In 2018, Texans collectively paid $2.1 billion in property taxes into the state’s Chapter 41 Wealth Equalization program—also know as “Robin Hood.” According to data from the state, property taxpayers in 185 districts paid into the system this year.

Robin Hood forces property owners in certain districts to pay more in school taxes than what’s necessary to fund their local school district. But in which districts did taxpayers pay the biggest penalties in 2018?

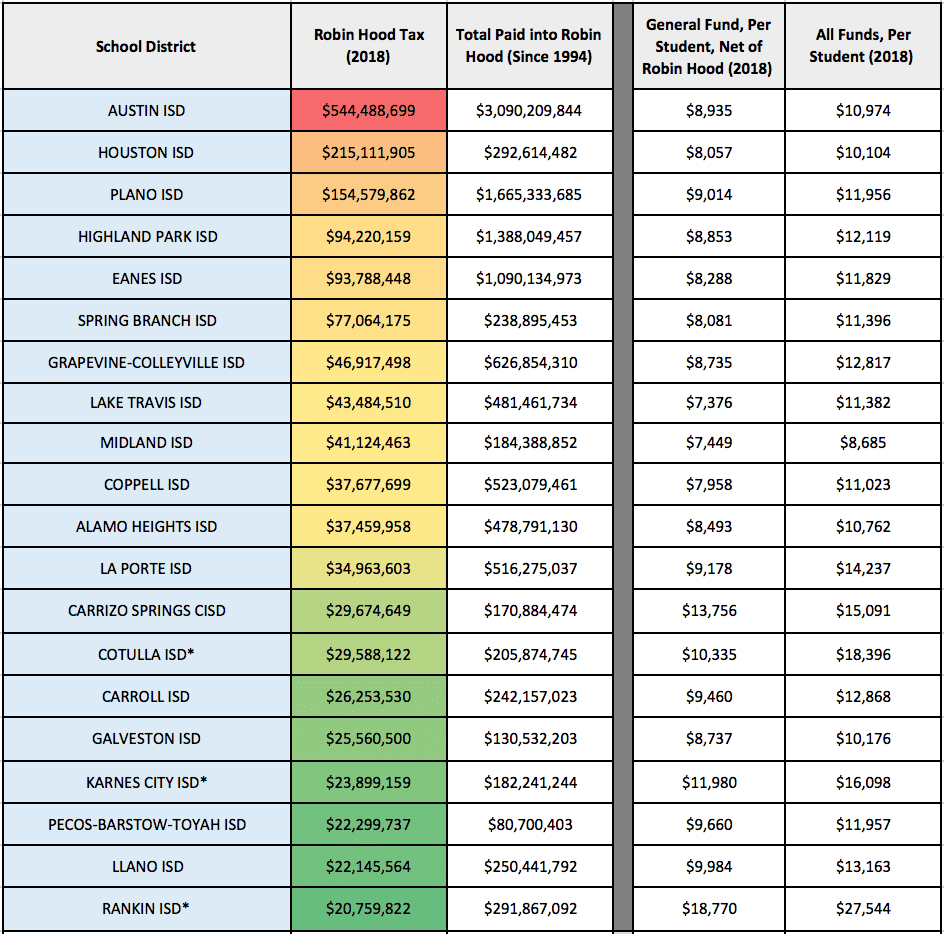

According to data from the Texas Education Agency, Austin ISD property taxpayers wrote the largest check, at $544.5 million. The $544.5 million figure represents the total amount in property taxes paid by AISD taxpayers that were not spent inside AISD schools. Instead, the state “recaptured” these funds and redistributed them to help fund other “property poor” school districts. AISD property owners have paid a staggering $3.1 billion in Robin Hood taxes since the program’s inception in 1994.

After recapture in 2018, AISD’s operating budget was left with an estimated $8,935 in federal, state and local tax revenue, per student.

Houston ISD taxpayers paid the second highest recapture tax in 2018, at $215.1 million, followed by Plano ISD taxpayers, at $154.5 million. After recapture, HISD’s operating budget was left with $8,057 in tax revenue, per student. PISD’s was left with $9,014, per student. These per student figures exclude revenue for debt service.

Since 1994, HISD taxpayers have paid $292.6 million into Robin Hood, while the state recaptured a total of $1.67 billion from PISD taxpayers, and sent it elsewhere.

Below are the top 20 districts in which property owners paid the biggest Robin Hood tax in 2018, along with the cumulative payments into Robin Hood since 1994. Included in the chart is the federal, state and local tax revenue allocated to the district’s operating budget and across all funds – net of recapture – on a per student basis.

*School districts with relatively low enrollment (below 1,500 students)

*School districts with relatively low enrollment (below 1,500 students)

If state lawmakers repealed Robin Hood, taxpayers in recapture districts could pay far less in school taxes without cutting funding to local schools. However, the state would need to find more than $2.1 billion in additional revenue elsewhere to offset the taxes collected by the Chapter 41 program.

The Texas Public Policy Foundation recently released a report detailing one solution. If state lawmakers capped the state’s budget growth at four percent per year – and dedicated 90 percent of the surplus revenue to lowering school property taxes – the Robin Hood tax could be phased out in 10 years.

By the 11th year, the entire school property tax for maintenance and operations (M&O) could be abolished, which would reduce the average Texan’s total property tax bill by 40 percent or more.

To find a year-by-year breakdown of how much property owners in each school district have paid into Robin Hood since 1994, click HERE.