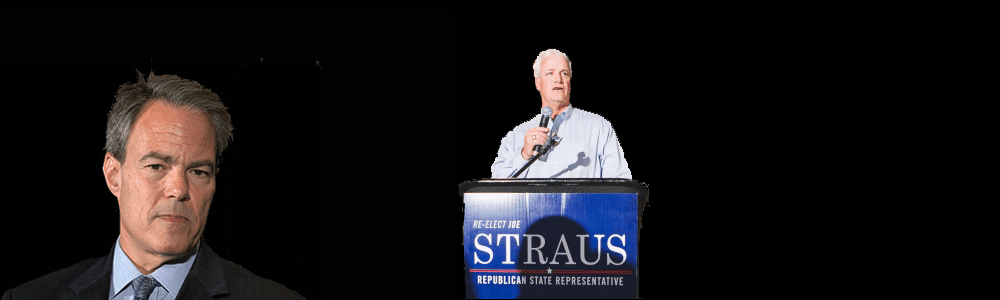

One of House Speaker Joe Straus’ closest advisors, State Rep. Lyle Larson of San Antonio, has come out in opposition not just to a tax cut plan proposed by the Senate, but any tax relief. Indeed, Larson is describing tax relief efforts as “gimmickry.” Meanwhile, Gov. Greg Abbott has said he would veto any budget that doesn’t include tax relief.

Under the guise of reducing debt, Larson is telling the press he wants to use surplus revenues to buy down the state’s existing debt-load before any tax relief is offered. While his rhetoric might sound good on the surface, he would in fact only create more headroom for future debt spending by Larson and his grow-government cronies.

Larson isn’t talking about cutting any spending — which is the way debt grows — he’s only targeting the current debt itself. This is like bringing down the current credit card balance, without changing the spending patterns that led to debt in the first place.

In fact, Joe Straus and his supporters have prevented efforts to enact constitutional limitations on spending from even getting hearings in the Texas House.

Debt should be reduced by cutting spending and controlling government growth, not by over-collecting taxes from the productive economy. Simply buying down debt, without accompanying measures to prevent future debt accrual, does not protect Texas taxpayers or the state’s economy.

Rather than enabling government to grow bigger, the legislature should work on keeping money in the hands of hard-working Texans. Conservatives have long held that surplus revenues flowing into state government should be returned to the taxpayers in the form of tax relief.

That’s not how Larson views money flowing into state coffers. According to Texas Public Radio, Larson recently derided tax relief measures. “The political gimmickry you’re gonna hear is, ‘let me give it back.’”

That puts Larson, and his boss Joe Straus, at odds with Gov. Greg Abbott, Lt. Gov. Dan Patrick and State Sen. Jane Nelson, who chairs the powerful Senate Finance Committee. The Senate budget has proposed $4 billion in property tax and business tax cuts.

“We are taking in substantial revenue, and we have an obligation to return a large share of those dollars to the people who have worked hard and earned that in the first place,” said Nelson said at a press conference unveiling her budget.

Abbott has said he would “reject any budget” that doesn’t contain tax relief measures for small businesses.

Straus’ opposition to tax relief and spending reform is nothing new. In the previous session, Straus’ leadership in the House only gave tax relief to specific businesses owned by cronies. When the House measure reached the Senate, it was transformed by then-Senator (and now State Comptroller) Glenn Hegar into across-the-board relief.

Straus and his closest lieutenants have already begun to confirm predictions made by both their supporters and critics, that there will continue to be contention between the House and Senate on fundamentally important issues to Texans. Tax relief is now added to that list.

“The collection of any taxes which are not absolutely required, which do not beyond reasonable doubt contribute to the public welfare, is only a species of legalized larceny … the wise and correct course to follow in taxation is not to destroy those who have already secured success, but to create conditions under which everyone will have a better chance to be successful.” – Calvin Coolidge