Given the legislative priorities of the AFL-CIO, it’s difficult to imagine why any Republican legislator would want to receive the endorsement of the liberal labor union.

Given the legislative priorities of the AFL-CIO, it’s difficult to imagine why any Republican legislator would want to receive the endorsement of the liberal labor union.

Abbott’s endorsement today against an incumbent Republican House member marks the third time this cycle the governor has supported conservative challengers.

Straus censure was about a pattern of obstruction, not any one policy.

Lawmakers appeared eager to adopt reforms that will improve the situations on college campuses and better secure the speech rights of Texans.

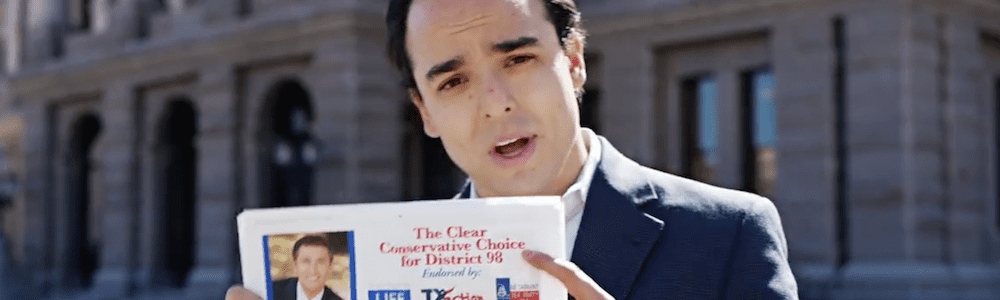

Former Governor: “Please send Chris to the Texas House so he can advance the conservative principles that make Texas great.”

Campaign finance reports reveal two lawmakers leasing cars with their campaign funds.

Macias Apologizes for Role in Electing Giovanni Capriglione.

The candidate for HD8 shows voters who she is by her associations.

The Texas Association of Business’ curious decision to endorse Angela Paxton is raising eyebrows in Senate District 8.

In the 30-second spot, paid for by Abbott’s campaign, Dokupil promises to work with Abbott to pass real property tax reform.