ormy abolished property taxes in 2014. Sales taxes and fees fund the city’s operations.

This year, new City Administrator Valerie Naff proposed adopting a property tax rate of $0.65 per $100 of valuation.

Martinez de Vara said that would have brought the city from a tax rate of zero to the “second highest rate in Bexar County.”

So many residents showed up to assert their support of zero taxes that the meeting had to be canceled. There was easily twice the occupancy limit in the building and most refused to leave until the tax rate was voted down.

He said the mayor and one of the two city commissioners also opposed the property tax proposal, and the crowd at the meeting was chanting for the city administrator to resign.

“Frankly, you have to be tone deaf to not know that property taxes in Von Ormy is a nonstarter,” he said.

“It was perhaps the most American thing I’ve ever seen,” he added. “If there was any tea lying around it would have ended up in a bay somewhere.”

Since September 30 was the deadline for Von Ormy to adopt a property tax rate, the proposal is dead for this year.

The city of Stafford in Fort Bend County is also property tax-free, relying on sales taxes and sound fiscal management.

In most cities, Texans are forced to battle their local governments over property tax increases.

This year, Fredericksburg residents succeeded in convincing their city officials to adopt the No New Revenue rate instead of raising property taxes by the highest amount allowed without voters’ approval.

Other cities, including El Paso and Rosenberg, also budgeted based on the No New Revenue rate. Any tax rate above the NNR is a tax increase.

Tarrant County and Keller ISD officials went further, setting rates below NNR—meaning actual tax cuts.

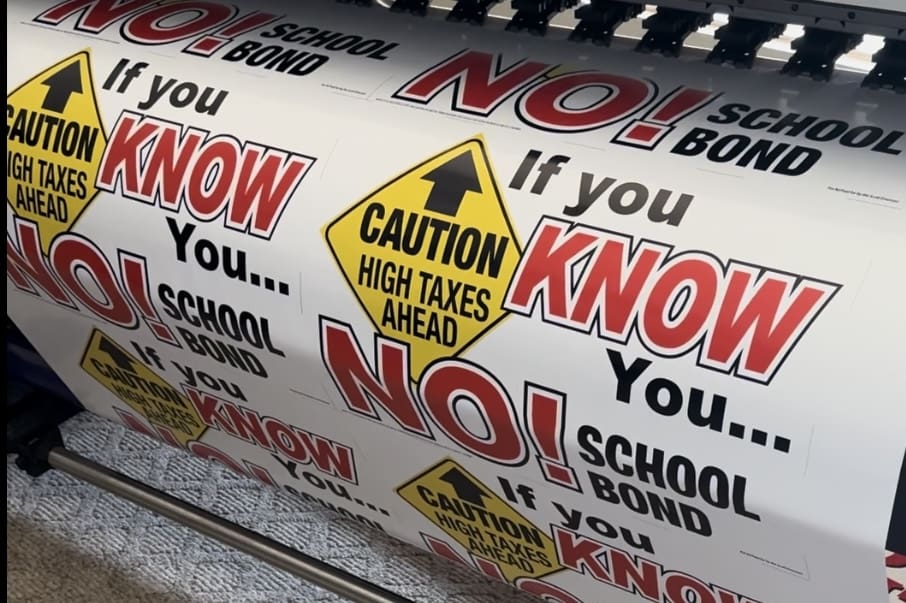

Most local governments chose to raise residents’ property taxes, and in November more than two dozen cities and school districts are asking voters to approve tax increases above the maximum allowed by state law.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!