Texans may be surprised to learn state lawmakers have spread inaccurate talking points related to what they’ve called their biggest legislative achievement in decades. It’s one of the most glaring examples of how few lawmakers apparently read the legislation they pass.

House Bill 3—an omnibus $11.5 billion spending bill lawmakers labeled “The Texas Plan”—dramatically increased per-student education spending in Texas. It also dedicated roughly half of the state’s $10.5 billion surplus, or $5.1 billion, to reducing school property tax rates.

But the bill summary provided by the Texas Education Agency revealed lawmakers have made misleading claims about the timing and impact of the reform.

No one in the mainstream media has reported on the error; in fact, they’ve added to the confusion by parroting inaccurate claims. That’s because reporters assumed the talking points published by lawmakers were accurate, and they failed to fact-check.

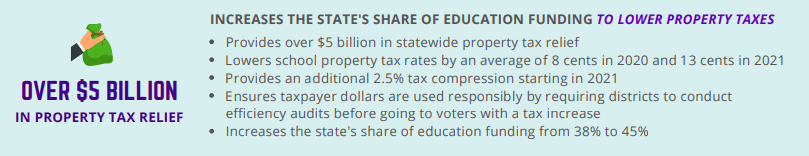

The Texas Plan website claims HB 3 “lowers school property tax rates by an average of 8 cents in 2020 and 13 cents in 2021,” or an implied total of 21 cents over two years.

According to information provided by the TEA, this statement is false and misleading in several ways. First, the average estimated school tax rate “compression” (or reduction) of 8 cents per $100 of property valuation will affect property taxes paid in the 2019 tax year, not in 2020. Second, there is no additional “13 cent” tax rate compression as the result of a state buy-down in 2020.

The TEA confirms there will be a tax rate cut in 2020, the amount of which will vary from district to district, but says it will be provided via a different mechanism—a 2.5 percent limit on the property tax revenue that a district can raise without voter approval. Regardless of what appraisal assumptions are used, this change cannot mathematically result in a tax rate cut of 13 additional cents.

The Texas Plan website also gets the timing wrong on when the 2.5 limit takes effect. It wrongly claims it starts in 2021, rather than in 2020. Again, although the TEA says this mechanism will result in lower tax rates, it does not estimate an additional 13-cent reduction per $100 of valuation. Experts have estimated the 2020 rate cut to be closer to 5 cents on average, or less.

Lawmakers may have simply published a typo. They likely intended to claim an 8 cent cut in 2019 and an additional 5 cent cut in 2020, for a total over two years of 13 cents—not an additional 13 cents, or 21 cents over two years. Big mistake.

The proof is in the pudding. School districts are drafting their budgets for the 2019-20 school year, which is based on property taxes paid in the 2019 tax year. Their claims line up squarely with the TEA’s estimates, rather than those made by lawmakers.

Take a look at Frisco ISD. District officials have projected a tax rate “compression” or reduction of 10 cents per $100 of property valuation in 2019. After the 2.5 percent limit on property tax growth goes into effect in 2020, FISD officials estimate an additional 1 cent tax rate reduction in that year and in each subsequent year, not the “13 cent” cut lawmakers touted.

Embarrassingly, media outlets such as the Dallas Morning News have recently published the lawmakers’ false claims, without fact-checking them. A June 30 DMN article read:

“About two-fifths of [HB 3 spending]— $5.1 billion — went to tax cuts, dropping property tax rates across Texas by an average of 8 cents per $100 valuation [in 2020] and close to 13 cents in 2021.”

It seems inconceivable that lawmakers could so clumsily mischaracterize both the timing and impact of what they’ve touted as their biggest legislative achievement. In doing so, they’ve misled the public and overstated the relief taxpayers will actually receive.

It raises the question: Did lawmakers read the final version of the bill prior to passing it, or did they regurgitate talking points without fact-checking their claims? Texans have good reason to be skeptical.

Editor’s Note: This article was updated on Thursday, July 11th, 2019, to better explain the estimated changes to the buy-down and 2.5 percent limit on school property tax revenue growth, and to add additional links to TEA resources published online.