A coauthor of a House proposal for school finance reform and property tax relief concedes that property taxpayers may be disappointed by its minimal impact on their wallets.

Both Democrat and Republican House lawmakers are pushing House Bill 3, labeled the “Texas Plan” by proponents. HB 3 would increase state funding for public education beyond student enrollment growth by a staggering $9 billion, with only 30 percent of that amount—or $2.7 billion—dedicated to “property tax relief.”

HB 3’s proponents claim taxpayers should expect a 4-cent reduction in school property tax rates. But one of its coauthors, State Rep. Matt Krause (R–Fort Worth), admitted on Facebook the tax relief would not be significant.

“Property Tax Relief: The bill “compresses” current ISD taxes by $.04 [4 cents]. This provision will actually lower property taxes. While not substantial on the whole, it is relief.”

Krause’s characterization is contradictory to claims made by other proponents of HB 3, who are heralding it as “transformational” for reforming school finance and for providing significant property tax relief. State Rep. Jeff Leach (R–Plano) called the plan “monumental school finance and property tax reform” in an email to constituents.

In the same post on social media, Krause claimed that HB 3 would “reduce” recapture, a selling point for overtaxed homeowners in urban and suburban areas.

“Reduces Robin Hood: I would like to see an end to the system (and it’s still worth fighting for). However, HB 3 reduce[s] Robin Hood payments by about 38 percent. This is a great step forward as we work towards full repeal.”

The claim HB 3 would “significantly reduce Robin Hood” recapture by 38 percent is dubious on its face. For those unfamiliar, Robin Hood forces taxpayers living in certain districts such as Austin and Plano ISDs to pay higher property tax bills than what is needed to fund their local schools. The state takes this excess tax revenue from Austin and Plano taxpayers and redistributes it to districts in relatively “property poor” areas.

Unlike the claims made by proponents, HB 3 would not reduce recapture over a two-year period by 38 percent; it would only prevent recapture from increasing over and above current levels.

Unlike the claims made by proponents, HB 3 would not reduce recapture over a two-year period by 38 percent; it would only prevent recapture from increasing over and above current levels.

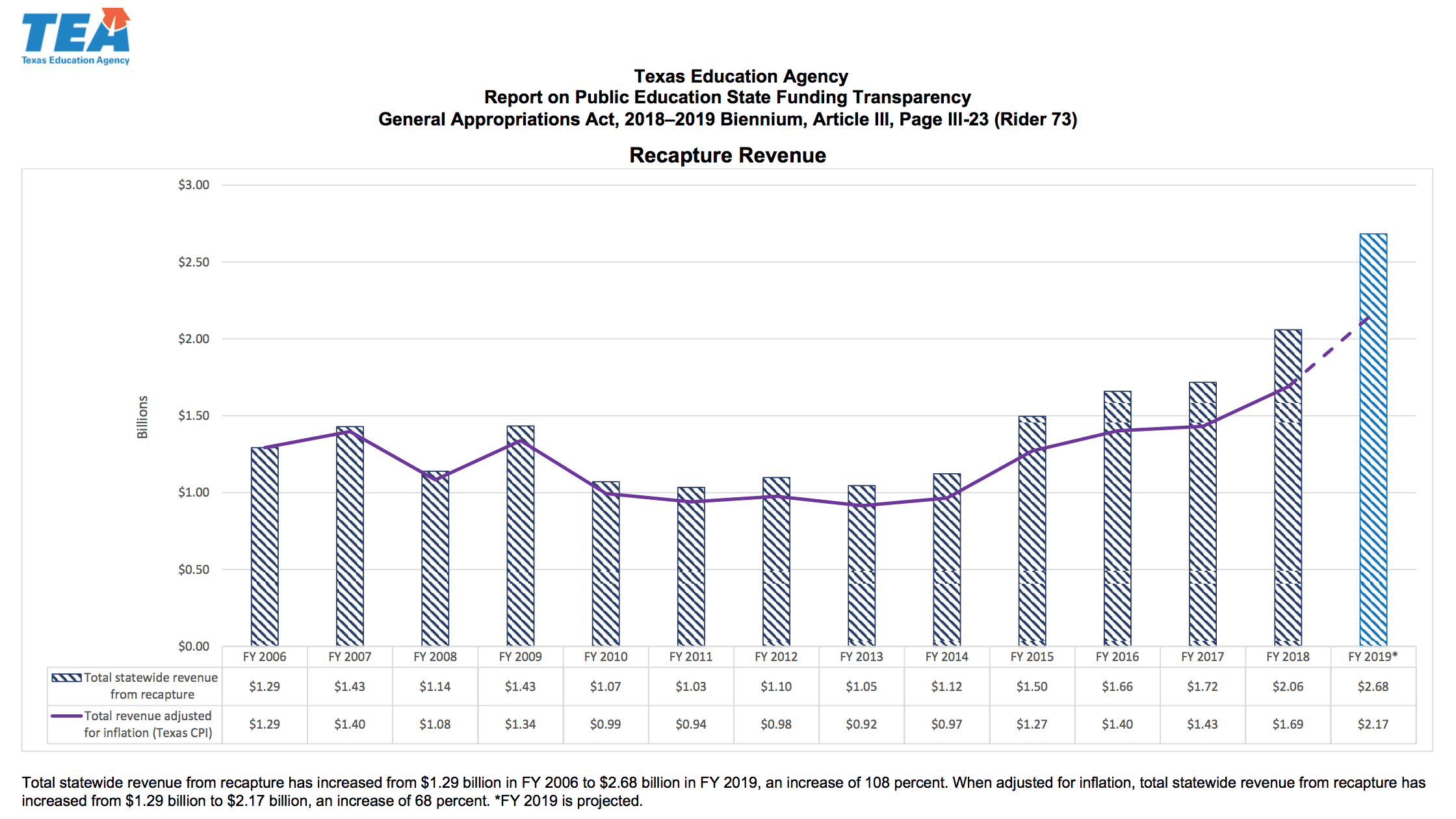

According to the Texas Education Agency, the state recaptured $4.74 billion in excess property taxes combined in 2018 and 2019. Under HB 3, the bill’s proponents claim recapture over the next two years would remain at $4.7 billion, rather than increasing to more than $7 billion.

In other words, taxpayers currently penalized by the Robin Hood tax would still see roughly the same amount in total recaptured from their district over the next two years, when compared to the combined amount in 2018-19.

HB 3 would not significantly reduce the state’s reliance on recapture, and certainly not by 38 percent. Preventing an increase is not synonymous with a reduction. While preventing Robin Hood from getting worse is admittedly better than doing nothing, taxpayers currently being punished by the system may not even notice.

Even if a 4-cent property tax rate cut is delivered, it’s less than a 3-percent tax rate reduction (only on school taxes) over two years. With many homes experiencing appraisal growth beyond 3 percent annually, any school tax “relief” delivered could be temporary and may not even last until lawmakers reconvene in 2021.

With $9 billion in new education spending proposed by the House, lawmakers are planning to use 70 percent of this excess state revenue to grow spending. Unless property tax reductions become a priority over spending, taxpayers should not expect significantly lower property tax bills or a reduction in Robin Hood recapture.